Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

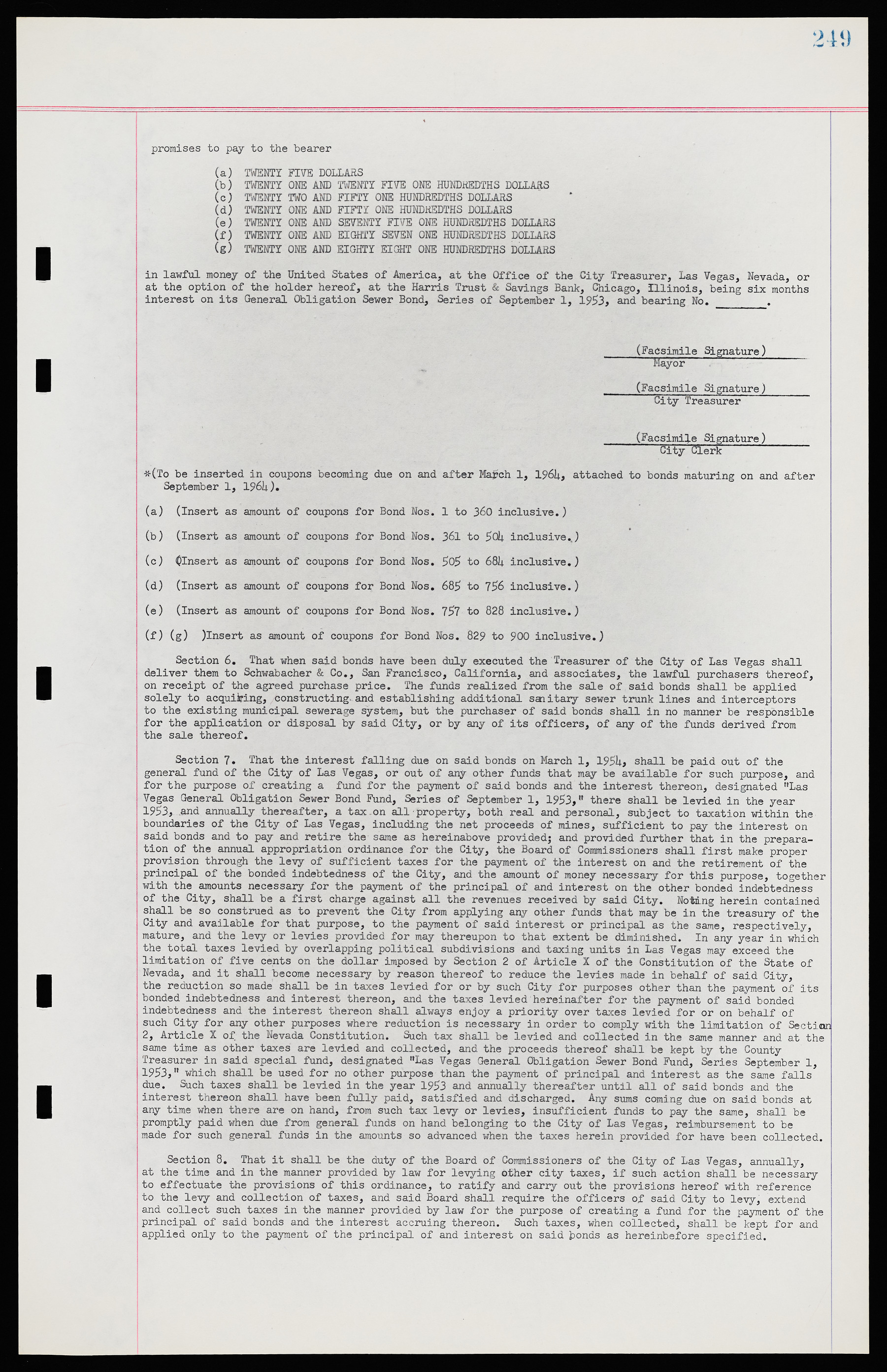

promises to pay to the bearer (a) TWENTY FIVE DOLLARS (b) TWENTY ONE AND TWENTY FIVE ONE HUNDREDTHS DOLLARS (c) TWENTY TWO AND FIFTY ONE HUNDREDTHS DOLLARS (d) TWENTY ONE AND FIFTY ONE HUNDREDTHS DOLLARS (e) TWENTY ONE AND SEVENTY FIVE ONE HUNDREDTHS DOLLARS (f) TWENTY ONE AND EIGHTY SEVEN ONE HUNDREDTHS DOLLARS (g) TWENTY ONE AND EIGHTY EIGHT ONE HUNDREDTHS DOLLARS in lawful money of the United States of America, at the Office of the City Treasurer, Las Vegas, Nevada, or at the option of the holder hereof, at the Harris Trust & Savings Bank, Chicago, Illinois, being six months interest on its General Obligation Sewer Bond, Series of September 1, 1953, and bearing No. ________. _____(Facsimile Signature) Mayor (Facsimile Signature)_______ City Treasurer _____(Facsimile Signature)_______ City Clerk *(To be inserted in coupons becoming due on and after March 1, 1964, attached to bonds maturing on and after September 1, 1964). (a) (Insert as amount of coupons for Bond Nos. 1 to 360 inclusive.) (b) (Insert as amount of coupons for Bond Nos. 361 to 504 inclusive.) (c) (Insert as amount of coupons for Bond Nos. 505 to 684 inclusive.) (d) (Insert as amount of coupons for Bond Nos. 685 to 756 inclusive.) (e) (Insert as amount of coupons for Bond Nos. 757 to 828 inclusive.) (f) (g) )Insert as amount of coupons for Bond Nos. 829 to 900 inclusive.) Section 6. That when said bonds have been duly executed the Treasurer of the City of Las Vegas shall deliver them to Schwabacher & Co., San Francisco, California, and associates, the lawful purchasers thereof, on receipt of the agreed purchase price. The funds realized from the sale of said bonds shall be applied solely to acquiring, constructing and establishing additional sanitary sewer trunk lines and interceptors to the existing municipal sewerage system, but the purchaser of said bonds shall in no manner be responsible for the application or disposal by said City, or by any of its officers, of any of the funds derived from the sale thereof. Section 7. That the interest falling due on said bonds on March 1, 1954, shall be paid out of the general fund of the City of Las Vegas, or out of any other funds that may be available for such purpose, and for the purpose of creating a fund for the payment of said bonds and the interest thereon, designated "Las Vegas General Obligation Sewer Bond Fund, Series of September 1, 1953," there shall be levied in the year 1953, and annually thereafter, a tax on all property, both real and personal, subject to taxation within the boundaries of the City of Las Vegas, including the net proceeds of mines, sufficient to pay the interest on said bonds and to pay and retire the same as hereinabove provided; and provided further that in the preparation of the annual appropriation ordinance for the City, the Board of Commissioners shall first make proper provision through the levy of sufficient taxes for the payment of the interest on and the retirement of the principal of the bonded indebtedness of the City, and the amount of money necessary for this purpose, together with the amounts necessary for the payment of the principal of and interest on the other bonded indebtedness of the City, shall be a first charge against all the revenues received by said City. Nothing herein contained shall be so construed as to prevent the City from applying any other funds that may be in the treasury of the City and available for that purpose, to the payment of said interest or principal as the same, respectively, mature, and the levy or levies provided for may thereupon to that extent be diminished. In any year in which the total taxes levied by overlapping political subdivisions and taxing units in Las Vegas may exceed the limitation of five cents on the dollar imposed by Section 2 of Article X of the Constitution of the State of Nevada, and it shall become necessary by reason thereof to reduce the levies made in behalf of said City, the reduction so made shall be in taxes levied for or by such City for purposes other than the payment of its bonded indebtedness and interest thereon, and the taxes levied hereinafter for the payment of said bonded indebtedness and the interest thereon shall always enjoy a priority over taxes levied for or on behalf of such City for any other purposes where reduction is necessary in order to comply with the limitation of Section 2, Article X of the Nevada Constitution. Such tax shall be levied and collected in the same manner and at the same time as other taxes are levied and collected, and the proceeds thereof shall be kept by the County Treasurer in said special fund, designated "Las Vegas General Obligation Sewer Bond Fund, Series September 1, 1953,” which shall be used for no other purpose than the payment of principal and interest as the same falls due. Such taxes shall be levied in the year 1953 and annually thereafter until all of said bonds and the interest thereon shall have been fully paid, satisfied and discharged. Any sums coming due on said bonds at any time when there are on hand, from such tax levy or levies, insufficient funds to pay the same, shall be promptly paid when due from general funds on hand belonging to the City of Las Vegas, reimbursement to be made for such general funds in the amounts so advanced when the taxes herein provided for have been collected. Section 8. That it shall be the duty of the Board of Commissioners of the City of Las Vegas, annually, at the time and in the manner provided by law for levying other city taxes, if such action shall be necessary to effectuate the provisions of this ordinance, to ratify and carry out the provisions hereof with reference to the levy and collection of taxes, and said Board shall require the officers of said City to levy, extend and collect such taxes in the manner provided by law for the purpose of creating a fund for the payment of the principal of said bonds and the interest accruing thereon. Such taxes, when collected, shall be kept for and applied only to the payment of the principal of and interest on said bonds as hereinbefore specified.