Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

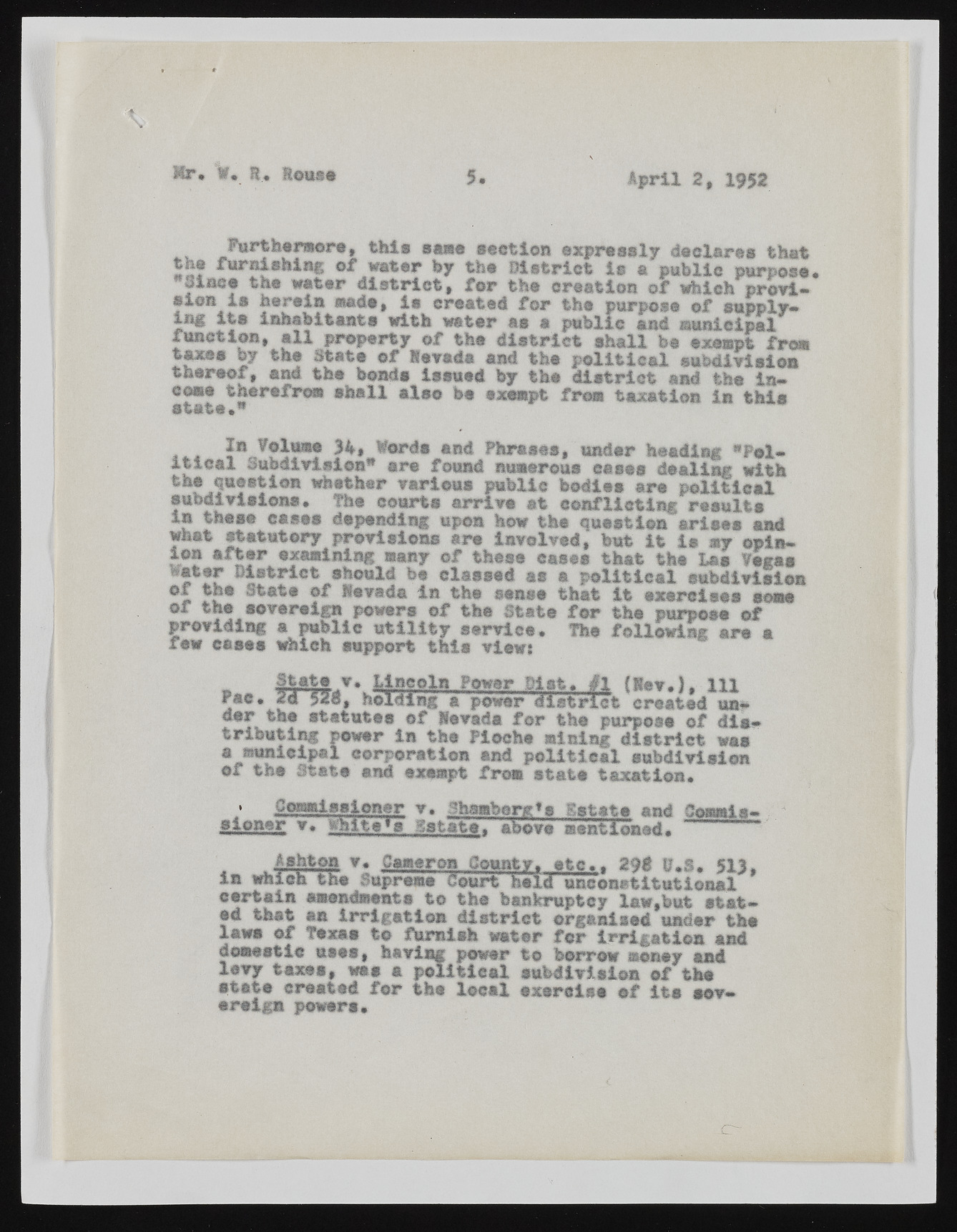

Mr* if* E* Eons* 5 April 2, 1952 , Furthermore, this same section expressly declares that the furnishing ef water fey the District is a public purpose* Since the water district, for the creation of which provision is herein made, is created for the purpose ©f supply— inn Its inhabitants with water as a public and aunielpal function, all property of the district shall be exempt fro* taxes by the State of Nevada and the political subdivision thereof, and the bonds issued by the district and the in-csot »aet et•h*erefrom shall also be exempt from taxation in this I ® ^ d s and Phrases, under heading "Political oubaivision* are found numerous cases dealing with stuhb® di5vttifs®iJoinosn* wheThteh erc ovuarrtis ouasrr ipvueb liact bcoodnifelsic tairneg proelsiutlitcsal in these esses depending upon how the question arises and what statutory provisions are Involved, but it is my opinio** after examining many of these cases that the Las Togas water District should be classed as a political subdivision of the State of Nevada in the sense that it exercises some of the sovereign powers of the State for the purpose of pfreowv icdaisnege wah ipcubhl iscu pupotritl itthyi ss evriveiwc;e* The following are a rp*a*c * xa 5*c» holding a Ppo*owger rB diilslt rHict createdi lulnder the statutes of Nevada for the purpose of distributing power in the Ploche mining district was a municipal corporation and political subdivision of the State and exempt from state taxation* I C™i.?sioner v. Jhamberg^s Estate and Commissioner v* White's Estate* above aaantlonad. Ashton v* Cameron County, etc.. gfg p*s* 513, in which the Supreme Court held unconstitutional certain amendments to the bankruptcy law,but stated that an irrigation district organised under the lawe of Texas to furnish water for irrigation and domestic uses, having power to borrow money and levy taxes, was a political subdivision of the eSrteatieg n cproewaetresd* for the local exercise of its sov