Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

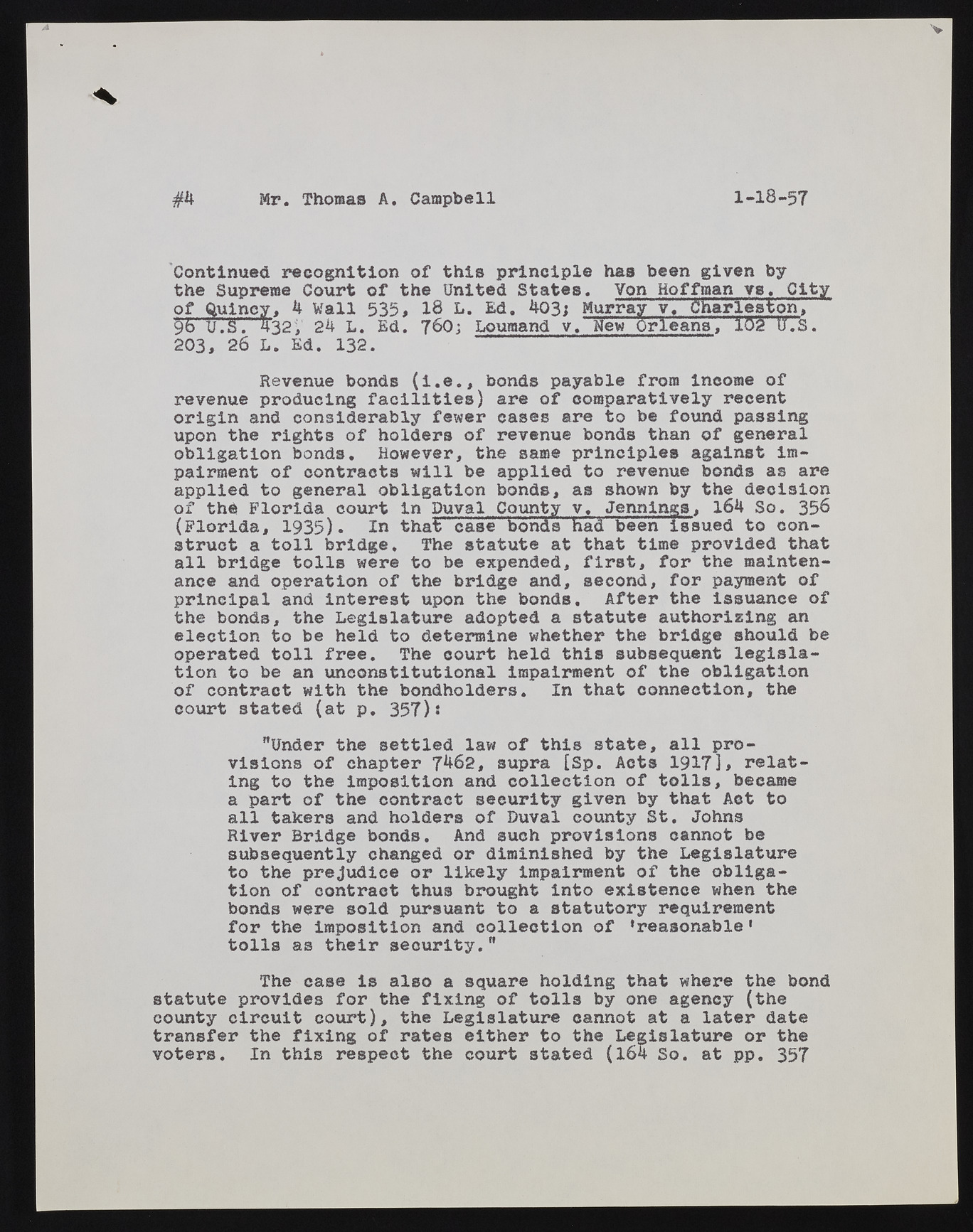

#4 Mr. Thomas A. Campbell 1-18-57 "Continued recognition of this principle has been given by the Supreme Court of the United States. Von Hoffman ve. City of ftulncy, 4 Wall 535> 18 I*. Ed. 403; Murray v. flrmrleaton. 96 U.SV 432i 24 L. Ed. 76Oj Loumand v. New Orleans, 16% W.**S. 203, 26 L. Ed. 132. Revenue bonds (i.e., bonds payable from income of revenue producing facilities) are of comparatively recent origin and considerably fewer cases are to be found passing upon the rights of holders of revenue bonds than of general obligation bonds. However, the same principles against impairment of contracts will be applied to revenue bonds as are applied to general obligation bonds, as shown by the decision of tha Florida court in Duval County v. Jennings, 164 So. 358 (Florida, 1935). In that case bonds hacl been issued to construct a toll bridge. The statute at that time provided that all bridge tolls were to be expended, first, for the maintenance and operation of the bridge and, second, for payment of principal and interest upon the bonds. After the issuance of the bonds, the Legislature adopted a statute authorizing an election to be held to determine whether the bridge should be operated toll free. The court held this subsequent legislation to be an unconstitutional impairment of the obligation of contract with the bondholders. In that connection, the court stated (at p. 357)8 "Under the settled law of this state, all provisions of chapter 7462, supra [Sp. Acts 19173* relating to the imposition and collection of tolls, became a part of the contract security given by that Act to all takers and holders of Duval county St. Johns River Bridge bonds. And such provisions cannot be subsequently changed or diminished by the Legislature to the prejudice or likely impairment of the obligation of contract thus brought into existence when the bonds were sold pursuant to a statutory requirement for the imposition and collection of ‘reasonable 1 tolls as their security." The ease is also a square holding that where the bond statute provides for the fixing of tolls by one agency (the county circuit court), the Legislature cannot at a later date transfer the fixing of rates either to the Legislature or the voters. In this respect the court stated (164 So. at pp. 357