Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

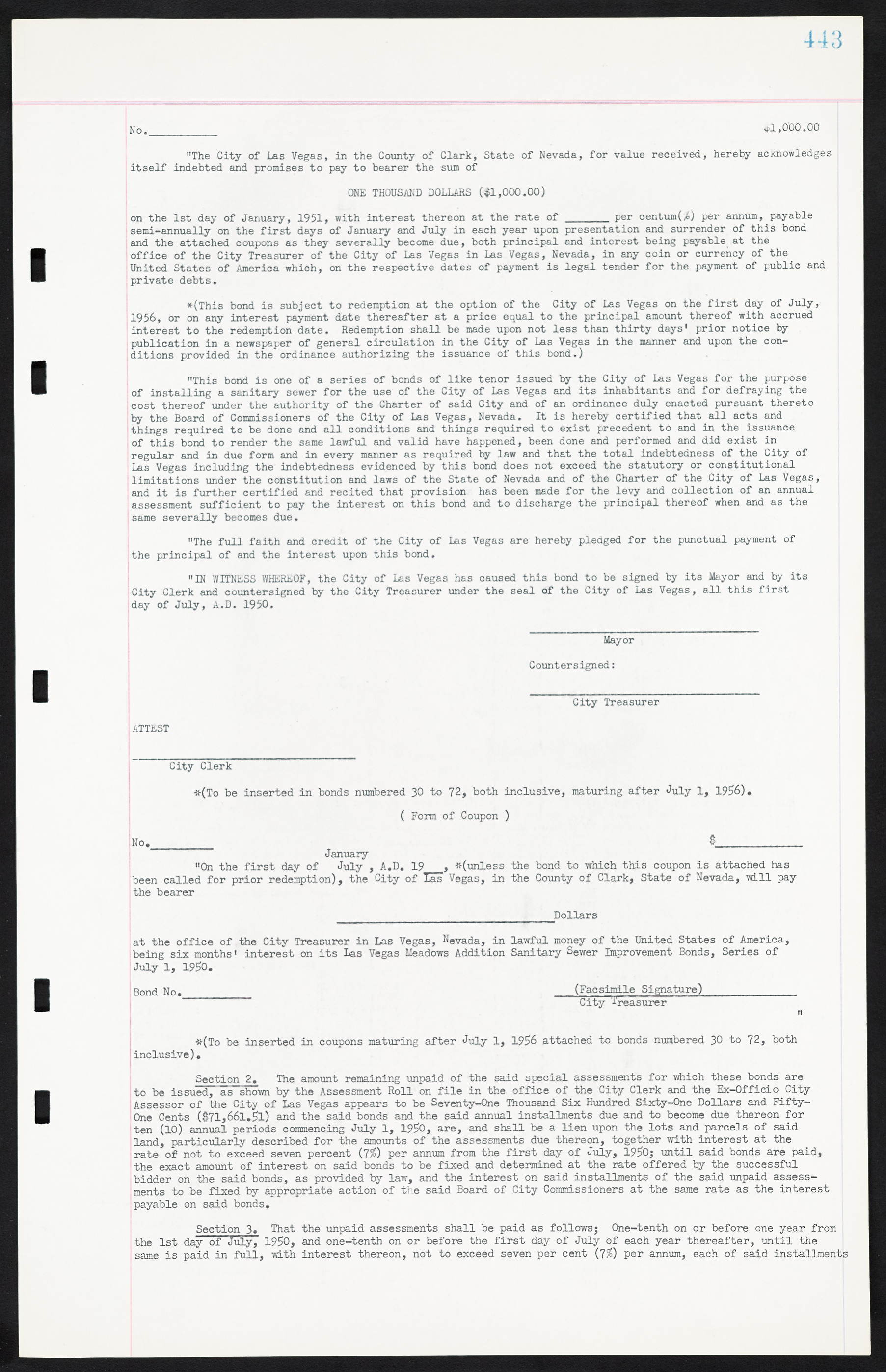

No._________ $1,000.00 "The City of Las Vegas, in the County of Clark, State of Nevada, for value received, hereby acknowledges itself indebted and promises to pay to bearer the sum of ONE THOUSAND DOLLARS ($1,000.00) on the 1st day of January, 1951, with interest thereon at the rate of ______per centum(%) per annum, payable semi-annually on the first days of January and July in each year upon presentation and surrender of this bond and the attached coupons as they severally become due, both principal and interest being payable at the office of the City Treasurer of the City of Las Vegas in Las Vegas, Nevada, in any coin or currency of the United States of America which, on the respective dates of payment is legal tender for the payment of public and private debts. *(This bond is subject to redemption at the option of the City of Las Vegas on the first day of July, 1956, or on any interest payment date thereafter at a price equal to the principal amount thereof with accrued interest to the redemption date. Redemption shall be made upon not less than thirty days' prior notice by publication in a newspaper of general circulation in the City of Las Vegas in the manner and upon the conditions provided in the ordinance authorizing the issuance of this bond.) "This bond is one of a series of bonds of like tenor issued by the City of Las Vegas for the purpose of installing a sanitary sewer for the use of the City of Las Vegas and its inhabitants and for defraying the cost thereof under the authority of the Charter of said City and of an ordinance duly enacted pursuant thereto by the Board of Commissioners of the City of Las Vegas, Nevada. It is hereby certified that all acts and things required to be done and all conditions and things required to exist precedent to and in the issuance of this bond to render the same lawful and valid have happened, been done and performed and did exist in regular and in due form and in every manner as required by law and that the total indebtedness of the City of Las Vegas including the indebtedness evidenced by this bond does not exceed the statutory or constitutional limitations under the constitution and laws of the State of Nevada and of the Charter of the City of Las Vegas, and it is further certified and recited that provision has been made for the levy and collection of an annual assessment sufficient to pay the interest on this bond and to discharge the principal thereof when and as the same severally becomes due. "The full faith and credit of the City of Las Vegas are hereby pledged for the punctual payment of the principal of and the interest upon this bond. "IN WITNESS WHEREOF, the City of Las Vegas has caused this bond to be signed by its Mayor and by its City Clerk and countersigned by the City Treasurer under the seal of the City of Las Vegas, all this first day of July, A.D. 1950. Mayor Countersigned: City Treasurer ATTEST City Clerk *(To be inserted in bonds numbered 30 to 72, both inclusive, maturing after July 1, 1956). ( Form of Coupon ) No.________ $___________ January "On the first day of July , A.D. 19__, *(unless the bond to which this coupon is attached has been called for prior redemption), the City of Las Vegas, in the County of Clark, State of Nevada, will pay the bearer _____________________________Dollars at the office of the City Treasurer in Las Vegas, Nevada, in lawful money of the United States of America, being six months' interest on its Las Vegas Meadows Addition Sanitary Sewer Improvement Bonds, Series of July 1, 1950. Bond No. __(Facsimile Signature)____________ City Treasurer " *(To be inserted in coupons maturing after July 1, 1956 attached to bonds numbered 30 to 72, both inclusive). Section 2. The amount remaining unpaid of the said special assessments for which these bonds are to be issued, as shown by the Assessment Roll on file in the office of the City Clerk and the Ex-Officio City Assessor of the City of Las Vegas appears to be Seventy-One Thousand Six Hundred Sixty-One Dollars and Fifty- One Cents ($71,661.51) and the said bonds and the said annual installments due and to become due thereon for ten (10) annual periods commencing July 1, 1950, are, and shall be a lien upon the lots and parcels of said land, particularly described for the amounts of the assessments due thereon, together with interest at the rate of not to exceed seven percent (7%) per annum from the first day of July, 1950; until said bonds are paid, the exact amount of interest on said bonds to be fixed and determined at the rate offered by the successful bidder on the said bonds, as provided by law, and the interest on said installments of the said unpaid assessments to be fixed by appropriate action of the said Board of City Commissioners at the same rate as the interest payable on said bonds. Section 3. That the unpaid assessments shall be paid as follows; One-tenth on or before one year from the 1st day of July, 19%, and one-tenth on or before the first day of July of each year thereafter, until the same is paid in full, with interest thereon, not to exceed seven per cent (7%) per annum, each of said installments