Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

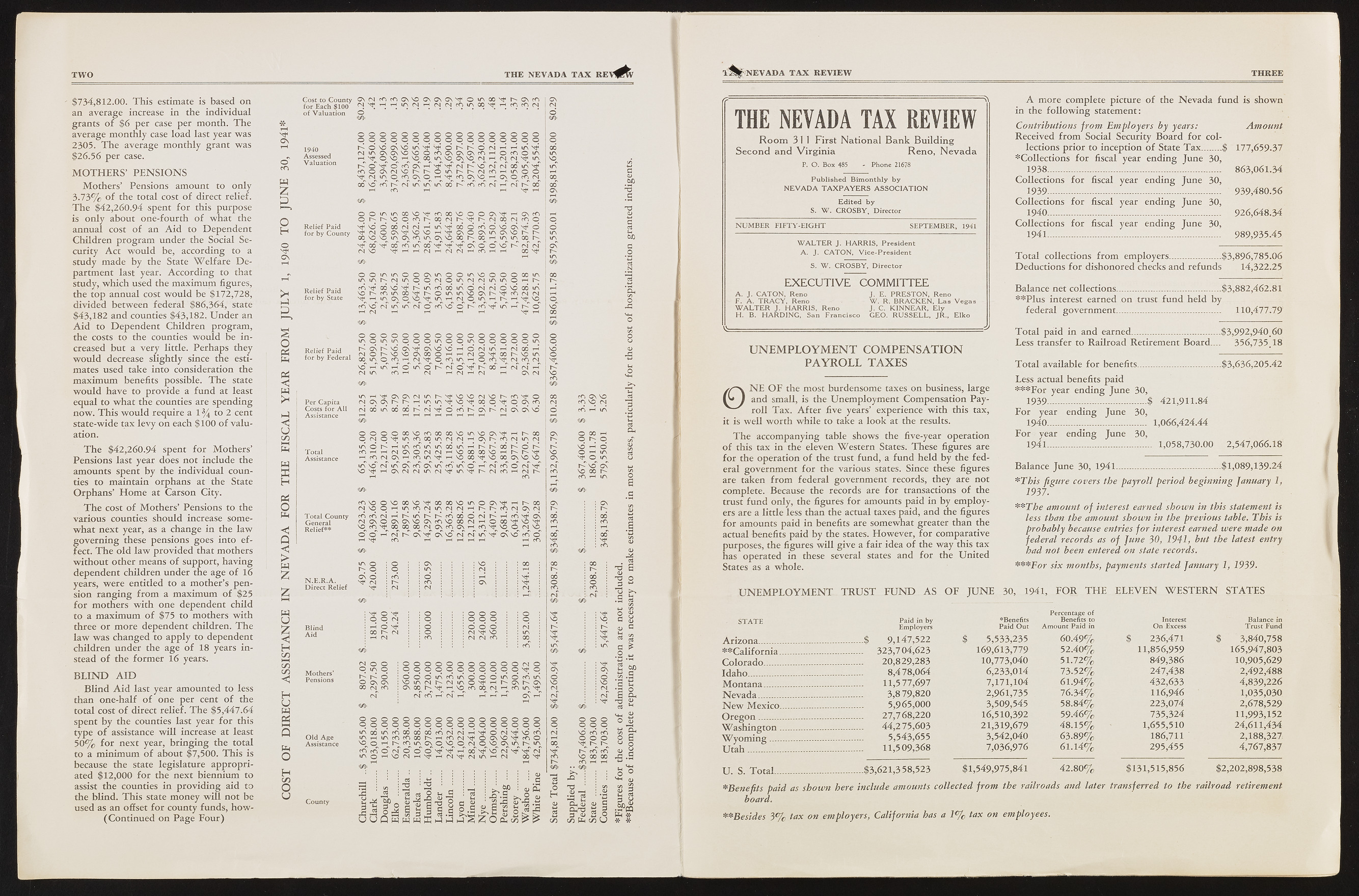

TW O THE NEVADA TAX REV $734,812.00. T h is estimate is based on an average increase in the individual grants o f $6 per case per month. T h e average m onthly case lo ad last year was 2305. T h e average m onthly grant was $26.56 per case. M O T H E R S ’ P E N S I O N S M oth ers’ Pensions am ount to only 3 .7 3 % o f the total cost o f direct relief. T h e $42,260.94 spent fo r this purpose is only about one-fourth o f w h at the annual cost o f an A id to D ependent C h ildren p ro gram under the Social Security A c t w o u ld be, according to a study m ade by the State W e lfa r e D e partm ent last year. A c c o rd in g to that study, w hich used the m axim um figures, the top annual cost w o u ld be $172,728, divided betw een fed eraT $86,364, state $43,182 and counties $43,182, U n d e r an A i d to D epen den t C h ildren program , the costs to the counties w o u ld be in creased but a very little. Perhaps they w o u ld decrease slightly since the estimates used take into consideration the m axim um benefits possible. T h e state w o u ld have to provide a fu n d at least equal to w h at the counties are spending n ow . T h is w o u ld require a 1 % to 2 cent state-wide tax levy on each $100 o f valu ation. T h e $42,260.94 spent fo r M oth ers’ Pensions last year does not include the amounts spent by the in dividu al counties to m aintain orphans at the State O rp h a n s’ H o m e at Carson City. T h e cost o f M oth ers’ Pensions to the various counties should increase somew h at next year, as a change in the la w g o v e rn in g these pensions goes into e ffect. T h e o ld la w provided that mothers w ith out other means o f support, having dependent children u nder the age o f 16 years, w ere entitled to a m other’s pen sion ra n g in g fro m a m axim um o f $25 fo r mothers w ith one dependent child to a m axim um o f $75 to mothers w ith three o r m ore dependent children. T h e la w w as changed to apply to dependent children u n der the age o f 18 years in stead o f the form er 16 years. B L I N D A I D B lin d A i d last year am ounted to less than on e-h alf o f one per cent o f the total cost o f direct relief. T h e $5,447.64 spent by the counties last year fo r this type o f assistance w ill increase at least 50% fo r next year, b rin g in g the total to a m inim um o f about $7,500. T h is is because the state legislature a p p ro p riated $12,000 fo r the next biennium to assist the counties in p ro v id in g aid to the blin d. T h is state m oney w ill not be used as an offset fo r county funds, h o w - c o n t in u e d on P age F o u r ) Cost to County ON(Mct>criC\'©C\C\G\'5t‘ © in a O '!ti^ G \ « 'i for Each $100 « t ^ ^ ^ n c tiir cc h i t , m n of Valuation wr H G\ rH 1940 Assessed o Valuation CD Wz p O H o C\ I * i-M P o ed PM <& C w >* H< u CH/Hl Pm wXH PS 0PM C Q 1 PM £ PM U Z < H co HH cn cn < HU PM PS PM o H co Ou County O oq oq oq qo oq oq oq oq oq oq oq oo MiACNCN'O'OOcOCNCNONcTi r—< mf^ no r-^vo m no g\ vo r'^d'N^d'cnGNi-fNF'NF'nft'^'ND ' ^ N i T 0 ^ C N 0 H \ f r T i G N ' 0 x no cn nf in’ ia o ' rn cn Relief Paid for by County Relief Paid for by State Relief Paid for by Federal Per Capita Costs for All Assistance Total Assistance Total County General Relief** N.E.R.A. Direct Relief Blind Aid Mothers’ Pensions Old Age Assistance o o o o o o o o H H l/ O CO © UN n f CO UN NF' ^ m o o q q cn q 9 Ntf 00 O O i n i r \ 0 0 \ O N ^ c O » ' O O O C \ N j < r - i C N c r > q N ^ ^ q r n i ^ c o N N ^ h N c o N r n q ^ ^ O C O N N H i A ^ C O O ^ d ' O C N ^ O N F C M O G N N F N O N O r H M F G N O G N i n G N N O r ' ^ r ' " X V D V O i A O N f n i A C N ' O O O N O O H i A i A M N N ^ a f’^afcnuNX M t^N^M F'G No'd'Nd'r'^'nfnf <M NO 0 0 N f O O i A i A O O C N ' A O O i A ' O O O O C O i f N l A i A h N i A O C N O i M N N i A i A O H N f O ^ a j v o ^ r ^ i A r n c o i n O N i N O V O o o i n ' O h - f T n n O O ' ^ h - O f A i A ' O C N h - ' ^ f ^ M M cn no" n f in" in n f o ' cn no' o ' r-~" cn mf" in" r-T i-T o ' rH (M rH rH r - f r H rH iono© oi noi no oo©o© oi noOo© o o o o o o o O O O O O m NM OCNh VOVOV O CNCONOVOO VHO HH X i n O r O H M ^ o c n m v(MoTinr ^iAcrD-rHc Tin(oM' r^'nHr oM' nHf ' M O N in h M x h N O oo h vo m h o cn vf (n cn m " n f n f By ? Cn cm oo0 0 in p i in X CN Cn oo NO o p i NmO l/N yH MF GN GN CM in L- MF NO NO (MNO h" cn nf O X cn Cn no (M GN GN q T- rH UN UN NF NO MF X o MF o C n cn (M cn no (M (N 00 UN 00 00 K CMMF O cn CN ni GN GN NO o cn r— in rH rH rH rH rH rH rH rH T—( rH 4©? o O o o X NO cn X CO NO in no GN rH X GN c X rH o (N o m m cn 00 in CM <M rH q q cn (M m (M q o r- o l/N 6 r-H in cn in in 00 in rH K 00 K o K NO r- o rH rH (N GN o (M CMrH NO X X NO rH h- r- mf NO c rH in rH m (N GN rH cn UN MF rH NO X ^ NO X GN NO NO q MF c in UN no" nf UN GN cn GN UN cn in o rH nf cn O (M MF nT r- no GN NO HP rH GN (N (M UN (MMF UN h- (M cn rH (M cn NO X rH cn rH cn rH m rH ig§ rC> NO o NO X NO MF X X NO in o GN VF X GN GN (N NO o rH in cn CMin (M (M rH q q cn <MGN (M q q cn cn ni rH in cn 00 o CM rH cn GN 00 00 <N GN o GN GN NO GN cn no X (M rH o X HF NO MF cn cn NO cn 00 00 X (M GN cn q rH cn NO (M^p rH rH O o rH nf GN MF C n no nf nTin mf' GNno" cn o' 00 00 rH cn rH rH rH rH rH rH cn MF rH cn cn o o GN NO X X X g o o in CM rH q GN o cn o rH m 00 X <N cn GN MF o c (N CM CM cn cn MF o MF 1 : o : : o o o : o | : : O o o (M ; i 9 i i i 9 o o i 9 i 9 : : no C rH o H i i o i i i o o o i i ni i K i i <L) X (M ; : o : : : <m MF no : : m m 1 : vf u rH (M : cn : ! : m (M cn : : x : : i mf a ( N O O o in o K 6 xO cn CN cm cn o o o in NO o O O O o O o O o o o (Mo MF o o q o o o o o o o O MF o q o o o in cn in d d o in O cn in o NO m (M (M in O MF rH GN GN NO GN L- nf rH O cn 00 (M^rH cn in MF (M^ <m" cn rH nf rH rH rH rH GN rH nT rH MF o o o O o o o o o o o o o o C O o o o o o o o o o o o o o o C o 00 00 00 cn (M (M rH m d (M MF NO* cn ni NO CT cn X rH cn (M MF o GN NO MF cn o rH C o cn in GN o NO O^ <Mo no q in in X NF g o ' m O MF MF rH X NF NO cm" MF MF nf mf" CT (M rH MF rH (M MF (M in rH (M X MF cn NO X rH cn r~ 4©= •• 4© 03 T3 (N in 'G <u G 03 u 60 G .2t-J 03 . N ‘5CO-i o JG <v *3 aJ Qm oa Eg 03 B0> s ra o G ^ NF q ©NO qn f NF oo ois 60 G o (U cu ao u G 0> < ? 0?3M o H BdB>S 40-3t C/D N3 •J£ *c3 CL| cu i Q-TO 1 a r<u i c/3 Pm ti MO a) 3 JHh C03J ? PM * * * i S f NEVADA TAX REVIEW THREE THE NEVADA TAX REVIEW R o o m 3 1 1 First N a tio n a l B a n k B u ild in g S e c o n d a n d V ir g in ia R e n o , N e v a d a P. O. Box 485 - Phone 21678 Published Bimonthly by NEVADA TAXPAYERS ASSOCIATION Edited by S. W. CROSBY, Director NUMBER FIFTY-EIGHT SEPTEMBER, 1941 WALTER J. HARRIS, President A. J. CATON, Vice-President S. W. CROSBY, Director E X E C U T I V E C O M M I T T E E A. J. CATON, Reno J, E. PRESTON, Reno F. A. TRACY, Reno W. R. BRACKEN, Las Vegas WALTER J. HARRIS, Reno J. C. KINNEAR, Ely H. B. HARDING, San Francisco CEO. RUSSELL, JR., Elko U N EM PLO YM E N T COMPENSATION PAYRO LL TAXES BN E O F the most burdensom e taxes on business, large and small, is the Unem ploym ent Com pensation Payro ll T a x . A ft e r five years’ experience w ith this tax, it is w e ll w orth w h ile to take a lo o k at the results. T h e accom panying table shows the five-year operation o f this tax in the eleven W este rn States. These figures are fo r the operation o f the trust fund, a fu n d held by the fe d eral governm ent fo r the various states. Since these figures are taken from federal governm ent records, they are not complete. Because the records are fo r transactions o f the trust fu n d only, the figures fo r amounts paid in by em ployers are a little less than the actual taxes paid, and die figures fo r amounts paid in benefits are somewhat greater than the actual benefits paid by the states. H ow ever, fo r comparative purposes, the figures w ill give a fair idea o f the w ay this tax has operated in these several states and fo r the U n ited States as a whole. A m ore complete picture o f the N e v a d a fu n d is show n in the fo llo w in g statement: Contributions from Employers by years: Received fro m Social Security B oard fo r collections prior to inception o f State T a x ........$ ^Collections fo r fiscal year ending June 30, 1938.......................... .......................................... Collections fo r fiscal year ending June 30, 1939-............................................- - ...................- Collections fo r fiscal year ending June 30, 1940 .................................... - ....................... Collections fo r fiscal year ending June 30, 1941 __________________________________________________................_ A m ou n t 177,659-37 863.061.34 939,480.56 926.648.34 989,935.45 T o ta l collections from em ployers_____________ $3,896,785.06 Deductions fo r dishonored checks and refunds 14,322.25 Balance net collections.-..................... ................ $3,882,462.81 * * P lu s interest earned on trust fu n d held by federal governm ent.................... ............ ........ 110,477.79 T o ta l paid in and earned........................ .......-$3,992,940.60 Less transfer to R ailroad Retirement Board.... 356,735.18 T o ta l available fo r benefits...... ................. ........ $3,636,205.42 Less actual benefits paid * * * F o r year ending June 30, 1939...............................t.=i,,r.$ 421,911.84 F or year ending June 30, 1 9 4 0 ..M u ............................ 1,066,424.44 F o r year ending June 30, 1941................ ......................... 1,058,730.00 2,547,066.18 Balance June 30, 1941... ...................... ......— $1,089,139-24 *Th is figure covers the payroll period beginning fanuary 1, 1937. **T h e amount o f interest earned shown in this statement is less than the amount shown in the previous table. This is probably because entries fo r interest earned were made on federal records as o f fune 30, 1941, but the latest entry had not been entered on state records. * * * F o r six months, payments started January 1, 1939. U N E M P L O Y M E N T T R U S T F U N D A S O F J U N E 30, 1941, F O R T H E E L E V E N W E S T E R N S T A T E S STATE *Benefits Percentage of Benefits to Interest Balance in Employers Paid Out Amount Paid in On Excess Trust Fund A riz o n a ............................... .......... $ 9,147,522 $ 5,533,235 60.49% $ 236,471 $ 3,840,758 * * C a lifo r n ia .—................ ~ .......... 323,704,623 169,613,779 52.40% 11,856,959 165,947,803 C o lo ra d o ............................. .......... 20,829,283 10,773,040 51.72% 849,386 10,905,629 Id ah o ................................... .......... 8,478,064 6,233,014 73.52% 247,438 2,492,488 M o n ta n a ............................ .......... 11,577,697 7,171,104 61.94% 432,633 4,839,226 N e v a d a .............. .......... ...... .......... 3,8 79,820 2,961,735 76.34% 116,946 1,035,030 N e w M e x ic o ............... ....... .......... 5,965,000 3,509,545 58.84% 223,074 2,678,529 O r e g o n ............................... .......... 27,768,220 16,510,392 59.46% 735,324 11,993,152 W a s h in g t o n ...................... .......... 44,275,603 21,319,679 4 8.15% 1,655,510 24,611,434 W y o m i n g .... ............... ...... .......... 5,543,655 3,542,040 63.89% 186,711 2,188,327 U ta h .......... 11,509,368 7,036,976 61.14% 295,455 4,767,837 U . S. T o ta l................... . 1 ..... ..$3,621,358,523 $1,549,975,841 4 2 .8 0 % $131,515,856 $2,202,898,538 *Benefits paid as shown here include amounts collected from the railroads and later transferred to the railroad retirement board. **Besides 3 % tax on em ployers, C a liforn ia has a 1 % tax on employees.