Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

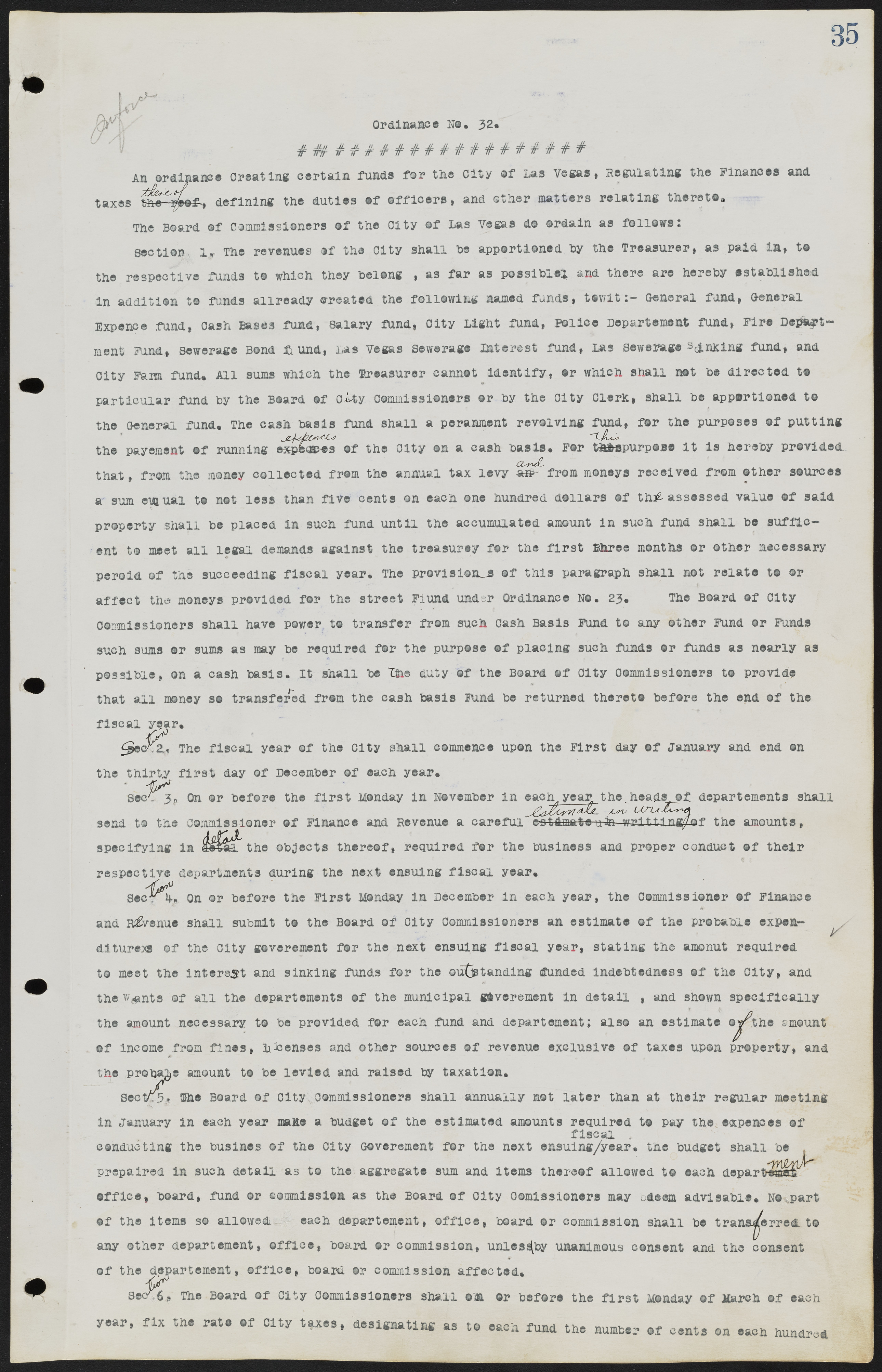

Ordinance No. 32. An ordinance Creating certain funds for the City of Las Vegas, Regulating the Finances and taxes thereof, defining the duties of officers, and other matters relating thereto. The Board of Commissioners of the City of Las Vegas do ordain as follows: section. The revenues of the City shall be apportioned by the Treasurer, as paid in, to the respective funds to which they belong, as far as possible and there are hereby established in addition to funds allready created the following named funds, to-wit:- General fund, General Expence fund, Cash Bases fund, Salary fund, City Light fund, Police Department fund, Fire Department Fund, Sewerage Bond fund, Las Vegas Sewerage Interest fund, Las Sewerage sinking fund, and City Farm fund. All sums which the Treasurer cannot identify, or which shall not be directed to particular fund by the Board of City Commissioners or by the City Clerk, shall be apportioned to the General fund. The cash basis fund shall a permanent revolving fund, for the purposes of putting the payment of running expenses of the City on a cash basis. For this purpose it is hereby provided that, from the money collected from the annual tax levy and from moneys received from ether sources a sum equal to not less than five cents on each one hundred dollars of the assessed value of said property shall be placed in such fund until the accumulated amount in such fund shall be sufficient to meet all legal demands against the treasury for the first three months or ether necessary period of the succeeding fiscal year. The provisions of this paragraph shall not relate to or affect the moneys provided for the street Fund under Ordinance No. 23. The Board of City Commissioners shall have power to transfer from such Cash Basis Fund to any other Fund or Funds such sums or sums as may be required for the purpose of placing such funds or funds as nearly as possible, on a cash basis. It shall be The duty of the Board of City Commissioners to provide that all money so transferred from the cash basis Fund be returned thereto before the end of the fiscal year. Section 2. The fiscal year of the City shall commence upon the First day of January and end on the thirty first day of December of each year. Section 3. On or before the first Monday in November in each year the heads of departments shall send to the commissioner of Finance and Revenue a careful estimate in writing of the amounts, specifying in detail the objects thereof, required for the business and proper conduct of their respective departments during the next ensuing fiscal year. Section 4. On or before the First Monday in December in each year, the Commissioner of Finance and Revenue shall submit to the Board of City Commissioners an estimate of the probable expenditures of the City government for the next ensuing fiscal year, stating the amount required to meet the interest and sinking funds for the outstanding funded indebtedness of the City, and the wants of all the departments of the municipal government in detail, and shewn specifically the amount necessary to be provided for each fund and department; also an estimate of the amount of income from fines, licenses and other sources of revenue exclusive of taxes upon property, and the probable amount to be levied and raised by taxation. Section 5. The Board of City Commissioners shall annually net later than at their regular meeting in January in each year make a budget of the estimated amounts required to pay the expenses of conducting the business of the City Government for the next ensuing fiscal year. The budget shall be prepared in such detail as to the aggregate sum and items thereof allowed to each department office, board, fund or commission as the Board of City Commissioners may deem advisable. No part of the items so allowed each department, office, board or commission shall be transferred to any other department, office, board or commission, unless by unanimous consent and the consent of the department, office, board or commission affected. Section 6. The Beard of City Commissioners shall on or before the first Monday of March of each year, fix the rate of City taxes, designating as to each fund the number of cents on each hundred