Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

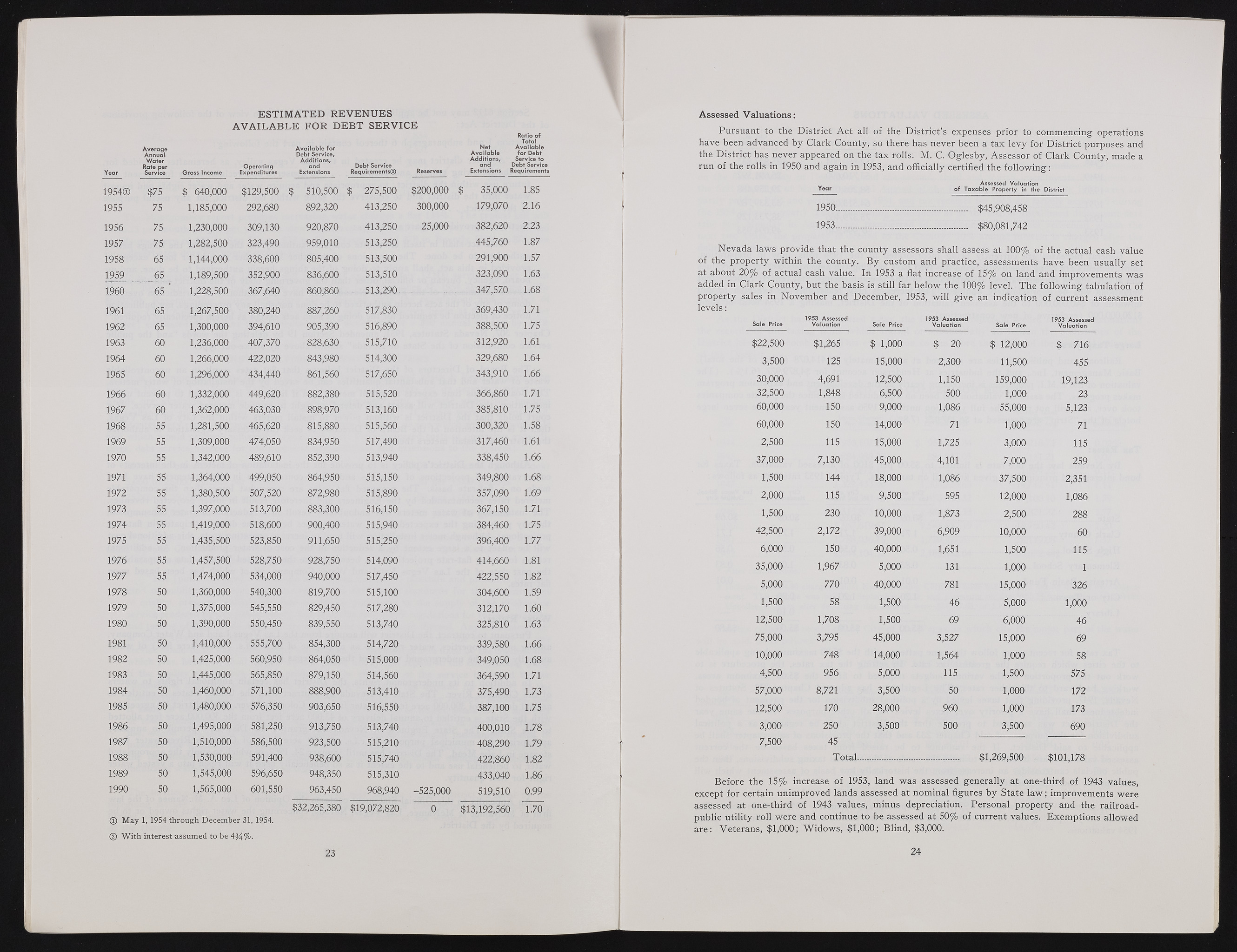

EST IM A TED R E V E N U E S A V A IL A B L E FO R D E B T S E R V IC E Year Average Annual Water Rate per Service Gross Income Operating Expenditures Available for Debt Service, Additions, and Extensions Debt Service Requirements® Reserves Ratio of Total Net Available Available for Debt Additions, Service to and Debt Service Extensions Requirements 1954® $75 $ 640,000 $129,500 $ 510,500 $ 275,500 $200,000 $ 35,000 1.85 1955 75 1,185,000 292,680 892,320 413,250 300,000 179,070 2.16 1956 75 1,230,000 309,130 920,870 413,250 25,000 382,620 2.23 1957 75 1,282,500 323,490 959,010 513,250 445,760 1.87 1958 65 1,144,000 338,600 805,400 513,500 291,900 1.57 1959 65 1,189,500 352,900 836,600 513,510 323,090 1.63 1960 65 1,228,500 367,640 860,860 513,290. 347,570 1.68 1961 65 1,267,500 380,240 887,260 517,830 369,430 1.71 1962 65 1,300,000 394,610 905,390 516,890 388,500 1.75 1963 60 1,236,000 407,370 828,630 515,710 312,920 1.61 1964 60 1,266,000 422,020 843,980 514,300 329,680 1.64 1965 60 1,296,000 434,440 861,560 517,650 343,910 1.66 1966 60 1,332,000 449,620 882,380 515,520 366,860 1.71 1967 60 1,362,000 463,030 898,970 513,160 385,810 1.75 1968 55 1,281,500 465,620 815,880 515,560 300,320 1.58 1969 55 1,309,000 474,050 834,950 517,490 317,460 1.61 1970 55 1,342,000 489,610 852,390 513,940 338,450 1.66 1971 55 1,364,000 499,050 864,950 515,150 349,800 1.68 1972 55 1,380,500 507,520 872,980 515,890 357,090 1.69 1973 55 1,397,000 513,700 883,300 516,150 367,150 1.71 1974 55 1,419,000 518,600 900,400 515,940 384,460 1.75 1975 55 1,435,500 523,850 911,650 515,250 396,400 1.77 1976 55 1,457,500 528,750 928,750 514,090 414,660 1.81 1977 55 1,474,000 534,000 940,000 517,450 422,550 1.82 1978 50 1,360,000 540,300 819,700 515,100 304,600 1.59 1979 50 1,375,000 545,550 829,450 517,280 312,170 1.60 1980 50 1,390,000 550,450 839,550 513,740 325,810 1.63 1981 50 1,410,000 555,700 854,300 514,720 339,580 1.66 1982 50 1,425,000 560,950 864,050 515,000 349,050 1.68 1983 50 1,445,000 565,850 879,150 514,560 364,590 1.71 1984 50 1,460,000 571,100 888,900 513,410 375,490 1.73 1985 50 1,480,000 576,350 903,650 516,550 387,100 1.75 1986 50 1,495,000 581,250 913,750 513,740 400,010 1.78 1987 50 1,510,000 586,500 923,500 515,210 408,290 1.79 1988'' 50 1,530,000 591,400 938,600 515,740 422,860 1.82 1989 50 1,545,000 596,650 948,350 515,310 433,040 1.86 1990 50 1,565,000 601,550 963,450 968,940 -525,000 519,510 0.99 $32,265,380 $19,072,820 0 $13,192,560 1.70 © May 1, 1954 through December 31, 1954. © With interest assumed to be 4^4%. 23 Assessed Valuations: Pursuant to the District Act all of the District’s expenses prior to commencing operations have been advanced by Clark County, so there has never been a tax levy for District purposes and the District has never appeared on the tax rolls: M. C. Oglesby, Assessor of Clark County, made a run of the rolls in 1950 and again in 1953, and officially certified the following: Assessed Valuation Year of Taxable Property in the District 1950.......................................................... $45,908,458 1953.......................................................... $80,081,742 Nevada laws provide that the county assessors shall assess at 100% of the actual cash value of the property within the county. By custom and practice, assessments have been usually set at about 20% of actual cash value. In 1953 a flat increase of 15% on land and improvements was added in Clark County, but the basis is still far below the 100% level. The following tabulation of property sales in November and December, 1953, will give an indication of current assessment levels: Sale Price 1953 Assessed Valuation Sale Price 1953 Assessed Valuation Sale Price 1953 Assessed Valuation $22,500 $1,265 $ 1,000 $ 20 $ 12,000 $ 716' 3,500 125 15,000 2,300 11,500 455 30,000 4,691 12,500 1,150 159,000 19,123 32,500 1,848 6,500 500 1,000 23 60,000 150 9,000 1,086 55,000 5,123 60,000 150 14,000 71 1,000 71 2,500 115 15,000 1,725 3,000 115 37,000 7,130 45,000 4,101 7,000 259 1,500 144 18,000 1,086 37,500 2,351 2,000 115 9,500 595 12,000 1,086 1,500 230 10,000 1,873 2,500 288 42,500 2,172 39,000 6,909 10,000 60 6,000 150 40,000 1,651 1,500 115 35,000 1,967 5,000 131 1,000 1 5,000 770 40,000 781 15,000 326 1,500 58 1,500 46 5,000 1,000 12,500 1,708 1,500 69 6,000 46 75,000 3,795 45,000 3,527 15,000 69 10,000 748 14,000 1,564 1,000 58 4,500 956 5,000 115 1,500 575 57,000 8,721 3,500 50 1,000 172 12,500 170 28,000 960 1,000 173 3,000 250 3,500 500 3,500 690 7,500 45 Total... $1,269,500 $101,178 Before the 15% increase of 1953, land was assessed generally at one-third of 1943 values, except for certain unimproved lands assessed at nominal figures by State law; improvements were assessed at one-third of 1943 values, minus depreciation. Personal property and the railroad-public utility roll were and continue to be assessed at 50% of current values. Exemptions allowed are: Veterans, $1,000; Widows, $1,000; Blind, $3,000. 24