Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

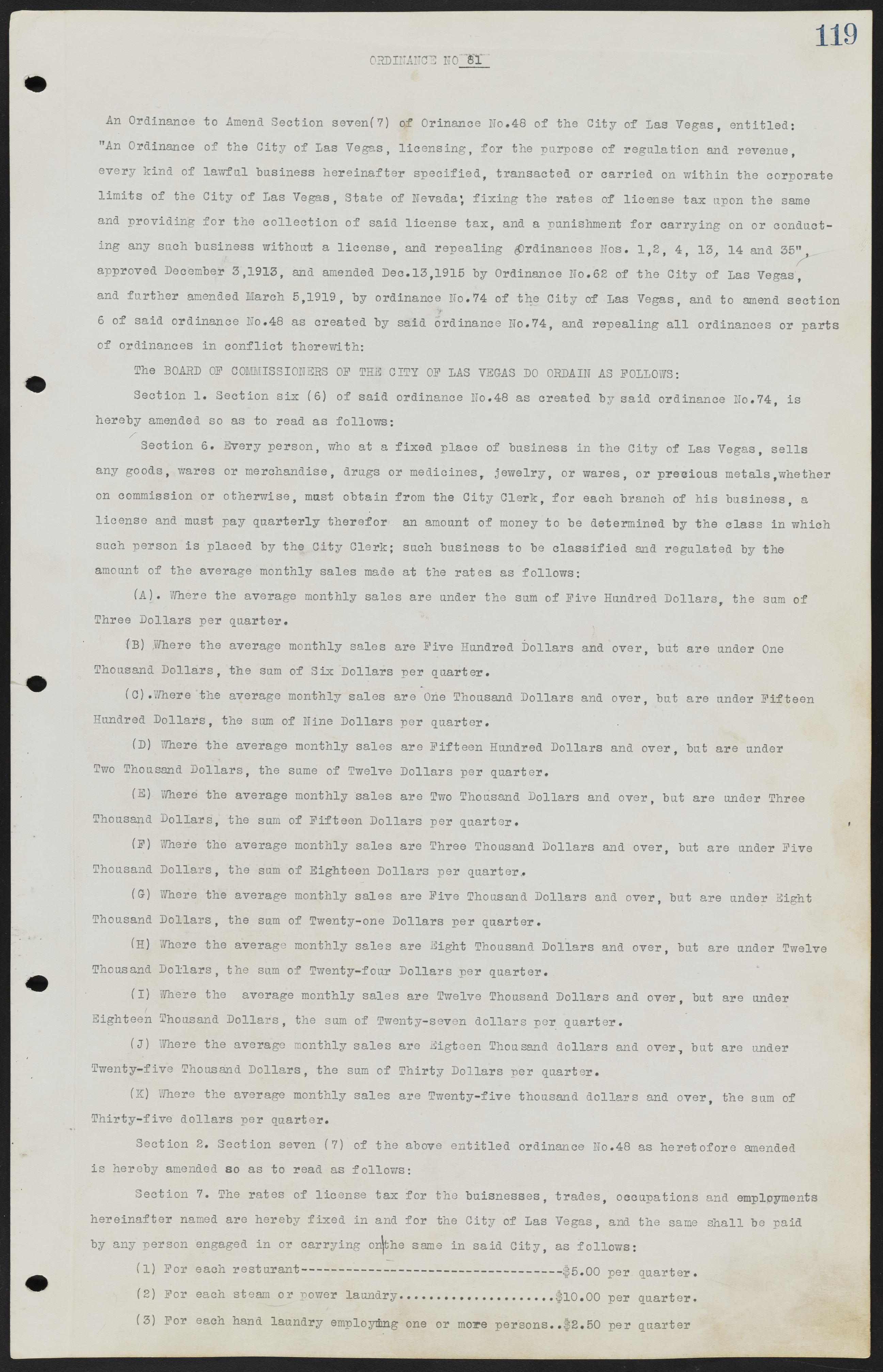

ORDINANCE NO. 81 An Ordinance to Amend Section seven (7) of Ordinance No. 48 of the City of Las Vegas, entitled: "An Ordinance of the City of Las Vegas, licensing, for the purpose of regulation and revenue every kind of lawful business hereinafter specified, transacted or carried on within the corporate limits of the City of Las Vegas, State of Nevada; fixing the rates of license tax upon the same and providing for the collection of said license tax, and a punishment for carrying on or conducting any such business without a license, and repealing Ordinances Nos. 1, 2, 4, 13, 14 and 35", approved December 3,1913, and amended Dec. 13, 1915 by Ordinance No. 62 of the City of Las Vegas and further amended March 5,1919, by ordinance No. 74 of the City of Las Vegas, and to amend section 6 of said ordinance No. 48 as created by said ordinance No. 74, and repealing all ordinances or parts of ordinances in conflict therewith: The BOARD OP COMMISSIONERS OF THE CITY OF LAS VEGAS DO ORDAIN AS FOLLOWS: Section 1. Section six (6) of said ordinance No. 48 as created by said ordinance No. 74, is hereby amended so as to read as follows: Section 6. Every person, who at a fixed place of business in the City of Las Vegas, sells any goods, wares or merchandise, drugs or medicines, jewelry, or wares, or precious metals, whether on commission or otherwise, must obtain from the City Clerk, for each branch of his business, a license and must pay quarterly therefor an amount of money to be determined by the class in which such person is placed by the City Clerk; such business to be classified and regulated by the amount of the average monthly sales made at the rates as follows: (A). Where the average monthly sales are under the sum of Five Hundred Dollars, the sum of Three Dollars per quarter. (B). Where the average monthly sales are Five Hundred Dollars and over, but are under One Thousand Dollars, the sum of Six Dollars per quarter. (C). Where the average monthly sales are One Thousand Dollars and over, but are under Fifteen Hundred Dollars, the sum of Nine Dollars per quarter. (D). Where the average monthly sales are Fifteen Hundred Dollars and over, but are under Two Thousand Dollars, the sum of Twelve Dollars per quarter. (E). Where the average monthly sales are Two Thousand Dollars and over, but are under Three Thousand Dollars, the sum of Fifteen Dollars per quarter. (F) Where the average monthly sales are Three Thousand Dollars and over, but are under Five Thousand Dollars, the sum of Eighteen Dollars per quarter. (G) Where the average monthly sales are Five Thousand Dollars and over, but are under Eight Thousand Dollars, the sum of Twenty-one Dollars per quarter. (H) Where the average monthly sales are Eight Thousand Dollars and over, but are under Twelve Thousand Dollars, the sum of Twenty-four Dollars per quarter. (I) Where the average monthly sales are Twelve Thousand Dollars and over, but are under Eighteen Thousand Dollars, the sum of Twenty-seven dollars per quarter. (J) Where the average monthly sales are Eighteen Thousand dollars and over, but are under Twenty-five Thousand Dollars, the sum of Thirty Dollars per quarter. (K) Where the average monthly sales are Twenty-five thousand dollars and over, the sum of Thirty-five dollars per quarter. Section 2. Section seven (7) of the above entitled ordinance No. 48 as heretofore amended is hereby amended so as to read as follows: Section 7. The rates of license tax for the businesses, trades, occupations and employments hereinafter named are hereby fixed in and for the City of Las Vegas, and the same shall be paid by any person engaged in or carrying on the same in said City, as follows: (1) For each restaurant----------------------------------------------------$5.00 per quarter. (2) For each steam or power laundry.............. $10.00 per quarter. (3) For each hand laundry employing one or more persons ..........$2.50 per quarter