Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

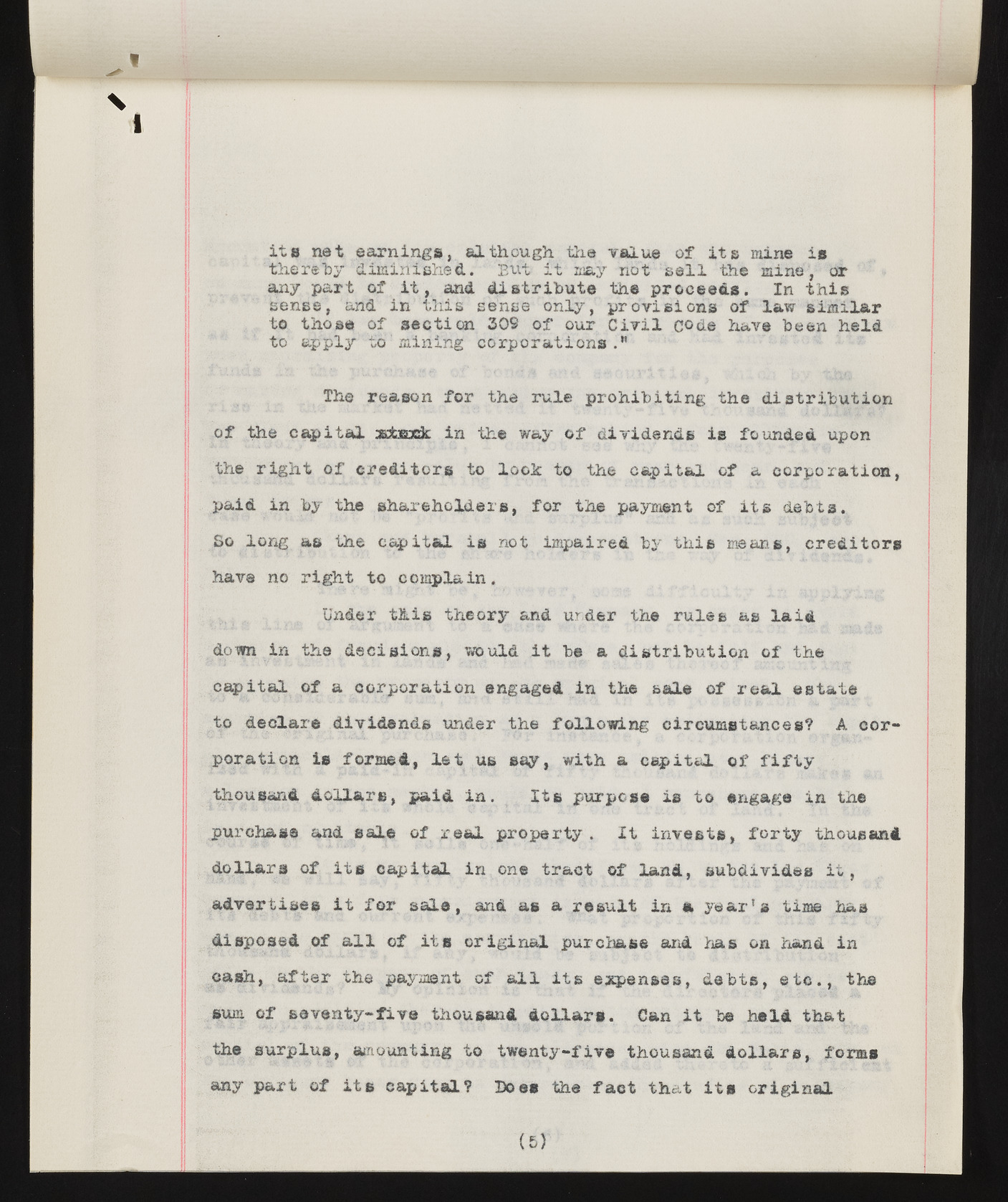

its net earnings, although the value of its mine is thereby diminished. But it may not sell the mine, or any part of it, and distribute the proceeds. In this sense, and in this sense only, provisions of law similar to those of section 309 of our Civil code have been held to apply to mining corporations." The reason for the rule prohibiting the distribution of the capital astsack in the way of dividends is founded upon the right of creditors to look to the capital of a corporation, paid in by the shareholders, for the payment of its debts. So long as the capital is not impaired by this means, creditors have no right to complain. Under this theory and ur.der the rules as laid down in the decisions, would it be a distribution of the capital of a corporation engaged in the sale of real estate to declare dividends under the following circumstances? A corporation is formed, let us say, with a capital of fifty thousand dollars, paid in. Its purpose is to engage in the purchase and sale of real property. It invests, forty thousand dollars of its capital in one tract of land, subdivides it, advertises it for sale, arid as a result in a year's time has disposed of all of its original purchase and has on hand in cash, after the payment of all its expenses, debts, etc., the sum of seventy-five thousand dollars. Can it be held that the surplus, amounting to twenty-five thousand dollars, forms any part of its capital? Does the fact that its original (5)