Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

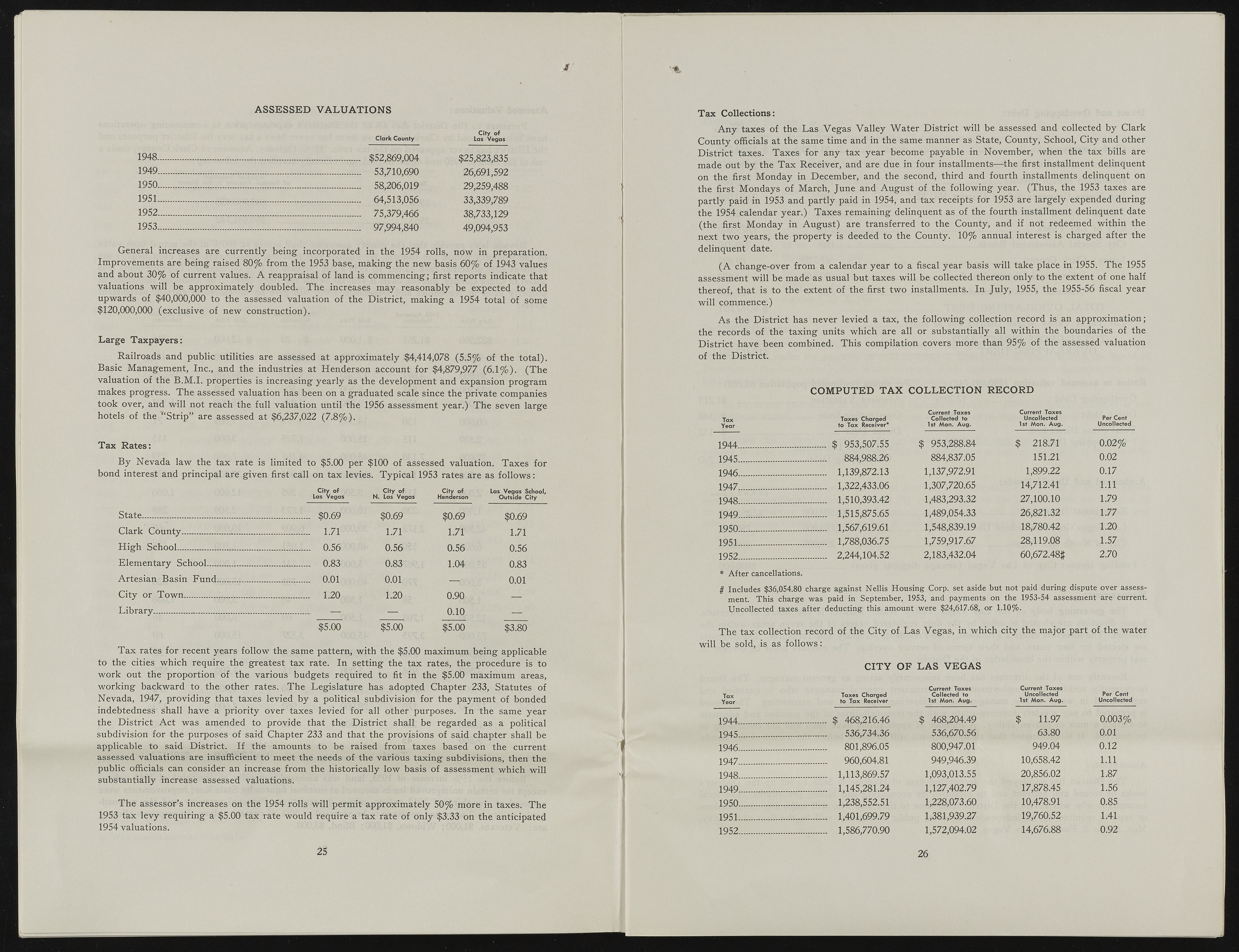

A SSE SSE D V A L U A T IO N S M 1948. 1949. 1950. 1951. 1952. 1953. Clark County $52,869,004 53,710,690 58,206,019 64,513,056 75,379,466 97,994,840 City of Las V e gas $25,823,835 26,691,592 29,259,488 33,339,789 38,733,129 49,094,953 General increases are currently being- incorporated in the 1954 rolls, n ow in preparation. Im provem ents are being raised 80% from the 1953 base, m aking the new basis 60% o f 1943 values and about 30% o f current values. A reappraisal o f land is com m en cing; first reports indicate that valuations w ill be approxim ately doubled. T he increases m ay reasonably be expected to add upwards o f $40,000,000 to the assessed valuation o f the District, m aking a 1954 total of som e $120,000,000 (exclusive o f new construction). Large Taxpayers: Railroads and public utilities are assessed at approxim ately $4,414,078 (5.5% o f the total). Basic M anagem ent, Inc., and the industries at H enderson account for $4,879,977 (6 .1 % ). (T h e valuation o f the B .M .I. properties is increasing yearly as the developm ent and expansion program makes progress. T he assessed valuation has been on a graduated scale since the private com panies took over, and w ill not reach the full valuation until the 1956 assessment year.) T h e seven large hotels of the '“ Strip” are assessed at $6,237,022 (7 .8 % ). Tax Rates: By Nevada law the tax rate is limited to $5.00 per $100 of assessed valuation. Taxes for bond interest and principal are given first call on tax levies. Typical 1953 rates are as follow s: City of City of City of Las Vegas N. Las Vegas Henderso n LasO Vutesgidaes CScithyool, State................................................. ................ $0.69 $0.69 $0.69 $0.69 Clark County................................. .............. 1.71 1.71 1.71 1.71 High School................................... ......8........ 0.56 0.56 0.56 0.56 Elementary School....................... ................ 0.83 0.83 1.04 0.83 Artesian Basin Fund:.................. ................ 0.01 0.01 —a ? 0.01 City or Town................................ ................. 1.20 1.20 0.90 I — Library.............. ............................. 1 — ? 0.10 \ $5.00 $5.00 $5.00 $3.80 T a x rates for recent years follow the same pattern, w ith the $5.00 m axim um being applicable to the cities w hich require the greatest tax rate. In setting the tax rates, the procedure is to w ork out the proportion o f the various budgets required to fit in the $5.00 maxim um areas, w orkin g backw ard to the other rates. T h e Legislature has adopted Chapter 233, Statutes o f N evada, 1947, providing that taxes levied by a political subdivision for the paym ent of bonded indebtedness shall have a priority over taxes levied for all other purposes. In the same year the D istrict A ct was amended to provide that the D istrict shall be regarded as a political subdivision for the purposes o f said Chapter 233 and that the provisions o f said chapter shall be applicable to said D istrict. If the amounts to be raised from taxes based on the current assessed valuations are insufficient to meet the needs of the various taxing subdivisions, then the public officials can consider an increase from the historically low basis o f assessment w hich will substantially increase assessed valuations. T he assessor’s increases on the 1954 rolls will perm it approxim ately 50% m ore in taxes. T h e 1953 tax levy requiring a $5.00 tax rate w ould require a tax rate of only $3.33 on the anticipated 1954 valuations. 25 Tax Collections: A n y taxes o f the Las V egas V alley W ater D istrict w ill be assessed and collected b y Clark County officials at the same tim e and in the same manner as State, County, School, City and other D istrict taxes. T axes for any tax year becom e payable in N ovem ber, when the tax bills are made out by the T a x Receiver, and are due in four installments— the first installment delinquent on the first M onday in D ecem ber, and the second, third and fourth installments delinquent on the first M ondays o f M arch, June and A ugust o f the follow in g year. (T hus, the 1953 taxes are partly paid in 1953 and partly paid in 1954, and tax receipts for 1953 are largely expended during the 1954 calendar year.) T axes rem aining delinquent as of the fourth installment delinquent date (the first M onday in A u gu st) are transferred to the County, and if not redeemed within the next tw o years, the property is deeded to the County. 10% annual interest is charged after the delinquent date. (A change-over from a calendar year to a fiscal year basis w ill take place in 1955. T he 1955 assessment w ill be made as usual but taxes w ill be collected thereon only to the extent o f one half thereof, that is to the extent o f the first tw o installments. In July, 1955, the 1955-56 fiscal year w ill com m ence.) A s the D istrict has never levied a tax, the follow in g collection record is an approxim ation; the records o f the taxing units w hich are all or substantially all within the boundaries o f the D istrict have been com bined. T his com pilation covers m ore than 95% o f the assessed valuation o f the D istrict. C O M P U T E D T A X C O L L E C T IO N RECORD Tax Year Taxes Charged to Tax Receiver* Current Taxes Collected to 1st Mon. Aug. Current Taxes Uncollected 1st Mon. Aug. Per Cent Uncollected 1944.................... ................. $ 953,507.55 $ 953,288.84 $ 218.71 0.02% 1945.................... ................. 884,988.26 884,837.05 151.21 0.02 1946.................... ................. 1,139,872.13 1,137,972.91 1,899.22 0.17 1947.................... ................. 1,322,433.06 1,307,720.65 14,712.41 1.11 1948..................................... 1,510,393.42 1,483,293.32 27,100.10 1.79 1949................... .................. 1,515,875.65 1,489,054.33 26,821.32 1.77 1950.................... ................. 1,567,619.61 1,548,839.19 18,780.42 1.20 1951...................................... 1,788,036.75 1,759,917.67 28,119.08 1.57 1952...................................... 2,244,104.52 2,183,432.04 60,672.48# 2.70 * After cancellations. # Includes $36,054.80 charge against Nellis Housing Corp. set aside but not paid during dispute over assessment. This charge was paid in September, 1953, and payments on the 1953-54 assessment are current. Uncollected taxes after deducting this amount were $24,617.68, or 1.10%. T h e tax collection record o f the City of Las V egas, in w hich city the m ajor part of the water w ill be sold, is as fo llo w s : C IT Y O F L A S V E G A S Tax Year Taxes Charged to Tax Receiver Current Taxes Collected to 1st Mon. Aug. Current Taxes Uncollected 1st Mon. Aug. Per Cent Uncollected 1944.................... ................. $ 468,216.46 $ 468,204.49 $ 11.97 0.003% 1945.................... ................. 536,734.36 536,670.56 63.80 0.01 1946.................... ................. 801,896.05 800,947.01 949.04 0.12 1947.................... .................. 960,604.81 949,946.39 10,658.42 1.11 1948.................... ................. 1,113,869.57 1,093,013.55 20,856.02 1.87 1949.................... ................. 1,145,281.24 1,127,402.79 17,878.45 1.56 1950.................... ............ . 1,238,552.51 1,228,073.60 10,478.91 0.85 1951.................... .................. 1,401,699.79 1,381,939.27 19,760.52 1.41 1952.................... ................. 1,586,770.90 1,572,094.02 14,676.88 0.92 2 6