Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

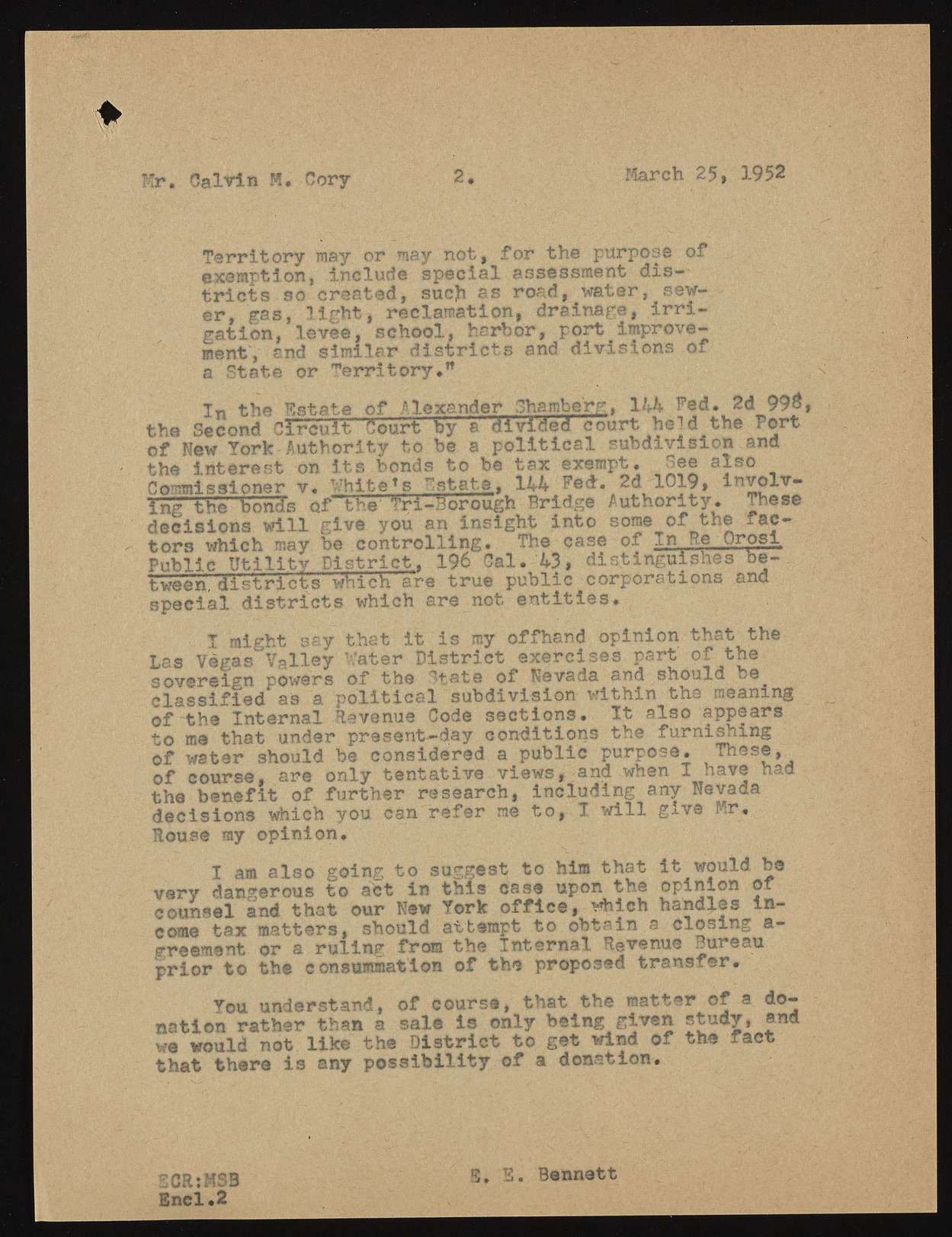

H Mr, C a lv in M, Cory March 25, 1952 Territory may o r may n o t, f o r the purpose o f exemption, include "special assessment districts so created, sucji as road, water, sewer, gas, light, reclamation, drainage, irrigation, levee, school, harbor, port improvement', and similar districts and divisions o f a State or Territory." I n th e E s ta te o f A lexander Shamberg, 144 Fed. 2d 99$j th e Second C ir c u it Court by a d iv id e d c o u r t h e ld th e P o rt o f New York A u th o rity to be a p o l i t i c a l s u b d iv is io n and th e i n t e r e s t on i t s bonds to be ta x exem pt. See a ls o Commissioner v« W hite Ts E s ta te , 144 Fed. 2d 1019, in v o lv - frig th e feoncfe o f“ th e tri-S o ro u g h B ridge A u th o rity . These d e c is io n s w ill g iv e you an in s ig h t in to some o f th e fact o r s w hich may be c o n t r o ll in g . The case o f In Re O rosl P u b lic U t i l i t y D i s t r i c t . 196 C al. 43, d is tin g u is h e s be-riw e'erii'd istricts' w hich a re tr u e p u b lic c o rp o ra tio n s and s p e c ia l d i s t r i c t s w hich a re not e n t i t i e s . | might say that it is my offhand opinion that the Las Vegas Valley Water District exercises part of the sovereign powers of the itate of Nevada and should be classified as a political subdivision within the meaning of the Internal Revenue Code sections. It also appears to me that under present-day conditions the furnishing of water should be considered a public purpose. These, of course, are only tentative views, and when I have had the benefit of further research, including any Nevada decisions which you can'refer rae to, I will give Mr, Rouse my opinion, I am also going to suggest to him that it would be very dangerous to act in this case upon the opinion of counsel and that our New York office, which handles income tax matters, should attempt to obtain a closing ft— greement or a ruling from the Internal Revenue Bureau prior t© the consummation of the proposed transfer# You understand, of course, that the matter of a donation rather than a sale is only being given study, and we would not like the District to get wind of the fact that there is any possibility of a donation. £ECnRe:lM .2 5. E. Bennett