Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

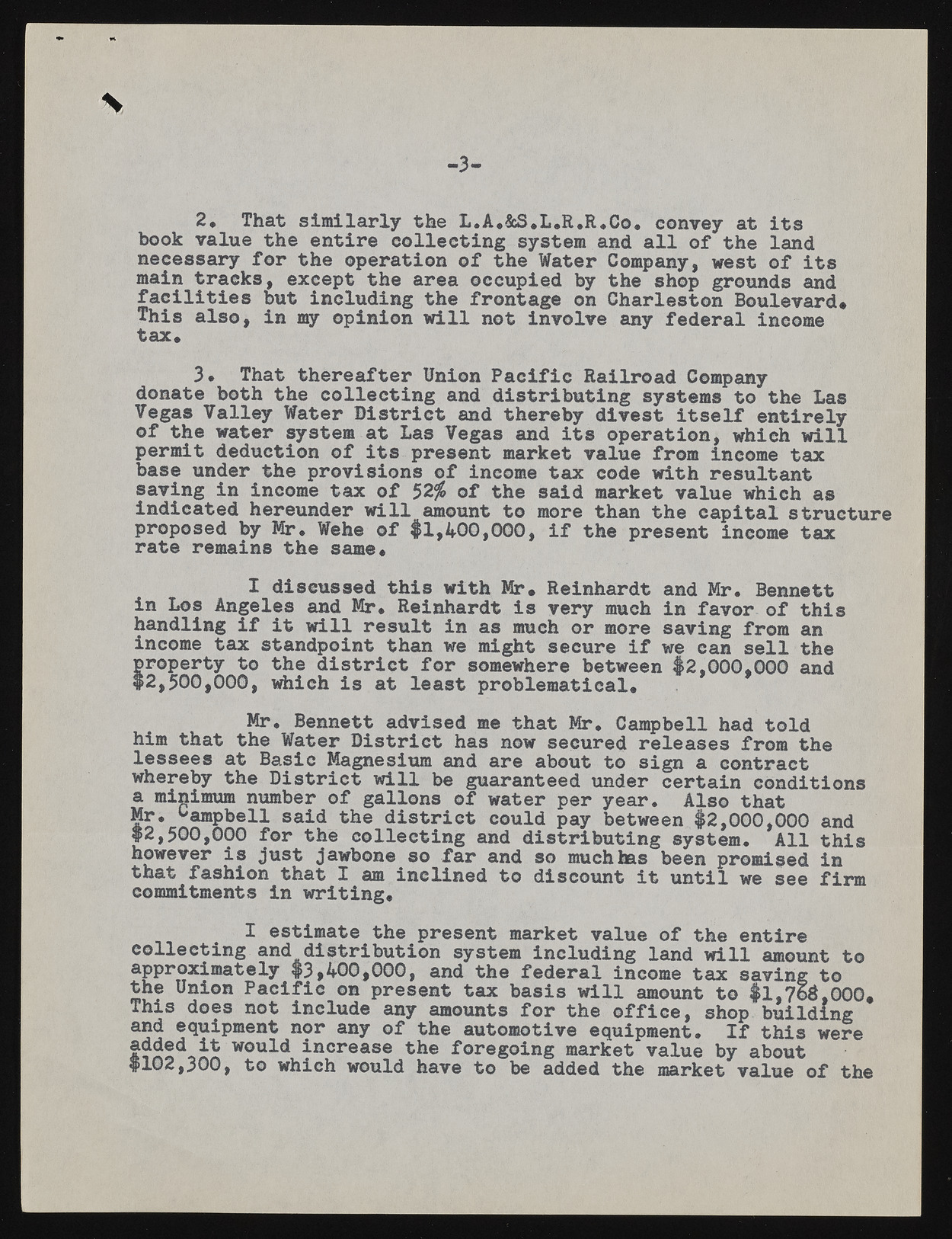

M -3- 2. That similarly the L.A.&S.L.R.R.Co. convey at its book value the entire collecting system and all of the land necessary for the operation of the Water Company, west of its main tracks, except the area occupied by the shop grounds and facilities but including the frontage on Charleston Boulevard* This also, in my ©pinion will not involve tax* any federal ineome 3* That thereafter Union Pacific Railroad Company donate both the collecting and distributing systems to the Las Vegas Valley Water District and thereby divest itself entirely of the water system at Las Vegas and its operation, which will permit deduction of its present market value from income tax base under the provisions of income tax code with resultant saving in income tax of 5 2 % of the said market value which as indicated hereunder will amount to more than the capital structure prratoep orseemda ibnys M rt.h eW eshaeme *of $1,400,000, if the present income tax I discussed this with Mr* Reinhardt and Mr. Bennett in Los Angeles and Mr. Reinhardt is very much in favor of this handling if it will result in as much or more saving from an income tax standpoint than we might secure if we can sell the property to the district for somewhere between $2 ,0 0 0 ,0 0 0 and $2 ,5 0 0 ,0 0 0 , which is at least problematical* Mr. Bennett advised me that Mr. Campbell had told him that the Water District has now secured releases from the lessees at Basic Magnesium and are about t© sign a contract whereby the District will be guaranteed under certain conditions a minimum number of gallons of water per year. Also that Mr. Campbell said the district could pay between $2,000,000 and $2,500,000 for the collecting and distributing system. All this however is just jawbone so far and so muchhas been promised in tchoamtm iftamesnhtiso n itnh warti tIi nagm. inclined to discount it until we see firm I estimate the present market value of the entire collecting and distribution system including land will amount to approximately $3 ,4 0 0 ,0 0 0 , and the federal income tax saving to the Union Pacific on present tax basis will amount to $1,76$,000. This does not include any amounts for the office, shop building and equipment nor any of the automotive equipment. If this were added it would increase the foregoing market value by about n'5.,3 0 0 , to which would have to be added the market value of the