Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

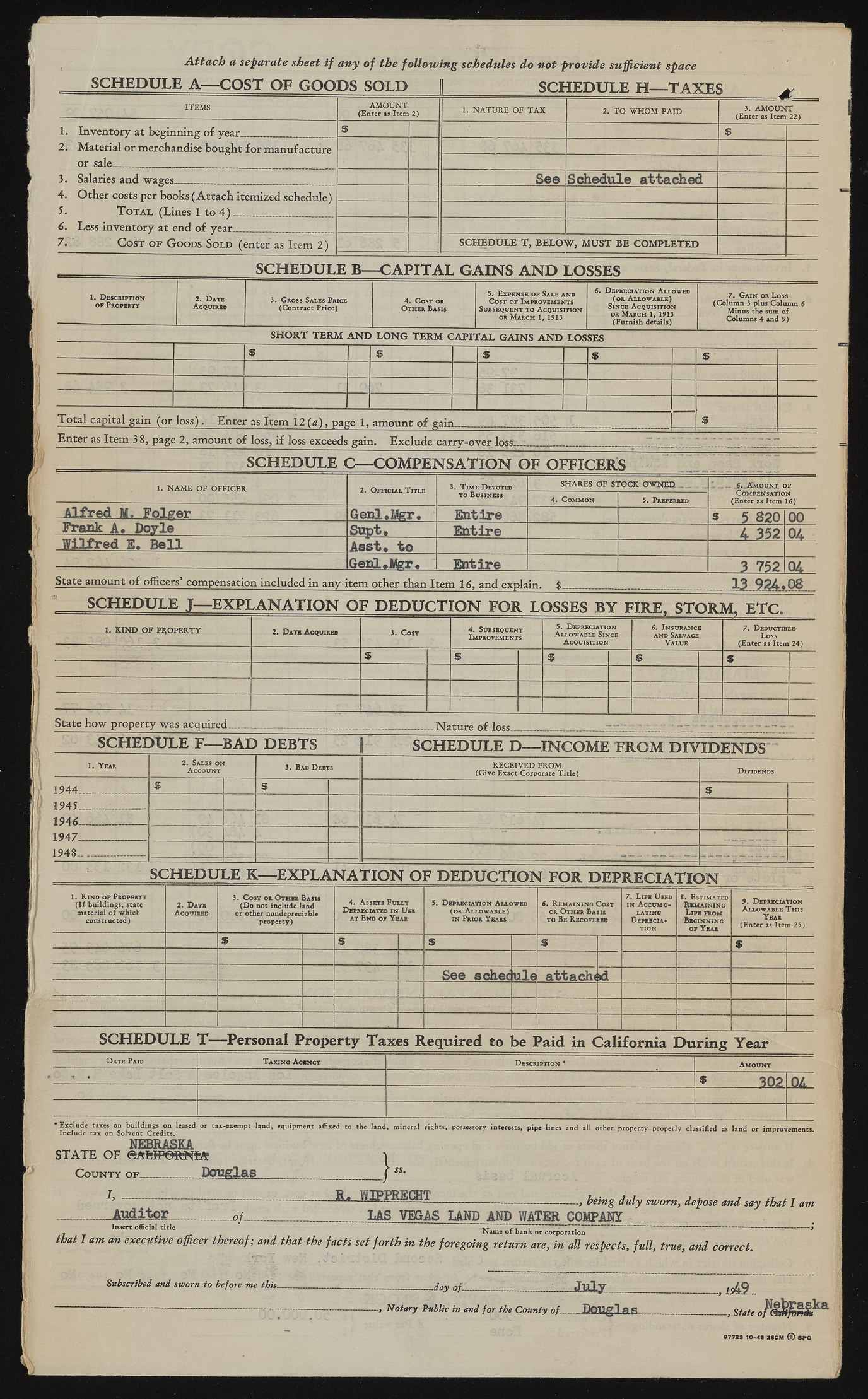

A tta ch a separate sheet if an y o f th e follow in g schedules do n ot provide sufficient space SCHEDULE A— COST OF GOODS SOLD SCHEDULE H— TAXES Si ITEMS AMOUNT (Enter as Item 2) 1. NATURE OF TA X 2. TO W HOM PAID 3. AMOUNT (Enter as Item 22) 1. Inventory at beginning of year s 9 2. Material or merchandise bought for manufacture or sale 3. Salaries and wages. See Schedule attached 4. Other costs per books (Attach itemized schedule) 5. T otal (Lines 1 to 4) 6. Less inventory at end of year 7 . C o s t o f G o o d s So l d (enter as I t e m 2 ) SCHEDULE T , BELOW, MUST BE COMPLETED 1. D escription o f Property SCHEDULE B— CAPITAL GAINS AND LOSSES 2. Date 6 . Depreciation Allowed 3. Gross Sales Price 4. Cost or ( or Allowable) A cquired (Contract Price) Other Basis Subsequent to A cquisition or March 1, 1913 Since A cquisition or March 1, 1913 (Furnish details) 7. Ga in or Loss (Column 3 plus Column 6 Minus the sum o f Columns 4 and 3) SHORT TERM A N D LONG TERM CAPITAL GAINS A N D LOSSES $ i 9 9 $ — Total capital gain (or loss). Enter as Item 12 (a), page 1, amount of gain. $ Enter as Item 38, page 2, amount of loss, if loss exceeds gain. Exclude carry-over loss_. SCHEDULE C— COMPENSATION OF OFFICERS 1. NAME OF OFFICER 2. Official T itle 3. T ime D evoted to Business SHARES OF STOCK O W N E D _____ | » ~ — jJ.-AJmqiijix of Compensation 4. Common 5. Preferred (Enter as Item 16 ) A l f r e d m . F o l g e r G e n l . M g r . E n t i r e 9 5 820 00 F r a n k A . D o y l e S u p t . E n t i r e 4 352 0A W i l f r e d E . B e l l A s s t , t o G e n l . M s r . E n t i r e ____ 3 752 Q L - State amount of officers’ compensation included in any item other than Item 16, and explain. $ 13 924e08 SCHEDULE T-—EXPLANATION OF DEDUCTION FOR LOSSES BY FIRE, STORM, ETC. 1. KIND OF PROPERTY 2. Date A cquired 3. Cost 4. Subsequent Improvements 5. Depreciation A llowable Since A cquisition 6. Insurance and Salvage Value 7. D eductible Loss (Enter as Item 24) 9 9 9 9 9 State how property was acquired.____ L;__ i_____ 1'___ ______________ Nature of loss SCHEI>ULE f— b a d d e b t s SCHEDULE D— INCOME FROM DIVIDENDS^ 1. Y ear 2. Sales o n A ccount 3. Bad Debts RECEIVED FROM (Give Exact Corporate Title) D ividends 1944____________ s 9 9 1945____ 1946 1947 aufcl-nr x' 1948____________ '--------------------- --- ----- SCHEDULE K— EXPLANATION OF DEDUCTION FOR DEPRECIATION 1. Kind of Propertt (If buildings, state material o f which constructed) 2. Datx A cquired 3. Cost or Other (D o not include 1 or other nondeprec property) Basis and able 4. A ssets Fully Depreciated in Usr at End op Year 3. Depreciation Allowed ( or A llowable) in Prior Years 6 . R emaining Cost or Other Basis to Be Recovered 7. Life Used in A ccumulating Depreciation S. E stimated Remaining Life from Beginning op Y eae 9 . D epreciation Allowable T his Year (Enter as Item 23) 9 9 9 9 9 See schectule attacheid SCHEDULE T— Personal Property Taxes Required to be Paid in California During Year D ate Paid T a x in g A gency D escription ? A m o u n t * . * 3 0 2 0 /, ?Exclude taxes on buildings on leased or tax-exempt l*nd, equipment affixed to the land, mineral rights, possessory interests, pipe lines and all other property properly classified as land or improvements Include tax on Solvent Credits. ' ? STAHTE OF eNAEfBefRFAOSfKWAfc* C o u n t y o f .___ _________Douglas 7, --- : Auditor R. WIPFRECHT Insert official title -of-.. LAS VISAS LAND AM) WATER COMPANY Name o f bank or corporation being duly sworn, depose and say that I am that I am an executive officer thereof; and that the facts set forth in the foregoing return are, in all respects, full, true, and correct. Subscribed and sworn to before m e this_ - i day o f - -July N otary Public in and fo r the C ounty o f— ____ Douglas 07723 10-40 280M © SPO