Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

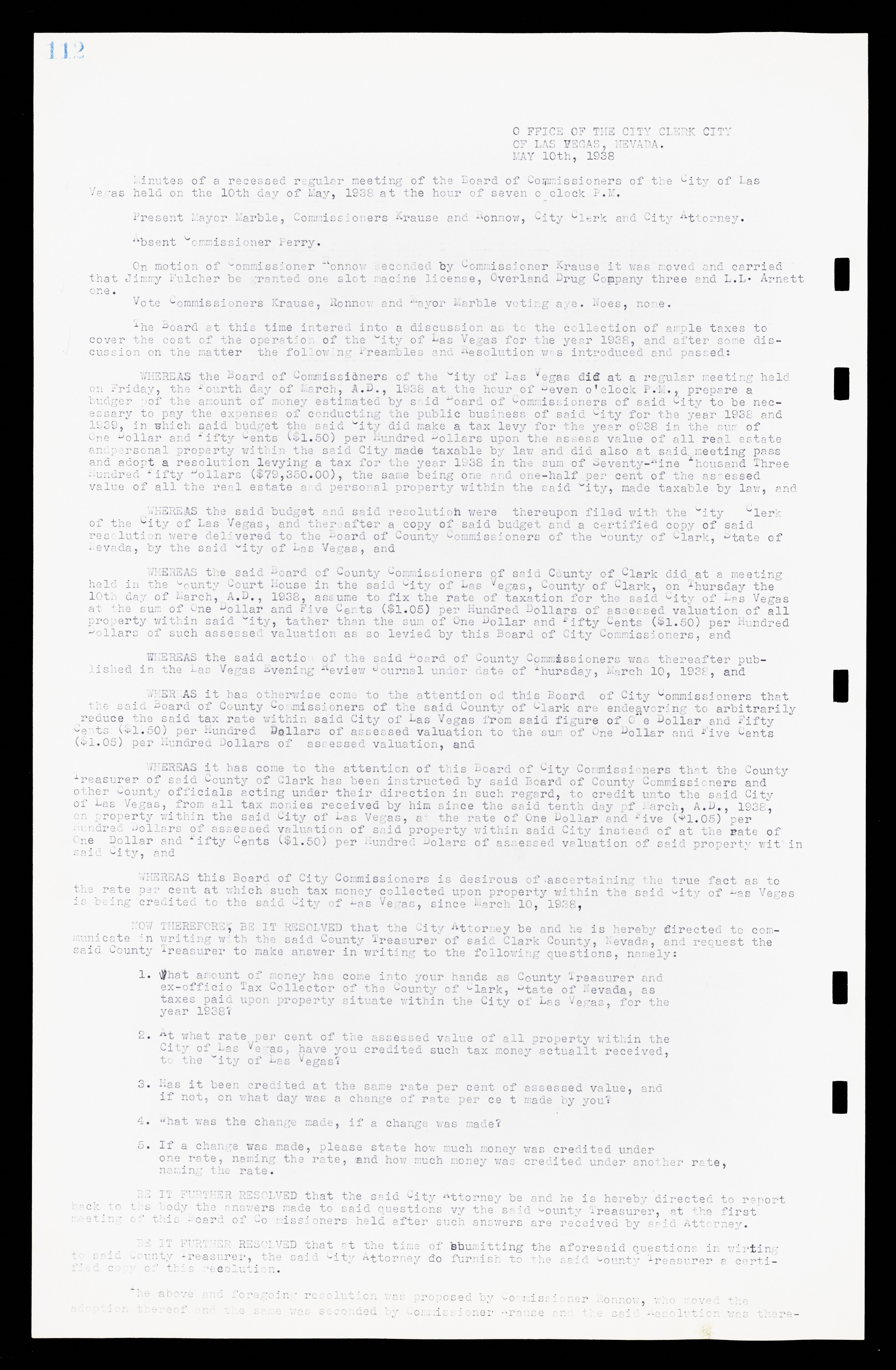

OFFICE OF THE CITY CLERK CITY OF LAS VEGAS, NEVADA. MAY 10th, 1938 Minutes of a recessed regular meeting of the Board of Commissioners of the City of Las Vegas held on the 10th day of May, 1938 at the hour of seven o'clock P.M. Present Mayor Marble, Commissioners Krause and Ronnow, City Clerk and City Attorney. Absent Commissioner Perry. On motion of Commissioner Ronnow seconded by Commissioner Krause it was moved and carried that Jimmy Fulcher be granted one slot machine license, Overland Drug Company three and L.L. Arnett one. Vote Commissioners Krause, Ronnow and Mayor Marble voting aye. Noes, none. The Board at this time entered into a discussion as to the collection of ample taxes to cover the cost of the operation of the City of Las Vegas for the year 1938, and after some discussion on the matter the following Preambles and Resolution was introduced and passed: WHEREAS the Board of Commissioners of the City of Las Vegas did at a regular meeting held on Friday, the Fourth day of March, A.D., 1938 at the hour of Seven o'clock P.M., prepare a budget of the amount of money estimated by said Board of Commissioners of said City to be necessary to pay the expenses of conducting the public business of said City for the year 1938 and 1939, in which said budget the said City did make a tax levy for the year 1938 in the sum of One Dollar and Fifty Cents ($1.50) per Hundred Dollars upon the assess value of all real estate and personal property within the said City made taxable by law and did also at said meeting pass and adopt a resolution levying a tax for the year 1938 in the sum of Seventy-Nine Thousand Three Hundred Fifty Dollars ($79,350.00), the same being one and one-half per cent of the assessed value of all the real estate and personal property within the said City, made taxable by law, and WHEREAS the said budget and said resolution were thereupon filed with the City Clerk of the City of Las Vegas, and thereafter a copy of said budget and a certified copy of said resolution were delivered to the Board of County Commissioners of the County of Clark, State of Nevada, by the said City of Las Vegas, and WHEREAS the said Board of County Commissioners of said County of Clark did at a meeting held in the County Court House in the said City of Las Vegas, County of Clark, on Thursday the 10th day of March, A.D., 1938, assume to fix the rate of taxation for the said City of Las Vegas at the sum of One Dollar and Five Cents ($1.05) per Hundred Dollars of assessed valuation of all property within said City, rather than the sum of One Dollar and Fifty Cents ($1.50) per Hundred Dollars of such assessed valuation as so levied by this Board of City Commissioners, and WHEREAS the said action of the said Board of County Commissioners was thereafter published in the Las Vegas Evening Review Journal under date of Thursday, March 10, 1938, and WHEREAS it has otherwise come to the attention of this Board of City Commissioners that the said Board of County Commissioners of the said County of Clark are endeavoring to arbitrarily reduce the said tax rate within said City of Las Vegas from said figure of One Dollar and Fifty Cents ($1.50) per Hundred Dollars of assessed valuation to the sum of One Dollar and Five Cents ($1.05) per Hundred Dollars of assessed valuation, and WHEREAS it has come to the attention of this Board of City Commissioners that the County Treasurer of said County of Clark has been instructed by said Board of County Commissioners and other County officials acting under their direction in such regard, to credit unto the said City of Las Vegas, from all tax monies received by him since the said tenth day of March, A.D., 1938, on property within the said City of Las Vegas, at the rate of One Dollar and Five ($1.05) per Hundred Dollars of assessed valuation of said property within said City instead of at the rate of One Dollar and Fifty Cents ($1.50) per Hundred Dollars of assessed valuation of said property within said City, and WHEREAS this Board of City Commissioners is desirous of ascertaining the true fact as to the rate per cent at which such tax money collected upon property within the said City of Las Vegas is being credited to the said City of Las Vegas, since March 10, 1938, NOW THEREFORE, BE IT RESOLVED that the City Attorney be and he is hereby directed to communicate in writing with the said County Treasurer of said Clark County, Nevada, and request the said County Treasurer to make answer in writing to the following questions, namely: 1. That amount of money has come into your hands as County Treasurer and ex-officio Tax Collector of the County of Clark, State of Nevada, as taxes paid upon property situate within the City of Las Vegas, for the year 1938? 2. At what rate per cent of the assessed value of all property within the City of Las Vegas, have you credited such tax money actually received, to the City of Las Vegas? 3. Has it been credited at the same rate per cent of assessed value, and if not, on what day was a change of rate percent made by you? 4. What was the change made, if a change was made? 5. If a change was made, please state how much money was credited under one rate, naming the rate, and how much money was credited under another rate, naming the rate. BE IT FURTHER RESOLVED that the said City Attorney be and he is hereby directed to report back to this body the answers made to said questions by the said County Treasurer, at the first meeting of this Board of Commissioners held after such answers are received by said Attorney. BE IT FURTHER RESOLVED that at the time of submitting the aforesaid questions in writing to said County Treasurer, the said City Attorney do furnish to the said County Treasurer a certified copy of this resolution. The above and foregoing resolution was proposed by Commissioner Ronnow, who moved the adoption thereof and the same was seconded by Commissioner Krause and the said Resolution was there-