Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

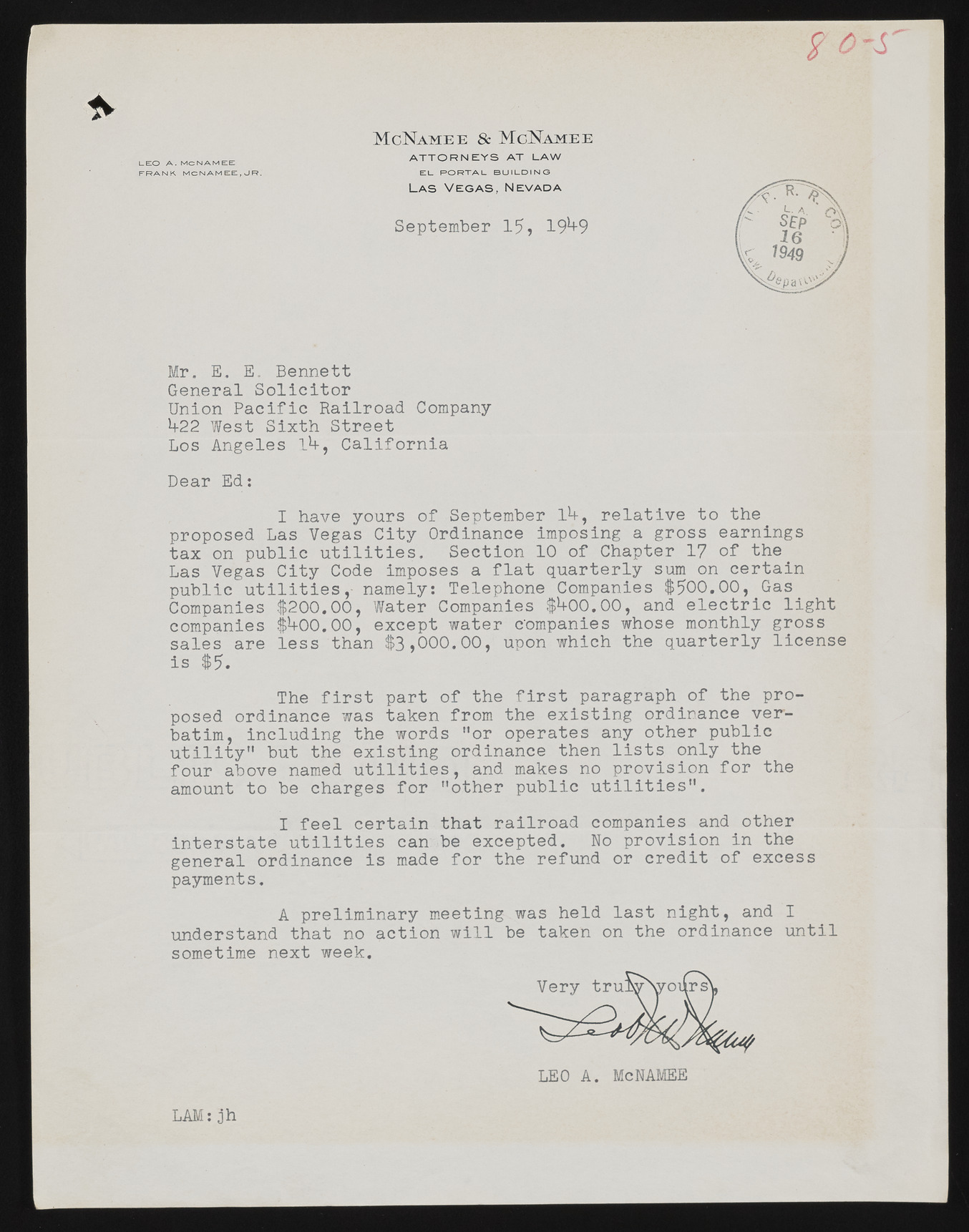

f 0 f S ' M cNa m e e & M oISTa m e e LEO A. MCNAMEE FRANK MCN AM EE , JR, A T T O R N E Y S AT LAW E L PO R T AL BUILD ING September 15, 19*+9 L a s V e g a s , N e v a d a Mr. E. E. Bennett General Solicitor Union Pacific Railroad Company *+22 West Sixth Street Los Angeles 1*+, California Dear Ed: I have yours of September 1*+, relative to the proposed Las Vegas City Ordinance imposing a gross earnings tax on public utilities. Section 10 of Chapter 17 of the Las Vegas City Code imposes a flat quarterly sum on certain public utilities,- namely: Telephone Companies $500.00, Gas Companies $200.00, Water Companies $*+00.00, and electric light companies $*+00.00, except water companies whose monthly gross sales are less than $3,000.00, upon which the quarterly license is $5. The first part of the first paragraph of the proposed ordinance was taken from the existing ordinance verbatim, including the words Mor operates any other public utility" but the existing ordinance then lists only the four above named utilities, and makes no provision for the amount to be charges for "other public utilities". I feel certain that railroad companies and other interstate utilities can be excepted. No provision in the general ordinance is made for the refund or credit of excess payments. A preliminary meeting was held last night, and I understand that no action will be taken on the ordinance until sometime next week. LEO A. McNAMEE LAM:jh