Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

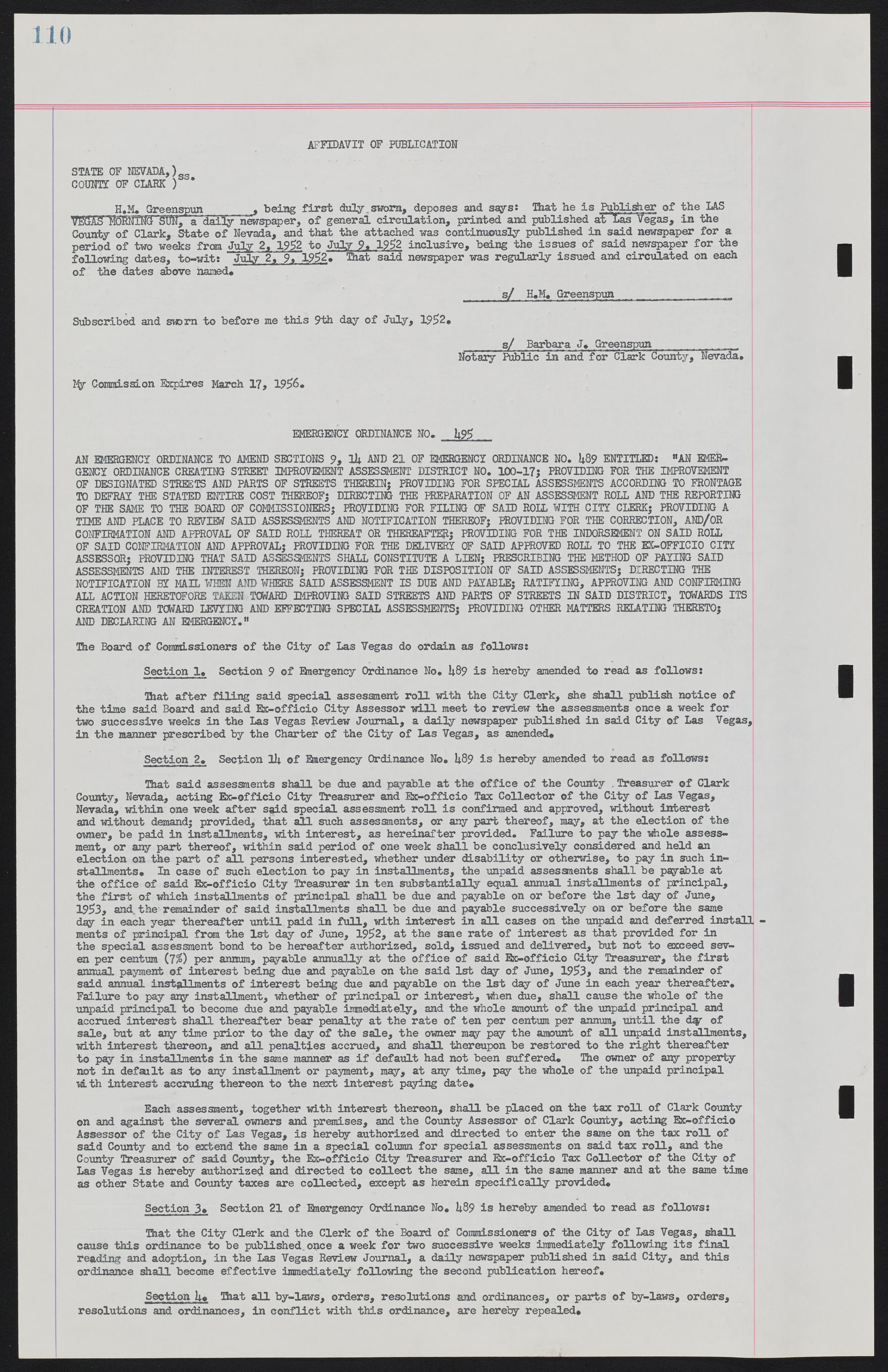

AFFIDAVIT OF PUBLICATION STATE OF NEVADA,) COUNTY OF CLARK ) H.M. Greenspun being first duly sworn, deposes and says: That he is Publisher of the LAS VEGAS MORNING SUN, a daily newspaper, of general circulation, printed and published at Las Vegas, in the County of Clark, State of Nevada, and that the attached was continuously published in said newspaper for a period of two weeks from July 2 1952 to July 9. 1952 inclusive, being the issues of said newspaper for the following dates, to-wit: July 2, 9. 1952. That said newspaper was regularly issued and circulated on each of the dates above named. s/ H.M. Greenspun Subscribed and sworn to before me this 9th day of July, 1952. ______s/ Barbara J. Greenspun Notary Public in and for Clark County, Nevada. My Commission Expires March 17, 1956. EMERGENCY ORDINANCE NO. 495 AN EMERGENCY ORDINANCE TO AMEND SECTIONS 9, l4 AND 21 OF EMERGENCY ORDINANCE NO. 489 ENTITLED: "AN EMERGENCY ORDINANCE CREATING STREET IMPROVEMENT ASSESSMENT DISTRICT NO. 100-175 PROVIDING FOR THE IMPROVEMENT OF DESIGNATED STREETS AND PARTS OF STREETS THEREIN; PROVIDING FOR SPECIAL ASSESSMENTS ACCORDING TO FRONTAGE TO DEFRAY THE STATED ENTIRE COST THEREOF; DIRECTING THE PREPARATION OF AN ASSESSMENT ROLL AND THE REPORTING OF THE SAME TO THE BOARD OF COMMISSIONERS; PROVIDING FOR FILING OF SAID ROLL WITH CITY CLERK; PROVIDING A TIME AND PLACE TO REVIEW SAID ASSESSMENTS AND NOTIFICATION THEREOF; PROVIDING FOR THE CORRECTION, AND/OR CONFIRMATION AND APPROVAL OF SAID ROIL THEREAT OR THEREAFTER; PROVIDING FOR THE INDORSEMENT ON SAID ROLL OF SAID CONFIRMATION AND APPROVAL; PROVIDING FOR THE DELIVERY OF SAID APPROVED ROLL TO THE EX-OFFICIO CITY ASSESSOR; PROVIDING THAT SAID ASSESSMENTS SHALL CONSTITUTE A LIEN; PRESCRIBING THE METHOD OF PAYING SAID ASSESSMENTS AND THE INTEREST THEREON; PROVIDING FOR THE DISPOSITION OF SAID ASSESSMENTS; DIRECTING THE NOTIFICATION BY MAIL WHEN AND WHERE SAID ASSESSMENT IS DUE AND PAYABLE; RATIFYING, APPROVING AND CONFIRMING ALL ACTION HERETOFORE TAKEN TOWARD IMPROVING SAID STREETS AND PARTS OF STREETS IN SAID DISTRICT, TOWARDS ITS CREATION AND TOWARD LEVYING AND EFFECTING SPECIAL ASSESSMENTS; PROVIDING OTHER MATTERS RELATING THERETO; AND DECLARING AN EMERGENCY." The Board of Commissioners of the City of Las Vegas do ordain as follows: Section 1. Section 9 of Emergency Ordinance No. 489 is hereby amended to read as follows: Ghat after filing said special assessment roll with the City Clerk, she shall publish notice of the time said Board and said Ex-officio City Assessor will meet to review the assessments once a week for two successive weeks in the Las Vegas Review Journal, a daily newspaper published in said City of Las Vegas, in the maimer prescribed by the Charter of the City of Las Vegas, as amended. Section 2. Section l4 of Emergency Ordinance No. 489 is hereby amended to read as follows: That said assessments shall be due and payable at the office of the County Treasurer of Clark County, Nevada, acting Ex-officio City Treasurer and Ex-officio Tax Collector of the City of Las Vegas, Nevada, within one week after said special assessment roll is confirmed and approved, without interest and without demand; provided, that all such assessments, or any part thereof, may, at the election of the owner, be paid in installments, with interest, as hereinafter provided. Failure to pay the whole assessment, or any part thereof, within said period of one week shall be conclusively considered and held an election on the part of all persons interested, whether under disability or otherwise, to pay in such installments. In case of such election to pay in installments, the unpaid assessments shall be payable at the office of said Ex-officio City Treasurer in ten substantially equal annual installments of principal, the first of which installments of principal shall, be due and payable on or before the 1st day of June, 1953, and the remainder of said installments shall be due and payable successively on or before the same day in each year thereafter until paid in full, with interest in all cases on the unpaid and deferred install - ments of principal from the 1st day of June, 1952, at the same rate of interest as that provided for in the special assessment bond to be hereafter authorized, sold, issued and delivered, but not to exceed seven per centum (7%) per annum, parable annually at the office of said Ex-officio City Treasurer, the first annual payment of interest being due and payable on the said 1st day of June, 1953, and the remainder of said annual installments of interest being due and payable on the 1st day of June in each year thereafter. Failure to pay any installment, whether of principal or interest, when due, shall cause the whole of the unpaid principal to become due and payable immediately, and the whole amount of the unpaid principal and accrued interest shall thereafter bear penalty at the rate of ten per centum per annum, until the dy of sale, but at any time prior to the day of the sale, the owner may pay the amount of all unpaid installments, with interest thereon, and all penalties accrued, and shall thereupon be restored to the right thereafter to pay in installments in the same manner as if default had not been suffered. The owner of any property not in default as to any installment or payment, may, at any time, pay the whole of the unpaid principal with interest accruing thereon to the next interest paying date. Each assessment, together with interest thereon, shall be placed on the tax roll of Clark County on and against the several owners and premises, and the County Assessor of Clark County, acting Ex-officio Assessor of the City of Las Vegas, is hereby authorized and directed to enter the same on the tax roll of said County and to extend the same in a special column for special assessments on said tax roll, and the County Treasurer of said County, the Ex-officio City Treasurer and Ex-officio Tax Collector of the City of Las Vegas is hereby authorized and directed to collect the same, all in the same manner and at the same time as other State and County taxes are collected, except as herein specifically provided. Section 3. Section 21 of Emergency Ordinance No. 489 is hereby amended to read as follows: That the City Clerk and the Clerk of the Board of Commissioners of the City of Las Vegas, shall cause this ordinance to be published, once a week for two successive weeks immediately following its final reading and adoption, in the Las Vegas Review Journal, a daily newspaper published in said City, and this ordinance shall become effective immediately following the second publication hereof. Section 4. That all by-laws, orders, resolutions and ordinances, or parts of by-laws, orders, resolutions and ordinances, in conflict with this ordinance, are hereby repealed.