Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

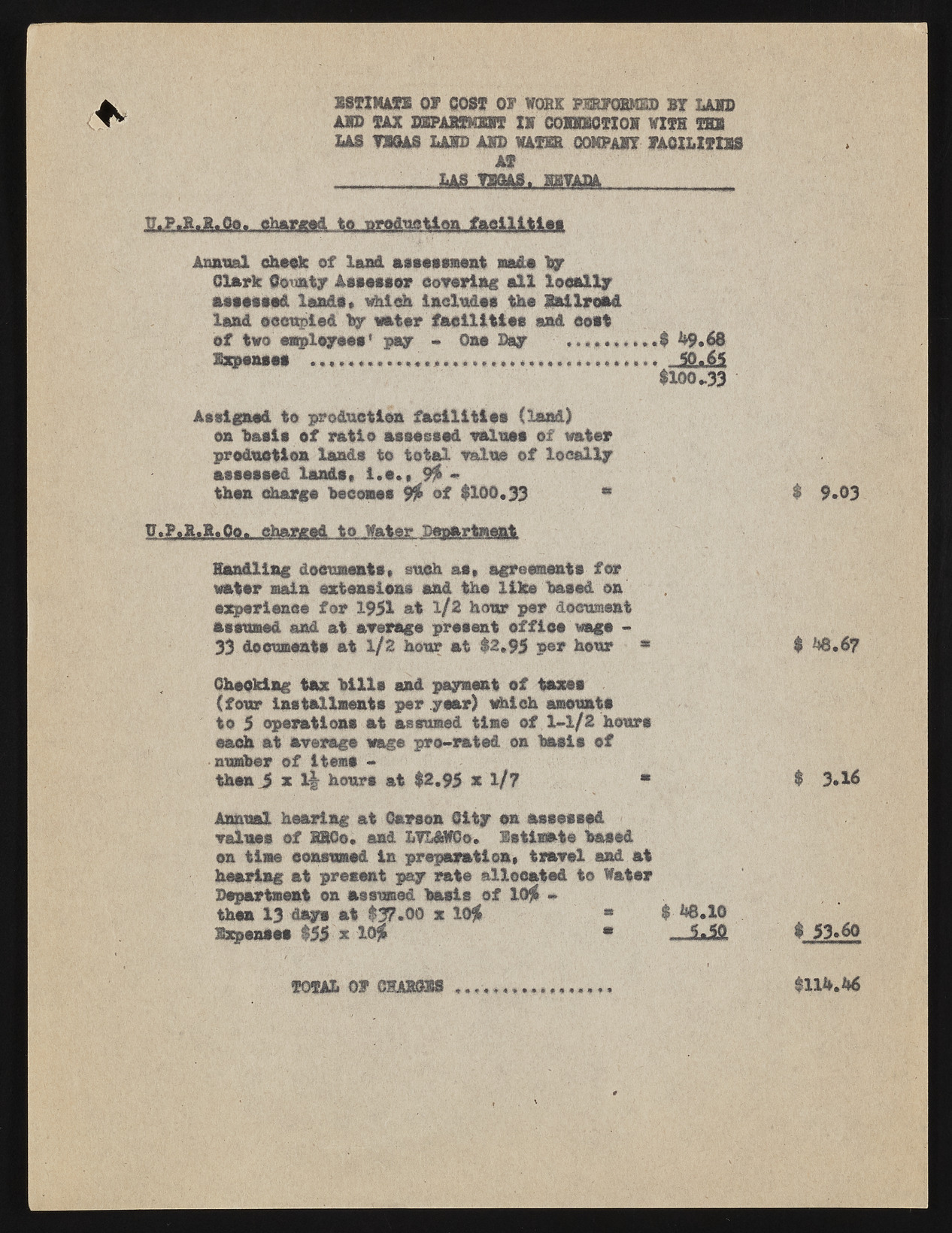

ESTIMATE 07 6089 07 WORK PKR70RMED BY LAID AID TAX B8FA89MXKT IV COXVBOTIOV WITH TBS LAS V9QAS LAID AID WATER COKPAVI YAOILITIES AT las v«ua. mavsna . - — —— — "i'H" imiiimm I* K- — -I- frr-T — V I II II muji..jjjrjiHiL D,P.R.R.0o. charged to production facllltloa Annual cheek of land assessment made by Clark County Assessor covering all locally assessed lands, which Includes the Railroad land occupied By water facilities and eoit of two employees' pay * One Day ^9.68 Expenses ........ ? .».............. . 50.6* $100^33 Assigned to production facilitiee (land) on basis of ratio assessed value* of water produetlon lands to total value of locally assessed lands, 1.*., 9$ ~ thea charge becomes 9fk of $100,33 * $ 9.03 U.F.a.R.Oo. charted to .Water Department Handling documents, such at, agreements for water main extensions and the like based on experience for 1951 at l/2 hour per document assumed and at average present office wage - 33 documents at 1/2 hour at $2,95 per hour * $ Mi.67 Checking tax bille and payment of taxes (four installments per year) which amount* to 5 operations at assumed time of 1-1/2 hours each at average wage pro-rated on basis ef number of item* - then j x l| hours at $2.95 x 1/7 * $ 3.16 Annual hearing at Carson City on assessed values of BBCo. and LVL&WCo. Estimate based on time eonaumed in preparation* travel and at hearing at present pay rate allocated to Water Department on assumed basis of ld£ - then 1 3 days at $37.00 x 10* * $ **6.10 Expenses $55 x 10% • .JL5fl $ 53.60 TOTAL 07 CHASSIS 4«f e e $llh,A6