Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

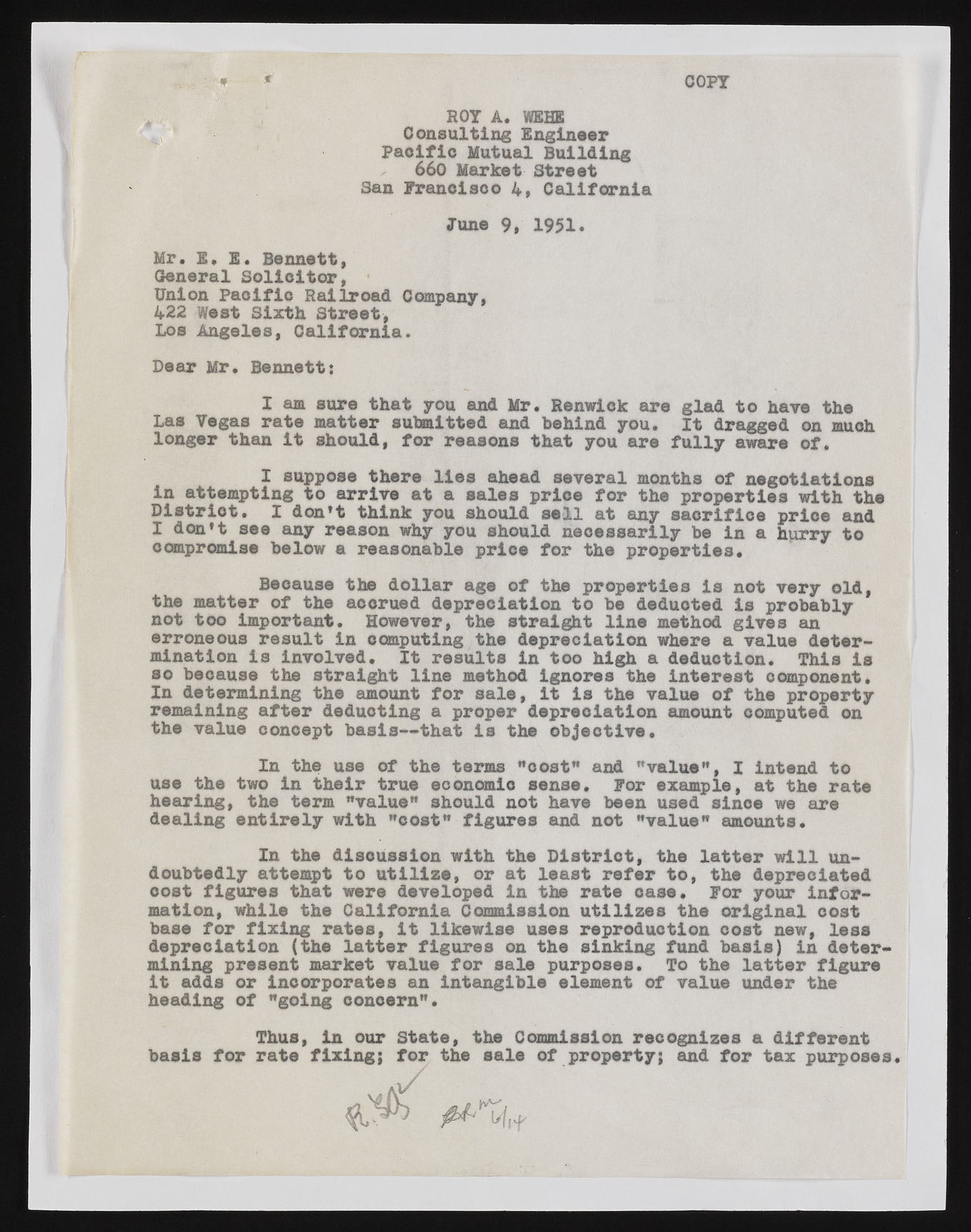

COPT ROT A. WEHE Consulting Engineer Pacific Mutual Building 660 Market Street San Francisco 4, California June 9, 1951. Mr. E. E. Bennett, General Solicitor, Union Paoific Railroad Company, 422 west Sixth Street, Los Angeles, California. Dear Mr. Bennett: I am sure that you and Mr. Renwlek are glad to have the Las Vegas rate matter submitted and behind you. It dragged on much longer than it should, for reasons that you are fully aware of. I suppose there lies ahead several months of negotiations in attempting to arrive at a sales price for the properties with the District. I don’t think you should sell at any sacrifice prioe and I don’t see any reason why you should neoessarily be in a hurry to compromise below a reasonable price for the properties. Because the dollar age of the properties is not very old, the matter of the accrued depreciation to be deducted is probably not too Important. However, the straight line method gives an erroneous result In computing the depreciation where a value determination is involved. It results in too high a deduction. This is so because the straight line method ignores the interest component* In determining the amount for sale, it is the value of the property remaining after deducting a proper depreciation amount computed on the value concept basis— that is the objective. In the use of the terms "cost” and "value", I intend to use the two in their true economic sense. For example, at the rate hearing, the term "value" should not have been used slnoe we are dealing entirely with "cost" figures and not "value" amounts* In the discussion with the District, the latter will undoubtedly attempt to utilize, or at least refer to, the depreciated cost figures that were developed in the rate case. For your information, while the California Commission utilizes the original cost base for fixing rates, it likewise uses reproduction cost new, less depreciation (the latter figures on the sinking fund basis) in determining present market value for sale purposes. To the latter figure it adds or incorporates an intangible element of value under the heading of "going concern". Thus, in our State, the Commission recognizes a different basis for rate fixing; for the sale of property; and for tax purposes*