Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

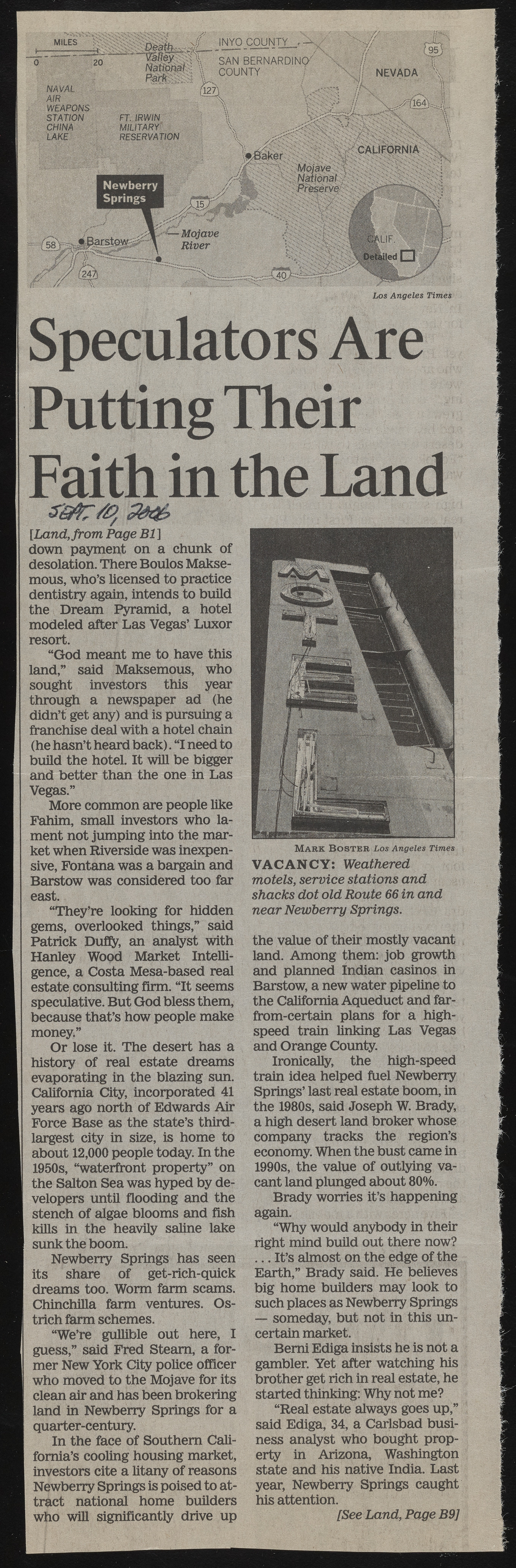

V (I NYO *rC OUNw T«'YMW ,WI WW s SAN BERNARDINO COUNTY S I I , M i l s .C8&mh*.^ National m w m NEVADA MAVAi m WSTmATmIONm CHINA LAKE F t m W f N ' MILITARYt < RESERVATION CAUE0RNIA Mojave \ \ Pr%$er.v$‘'' Mojave #Barst0W River Newberry Springs Los Angeles Times Putting Their Faith in the Land [Land, from Page B1 ] down paym ent on a chunk of desolation. There Boulos M akse-mous, who’s licensed to practice dentistiy again, intends to build the D ream [pyramid, a hotel m odeled after L a s Vegas’ Luxor resort. “G o d m eant me to have this land,” said Maksem ous, who sought investors this year through a newspaper ad (he didn’t get any) and is pursuing a franchise deal with a hotel chain (he hasn’t heard b a c k ). “I need to build the hotel. It will be bigger and better than the one in L a s Vegas.” M ore common are people like Fahim, sm all investors Who lament not jum ping into the m arket when Riverside w as inexpensive, Fontana w as a bargain and Barstow w as considered too far east. “They’re looking for hidden gems, overlooked things,” said Patrick Duffy, an analyst with H anley W ood M arket Intelligence, a C osta M esa-based real estate consulting firm. “It seems speculative. B ut G od bless them, because that’s how people make money.” O r lose it. The desert has a history o f real estate dream s evaporating in the blazing sun. California City, incorporated 41 years ago north of Edw ards A ir Force B ase as the state’s third-largest city in size, is home to about 12,000 people today. In the 1950s, “waterfront property” on the Salton Sea w as hyped by developers until flooding and the stench o f algae bloom s and fish kills in the heavily saline lake sunk the boom . New berry Springs has seen its share of get-rich-quick dream s too. W orm farm scams. Chinchilla farm ventures. O strich farm schemes. “W e’re gullible out here, I guess,” said Fred Steam , a form er N ew York City police officer who moved to the Mojave for its clean air and has been brokering land in N ew berry Springs for a quarter-century. In the face o f Southern California’s cooling housing market, investors cite a litany of reasons N ew berry Springs is poised to attract national hom e builders who will significantly drive up M ARK B o s t e r L os Angeles Times V A C A N C Y : Weathered motels, service stations and shacks dot old Route 66 in and near New berry Springs. the value of their mostly vacant land. A m ong them: jo b growth and planned Indian casinos in Barstow, a new w ater pipeline to the California Aqueduct and far-from -certain plans for a highspeed train linking L a s Vegas and O range County. Ironically, the high-speed train idea helped fuel New berry Springs’ last real estate boom , in the 1980s, said Joseph W. Brady, a high desert land broker whose com pany tracks the region’s economy. W hen the bust came in 1990s, the value o f outlying vacant land plunged about 80%. B ra d y worries it’s happening again. “W hy would anybody in their right m ind build out there now? . . . It’s alm ost on the edge of the Earth,” B rady said. H e believes b ig hom e builders m ay look to such places as New berry Springs — someday, but not in this uncertain market. B em i E diga insists he is not a gambler. Yet after watching his brother get rich in real estate, he started thinking: W hy not me? “R eal estate always goes up,” said Ediga, 34, a C arlsbad bush ness analyst who bought property in Arizona, W ashington state and his native India. Last year, New berry Springs caught his attention. [SeeLand, Page B9]