Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

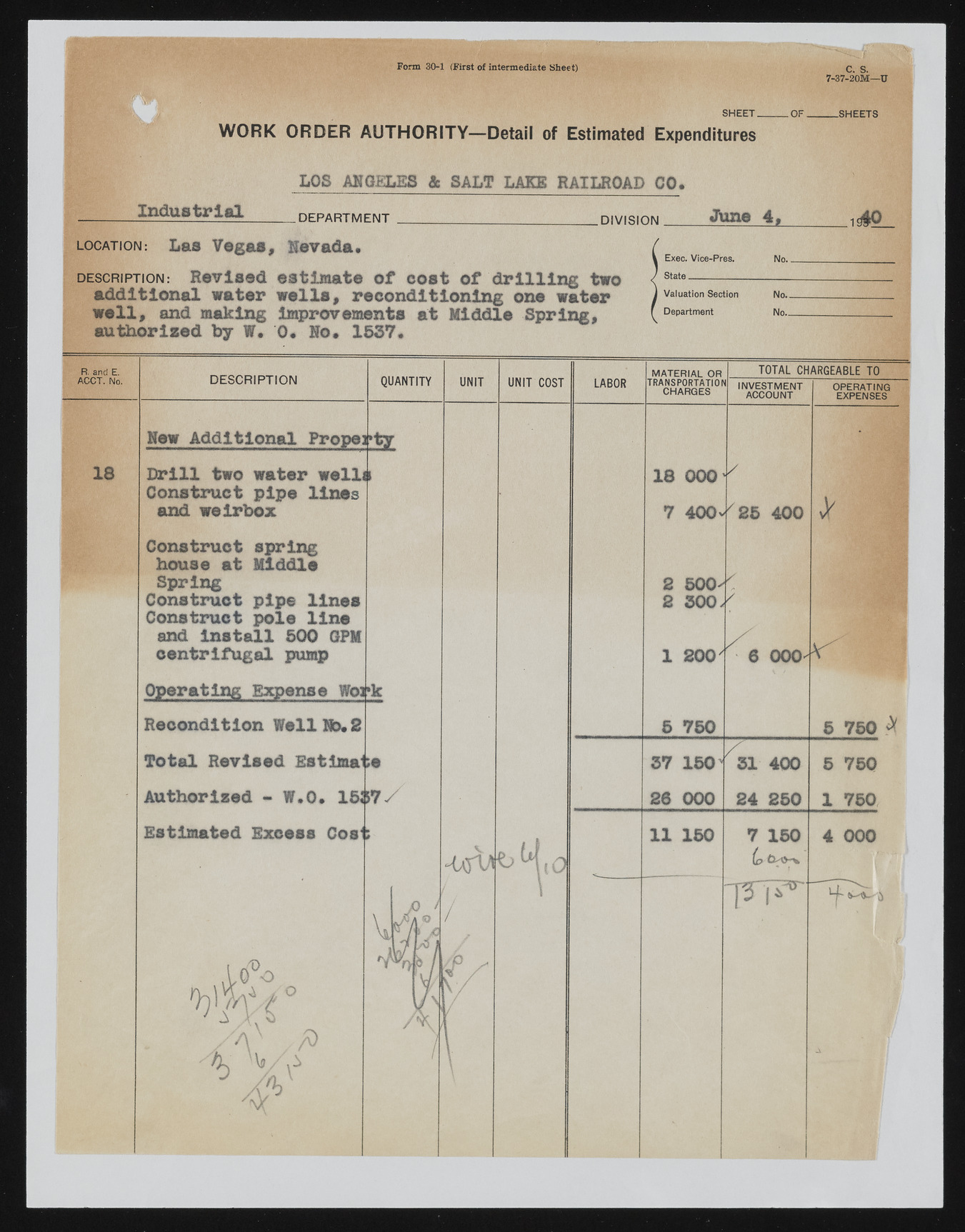

Form 30-1 (First o f interm ediate Sheet) C. S. 7-37-20M — U SHEET_____ OF. WORK ORDER AUTHORITY—Detail of Estimated Expenditures -SHEETS LOS ANGELES & S A L T LAKE R A I L R O A D CO. Industrial .DEPARTMENT l o c a t i o n : Las Vegas, Nevada. .DIVISION June 4, 1^0 d e s c r i p t i o n : R e v i s e d estimate of cost of d r i l l i n g two additional w a t e r wells, r e c o n d i t i o n i n g one water well, and m a k i n g improvements at Middle Spring, authorized b y W. 0. No. 1537. Exec. Vice-Pres. State_________ No. _ Valuation Section Department N o - N o - R. and E. ACCT. No. 18 DESCRIPTION New Additional Property Drill two w a t e r well# Const r u c t p i p e lines a n d w e i r b o x Const r u c t spring ho u s e at Middle Sp r i n g Const r u c t pipe lines Construct pole line and install 500 GPM centrifugal p u m p Operating Expense W o ^ k QUANTITY UNIT UNIT COST R e c o n d i t i o n V e i l NC. 2 Total R e v i s e d Estimate A u t h o r i z e d - W.O. 1537./ E s t i m a t e d Excess Cost O ^ O % a ) y v - t r v | L > % o LABOR M A TE R IA L OR TRANSPORTATION CHARGES 18 000 TOTAL CHARGEABLE TO INVESTMENT ACCOUNT 7 4 0 0 ^ 2 5 400 2 500 y 2 3 0 0 // 1 200 5 7 5 0 37 150 6 000 ^ OPERATING EXPENSES Jr 31 400 26 000 24 2 5 0 1 1 150 7 1 5 0 Pi AT 5 750 5 750 1 750 4 000 '4~