Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

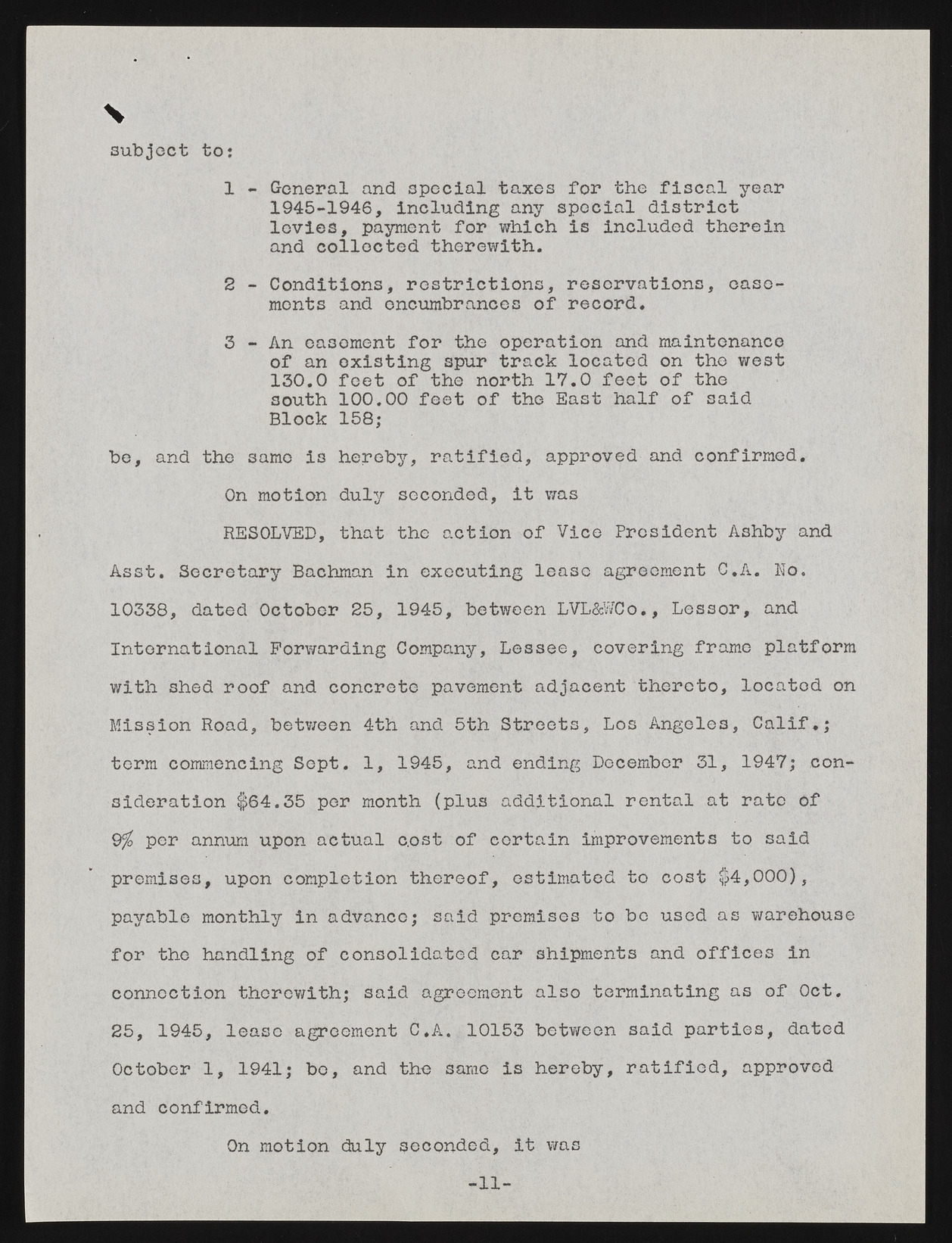

\ subject to: 1 - General and special taxes for the fiscal year 1945-1946, including any special district levies, payment for which is included therein and collected therewith. 2 - Conditions, restrictions, reservations, caso-monts and encumbrances of record. 3 - An easement for the operation and maintenance of an existing spur track located on the west 130.0 feet of the north 17.0 feet of the south 100.00 feet of the East half of said Block 158; be, and the same is hereby, ratified, approved and confirmed. On motion duly seconded, it was RESOLVED, that the action of Vice President Ashby and Asst. Secretary Bachman in executing lease agreement C.A. No. 10338, dated October 25, 1945, between LVL&WCo., Lessor, and International Forwarding Company, Lessee, covering frame platform with shed roof and concrete pavement adjacent thereto, locatod on Mission Road, between 4th and 5th Streets, Los Angeles, Calif,; term commencing Sept. 1, 1945, and ending December 31, 1947; consideration $64.35 per month (plus additional rental at rate of 9% per annum upon actual c.ost of certain improvements to said premises, upon completion thereof, estimated to cost $4,000), payable monthly in advance; said premises to bo used as warehouse for the handling of consolidated car shipments and offices in connection therewith; said agreement also terminating as of Oct. 25, 1945, lease agreement C.A. 10153 between said parties, dated October 1, 1941; bo, and the same is hereby, ratified, approved and confirmed. On motion duly seconded, it was -11-