Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

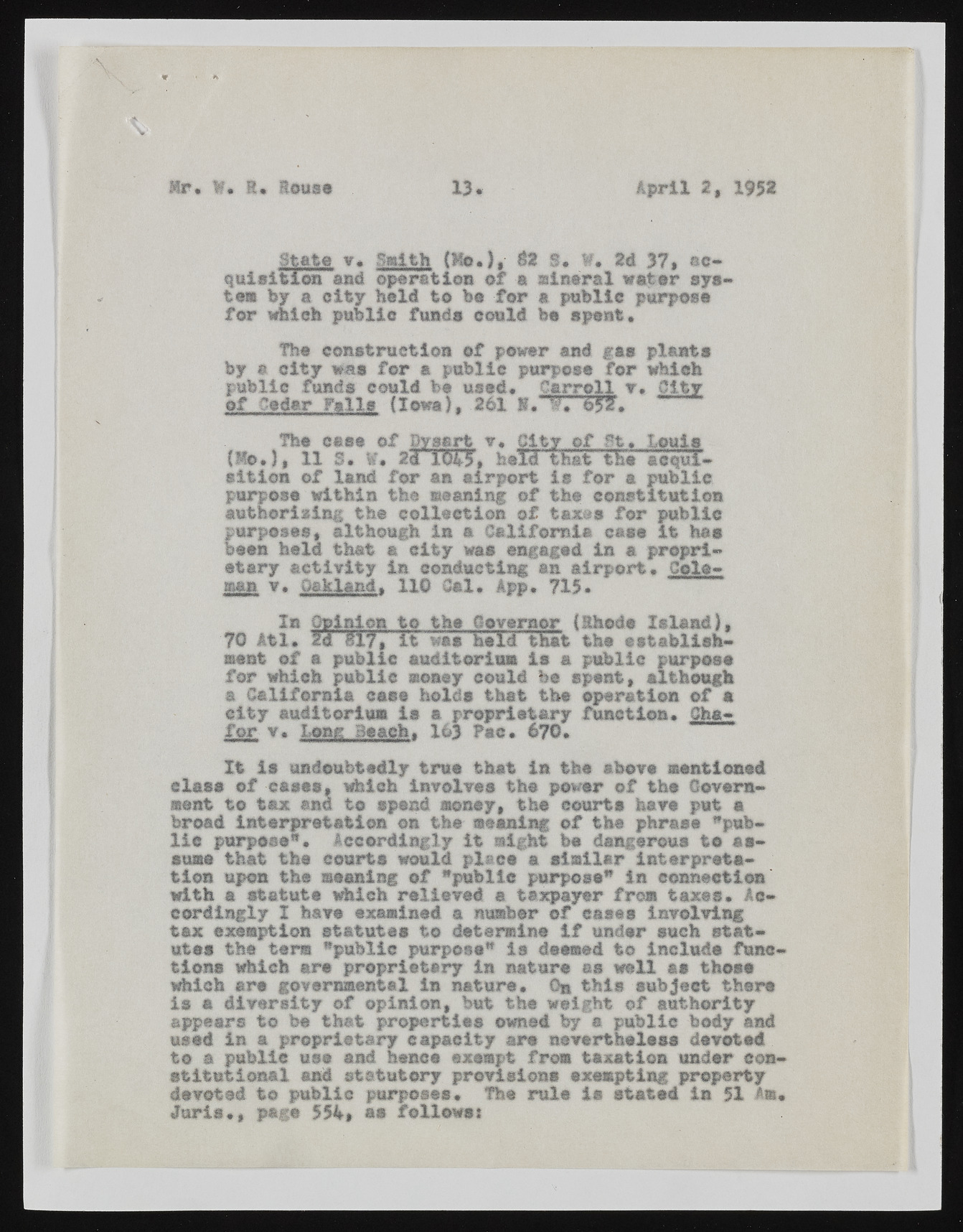

Mr. W* H. House 13. April 2, 1952 State v* Smith (He.), tt $. V. 2d 37, acquisitionand operatlee of a mineral water system by a city held to be for a public purpose for which public funds could be spent* The construction of power and gas plants by e city was for a public purpose for which public funds could fee used* Carroll v* City of Cedar falls (Iowa), 261 S . T 1 5 ? . Use case of Bysort r. City of St* Louis (Ho*), 11 S* V* 2<rio0| held that ihe aequi-sltion of land for an airport is for a public purpose within the meaning of the constitution authorising the collection of tax@s for public purposes, although in a California case it has been held that a city was engaged in a proprietary activity in conducting an airport* Coleman v. Oakland. H O Cal* App. 715. In Opinion to the Governor (Rhode Island). '70 Atl* * 0 1 7 # it Was held 'that the establishment of a public auditorium Is a public purpose for which public money could be spent, although a California ease holds that the operation of a city auditorium is a proprietary function* Sha-tor v* Long Beach. 163 Pac* 670. It is undoubtedly true that in the above mentioned class of cases, which involves the power of the Government to tax and to spend money, the courts have put a broad interpretation on the meaning of the phrase "public purpose** Accordingly It might be dangerous to assume that the courts would place a similar interpretation upon the meaning of "public purpose* in connection with a statute which relieved a taxpayer from taxes. Accordingly I have examined a number of cases involving tax exemption statutes to determine if under such statutes the term "public purpose* is deemed to include functions which are proprietary in nature as well as those which are governmental in nature* 0» this subject there is a diversity of opinion, but the weight of authority appears to be that properties owed by a public body and used in a proprietary capacity are nevertheless devoted to a public use and hence exempt from taxation under constitutional and statutory provisions exempting property devoted to public purposes* The rule is stated in 51 Am Juris*, page 554, as follows: