Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

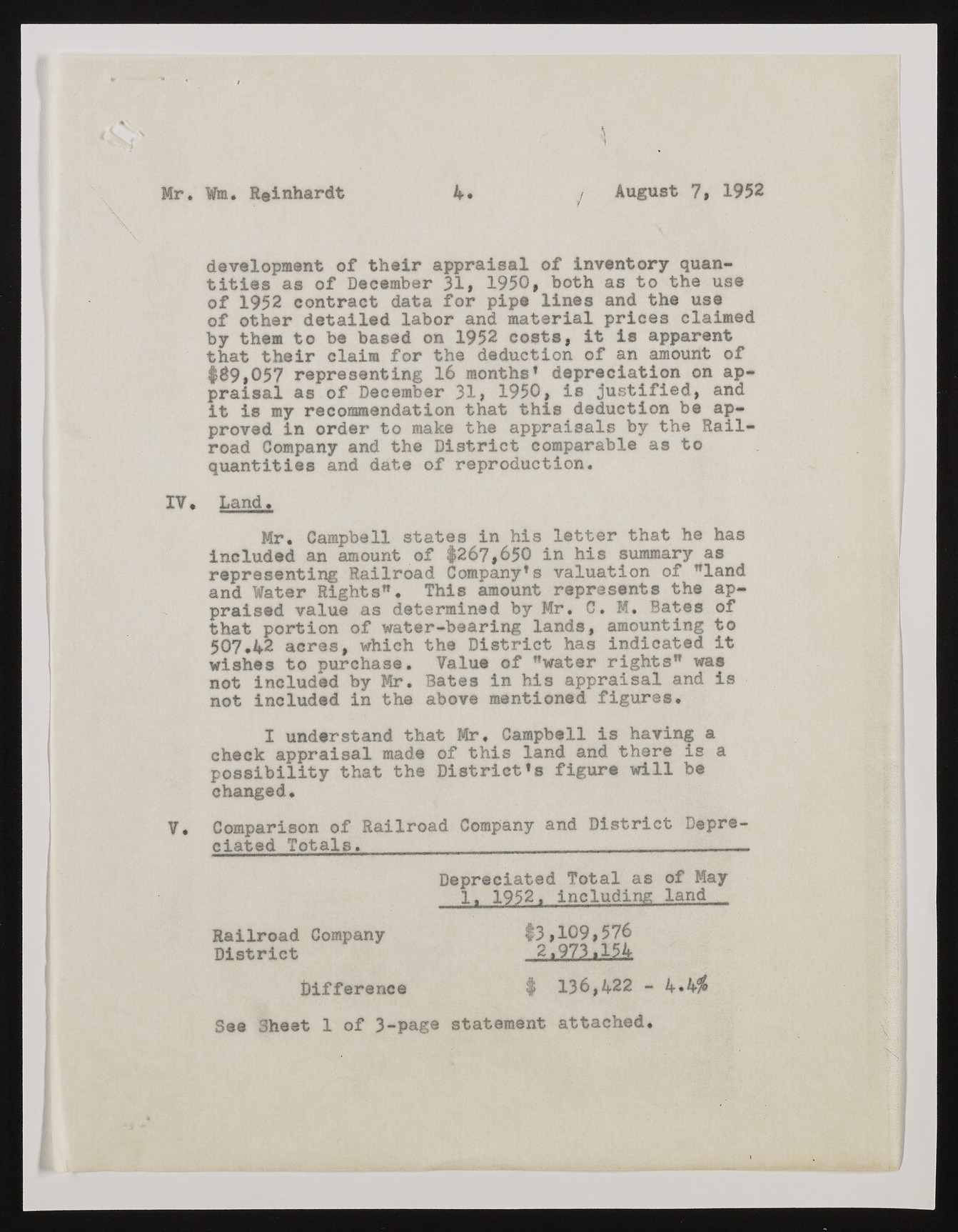

i Mr. Win. Reinhardt 4. / August 7, 1952 development of their appraisal of inventory quantities as of December 31, 1950, both as to the us® of 1952 contract data for pipe lines and the use of other detailed labor and material prices claimed by them to be based on 1952 costs, it is apparent that their claim for the deduction of an amount of #$9,057 representing 16 months1 depreciation on appraisal as of December 31, 1950, is justified, and it is my recommendation that this deduction be approved in order to make the appraisals by the Railroad Company and the District comparable as to quantities and date of reproduction. IV. Land. Mr. Campbell states in his letter that he has included an amount of #267,650 in his summary as representing Railroad Company’s valuation of ”land and Water Rights”. This amount represents the appraised value as determined by Mr* C. M. Bates of that portion of water-bearing lands, amounting to 507.42 acres, which the District has indicated It wishes to purchase. Value of ”wat@r rights” was not included by Mr. Bates in his appraisal and is not included in the above mentioned figures. I understand that Mr. Campbell is having a check appraisal made of this land and there is a possibility that the District’s figure will be changed. V. Comparison of Railroad Company and District Depre-ciated T o t a l s . ............ .... Depreciated Total as of May 1. 1952, including land Railroad Company #3,109,576 District 2.973.154 Difference | 136,422 - 4*4$ See Sheet 1 of 3-page statement attached.