Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

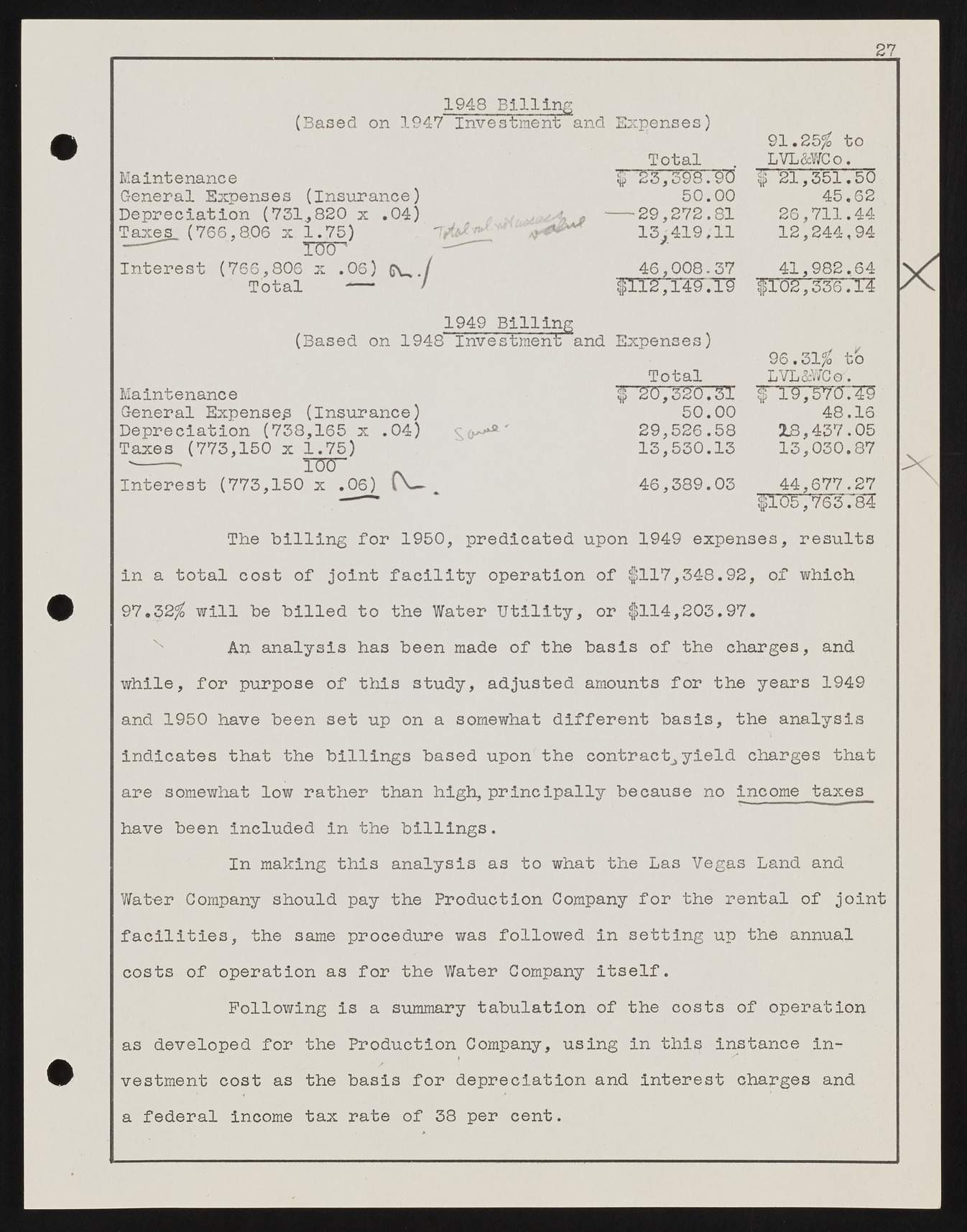

27 1948 Billing (Based on 1947 Investment and Expenses) Maintenance General Expenses (Insurance) Depreciation (731,820 x .04) Taxes, (766,806 x 1.75) — " lOU^ Interest (766,806 x .06) (jv^./ Total ?*— * t Total | 2 3 , 3 9 8.90 50.00 — 29,272.81 13*419;11 46,008.37 $112,149.19 1949 Billing (Based on 1948 Investment and Expenses) Maintenance General Expense^ (Insurance) Depreciation (738,165 x .04) Taxes (773,150 x 1.75) ' — > 100 Interest (773,150 x .06) V\— Total $ 20,320.31 50.00 29,526.58 13,530.13 46,389.03 91.25# to LVL&WCo. $ 21 ,351 .50 45 .6 2 26 ,711 .44 12 ,244 ,94 41 ,982 .64 f T O , 336 .14 96. 31# to LVL&WC&• $ 197F7TT713 48 .16 IS ,437 .05 13 ,030 .87 44 ,677 .27 fl05 ,763 .84 The billing for 1950, predicated upon 1949 expenses, results in a total cost of joint facility operation of $117,348.92, of which 97.32# will be billed to the Water Utility, or $114,203.97. An analysis has been made of the basis of the charges, and while, for purpose of this study, adjusted amounts for the years 1949 and 1950 have been set up on a somewhat different basis, the analysis indicates that the billings based upon the contract^yield charges that are somewhat low rather than high, principally because no income taxes have been included in the billings. In making this analysis as to what the Las Vegas Land and Wat-er Company should pay the Production Company for the rental of joint facilities, the same procedure was followed in setting up the annual costs of operation as for the Water Company itself. Following is a summary tabulation of the costs of operation as developed for the Production Company, using in this instance investment cost as the basis for depreciation and interest charges and a federal income tax rate of 38 per cent.