Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

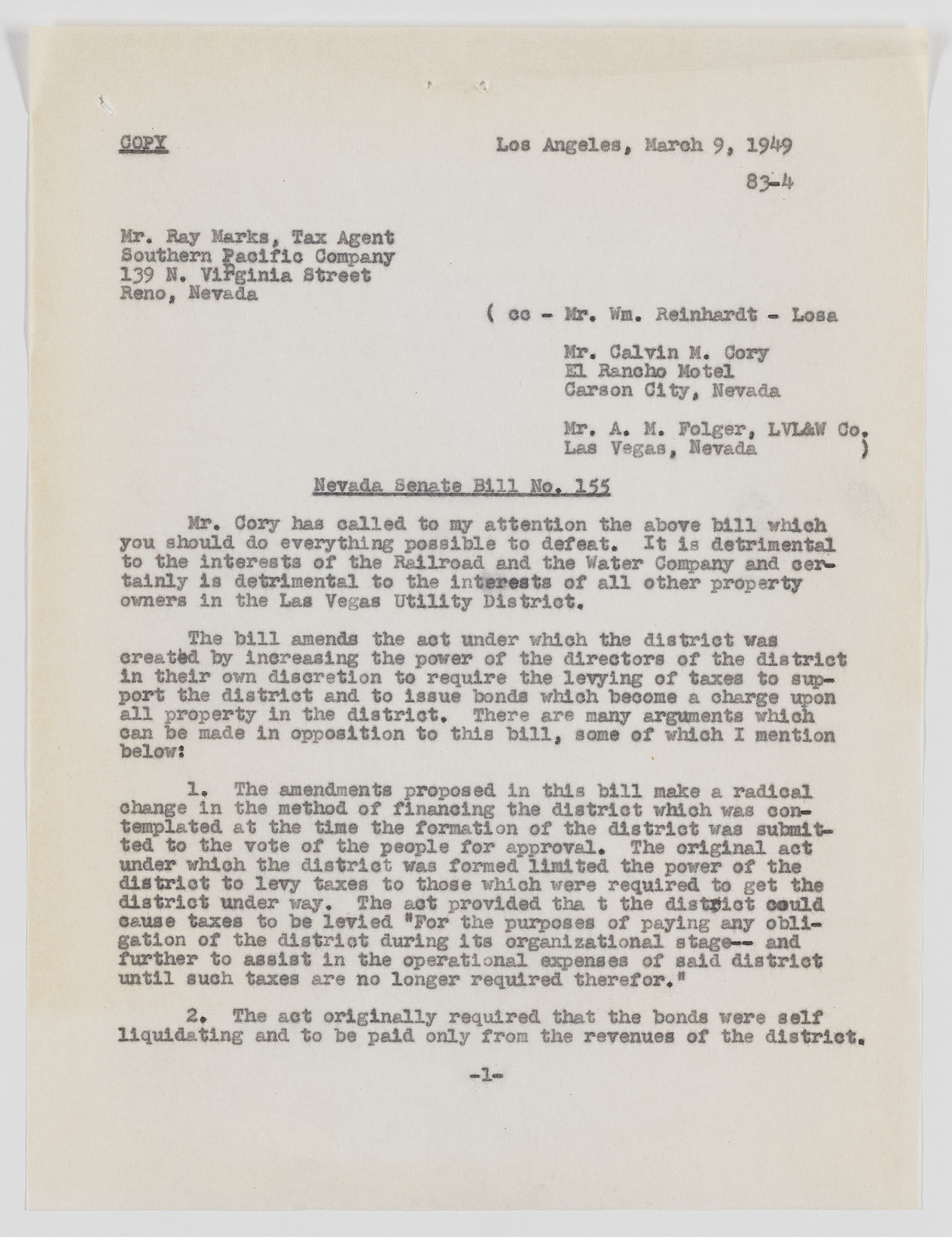

COPY Lug Angeles, March $$ ii§ Hr. lay Marks, Tax Agent Southern F&oiflo Company 139 N. Virginia Street Reno, Nevada ( oo - Hr. Wm. Reinhardt - Lose Hr. Calvin H. dory SI Ranch© Hotel Caraon City, Nevada Mr, A. M. Folger, LVL&W Co. Las Vegas, Nevada f mm mi m* m Hr. Cory has called to my attention the above bill which you should do everything possible to defeat. St is detrimental to the interests of the Railroad and the Water Company and certainly is detrimental to the interests of all other property owners in the Las Vegas Utility District. The bill amends the aot under whieh the district was created by increasing the power of the directors of the district in their own discretion to require the levying of taxes to support the district and to issue bonds which become a charge upon all property in the district. There are many arguments which can be made in opposition to this bill, some of which I mention below: 1, The amendments proposed in this bill make a radical change In the method of financing the district which was contemplated at the time the formation of the district was submitted to the vote of the people for approval. The original act under which the district was formed limited the power of the district to levy taxes to those which were required to get the district under way. The act provided tha t the district could cause taxes to be levied •For the purposes of paying any obligation of the district during its organisational stage— and further to assist in the operational expenses of said district until such taxes are no longer required therefor,* 2, The act originally required that the bonds were self liquidating and to be paid only from the revenues of the district.