Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

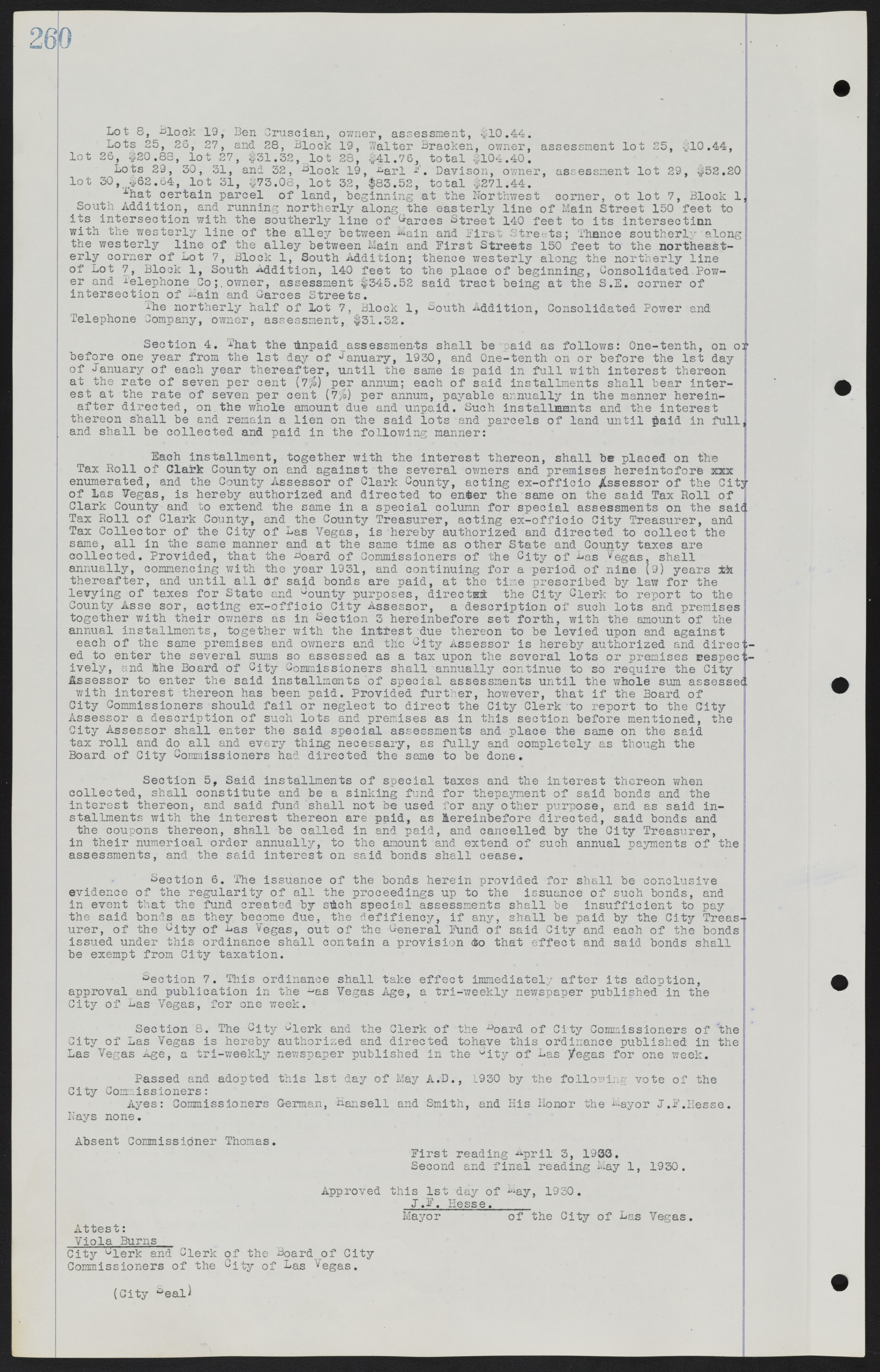

Lot 8, Block 19, Den Cruscian, owner, assessment, $10.44. Lots 25, 26, 27, and 28, Block 19, Walter Bracken, owner, assessment lot 25, $10.44, lot 26, $20.88, lot 27, $31.32, lot 28, $41.76, total $104.40. Lots 29, 30, 31, and 32, Block: 19, Earl F. Davison, owner, assessment lot 29, $52.20 lot 30, $62.64, lot 31, $73.08, lot 32, $83.52, total $271.44. That certain parcel of land, beginning at the Northwest corner, of lot 7, Block 1, South Addition, and running northerly along the easterly line of Main Street 150 feet to its intersection with the southerly line of Garces Street 140 feet to its intersection with the westerly line of the alley between Main and First Streets; Thence southerly along the westerly line of the alley between Main and First Streets 150 feet to the northeasterly corner of Lot 7, Block 1, South Addition; thence westerly along the northerly line of Lot 7, Block 1, South Addition, 140 feet to the place of beginning, Consolidated Power and Telephone Co; owner, assessment $345.52 said tract being at the S. E. corner of intersection of Main and Garces Streets. The northerly half of Lot 7, Block 1, South Addition, Consolidated Power and Telephone Company, owner, assessment, $31.32. Section 4. That the unpaid assessments shall be paid as follows: One-tenth, on or before one year from the 1st day of January, 1930, and One-tenth on or before the 1st day of January of each year thereafter, until the same is paid in full with interest thereon at the rate of seven per cent (7%) per annum; each of said installments shall bear interest at the rate of seven per cent (7%) per annum, payable annually in the manner hereinafter directed, on the whole amount due and unpaid. Such installments and the interest thereon shall be and remain a lien on the said lots and parcels of land until paid in full, and shall be collected and paid in the following manner: Each installment, together with the interest thereon, shall be placed on the Tax Roll of Clark County on and against the several owners and premises hereinbefore enumerated, and the County Assessor of Clark County, acting ex-officio Assessor of the City of Las Vegas, is hereby authorized and directed to enter the same on the said Tax Roll of Clark County and to extend the same in a special column for special assessments on the said Tax Roll of Clark County, and the County Treasurer, acting ex-officio City Treasurer, and Tax Collector of the City of Las Vegas, is hereby authorized and directed to collect the same, all in the same manner and at the same time as other State and County taxes are collected. Provided, that the Board of Commissioners of the City of Las Vegas, shall annually, commencing with the year 1931, and continuing for a period of nine (9) years thereafter, and until all of said bonds are paid, at the time prescribed by law for the levying of taxes for State and County purposes, direct the City Clerk to report to the County Assessor, acting ex-officio City Assessor, a description of such lots and premises together with their owners as in Section 3 hereinbefore set forth, with the amount of the annual installments, together with the interest due thereon to be levied upon and against each of the same premises and owners and the City Assessor is hereby authorized and directed to enter the several sums so assessed as a tax upon the several lots or premises respectively, and the Board of City Commissioners shall annually continue to so require the City Assessor to enter the said installments of special assessments until the whole sum assessed with interest thereon has been paid. Provided further, however, that if the Board of City Commissioners should fail or neglect to direct the City Clerk to report to the City Assessor a description of such lots and premises as in this section before mentioned, the City Assessor shall enter the said special assessments and place the same on the said tax roll and do all and every thing necessary, as fully and completely as though the Board of City Commissioners had directed the same to be done. Section 5, Said installments of special taxes and the interest thereon when collected, shall constitute and be a sinking fund for the payment of said bonds and the interest thereon, and said fund shall not be used for any other purpose, and as said installments with the interest thereon are paid, as hereinbefore directed, said bonds and the coupons thereon, shall be called in and paid, and cancelled by the City Treasurer, in their numerical order annually, to the amount and extend of such annual payments of the assessments, and the said interest on said bonds shall cease. Section 6. The issuance of the bonds herein provided for shall be conclusive evidence of the regularity of all the proceedings up to the issuance of such bonds, and in event that the fund created by such special assessments shall be insufficient to pay the said bonds as they become due, the deficiency, if any, shall be paid by the City Treasurer, of the City of Las Vegas, out of the General Fund of said City and each of the bonds issued under this ordinance shall contain a provision to that effect and said bonds shall be exempt from City taxation. Section 7. This ordinance shall take effect immediately after its adoption, approval and publication in the Las Vegas Age, a tri-weekly newspaper published in the City of Las Vegas, for one week. Section 8. The City Clerk and the Clerk of the Board of City Commissioners of the City of Las Vegas is hereby authorized and directed to have this ordinance published in the Las Vegas Age, a tri-weekly newspaper published in the City of Las Vegas for one week. Passed and adopted this 1st day of May A.D., 1930 by the following vote of the City Commissioners: Ayes: Commissioners German, Hansell and Smith, and His Honor the Mayor J. F. Hesse. Nays none. Absent Commissioner Thomas. First reading April 3, 1933. Second and final reading May 1, 1930. Approved this 1st day of May, 1930. J. F. Hesse.______ Mayor of the City of Las Vegas. Attest: Viola Burns City Clerk and Clerk of the Board of City Commissioners of the City of Las Vegas. (City Seal)