Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

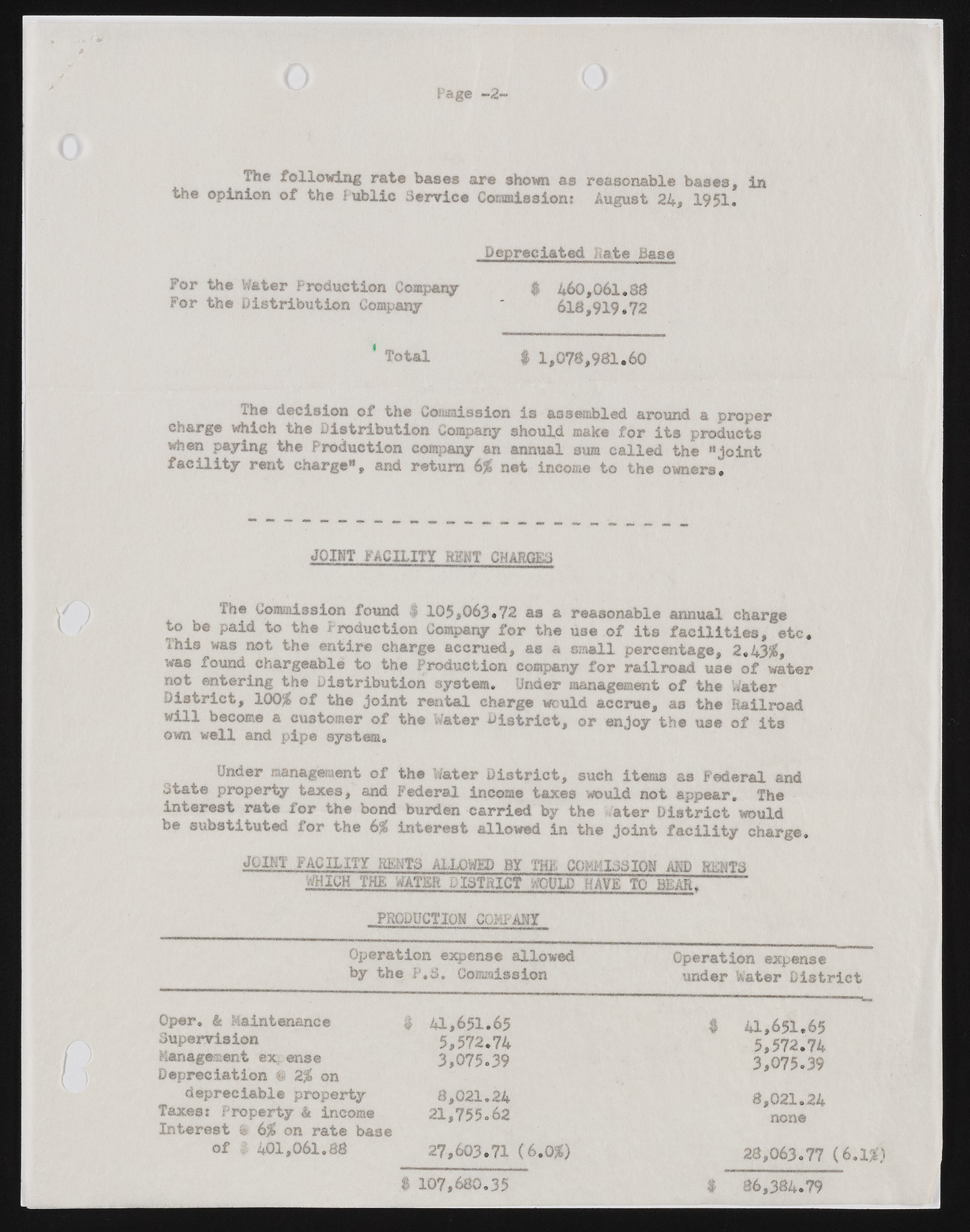

Page -2 “ The following rate bases are shown as reasonable bases, in the opinion of the Public Service Commission: August 24, 1951. Depreciated Rate Base For the Water Production Company $ 460,061.88 For the Distribution Company ' 618,919.72 ‘ ^ t a l $ 1,078,981.60 The decision of the Commission is assembled around a proper charge which the Distribution Company should make for its products when paying the Production company an annual sum called the "joint facility rent charge", and return 6$ net income to the owners. JOINT FACILITY HINT CHARGED fha Commission found $ 105*063.72 as a reasonable annual charge to be paid to the Production Company for the use of its facilities, etc. This was not the entire charge accrued, as a small percentage, 2.43$, was found chargeable to the Production company for railroad us© of water not entering the Distribution system. Under management of the Water District, 100$ of the joint rental charge would accrue, as the Railroad will become a customer of the Water District, or enjoy the use of its own well and pipe system. Under management of the Water District, such items as Federal and State property taxes, and Federal income taxes would not appear. The interest rate for the bond burden carried by the ater District would be substituted for the 6$ interest allowed in the joint facility charge. JOINT FACILITY RENTS ALLOWED BY THE COMMISSION A ® RENTS WHICH THE WATER DISTRICT WOULD HAVE TO 3EA£ “ PRODUCTIONCOMPANY Operation expense allowed by Operation expense the P.8. Commission under Mater District Oper. & Maintenance Supervision Management ex. ense Depreciation § 2$ on depreciable property Taxes: Property & income Interest (S 6$ on rate base of | 401,061.88 I 41,651.65 5,572.74 3,075.39 8,021.24 21,755.62 27,603.71 (6.0$) $ 41,651.65 5,572.74 3,075.39 8,021.24 none 28,063.77 (6.1$) $ 107,680.35 $ 86,384.79