Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

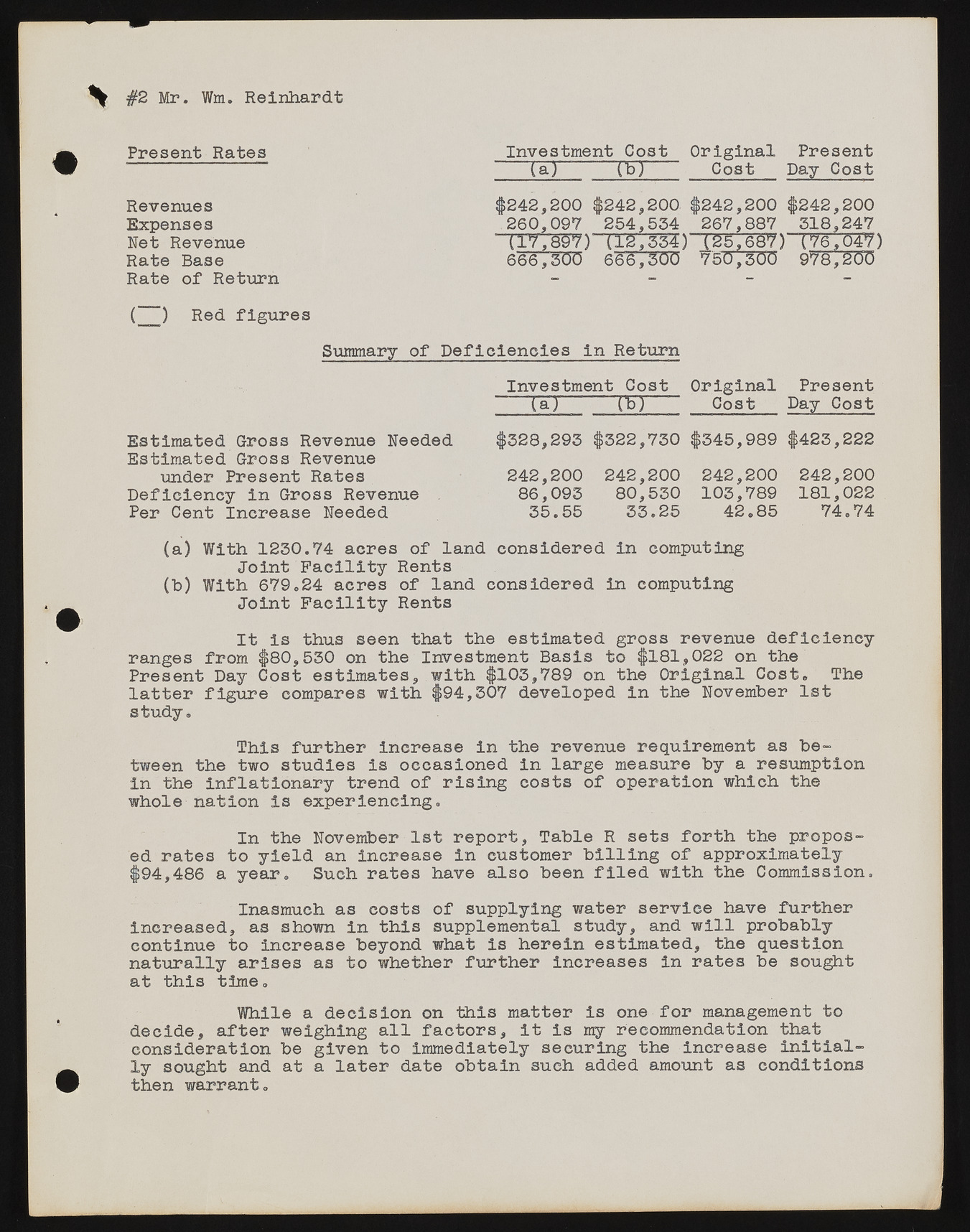

#2 Mr. Wm. Reinhardt Present Rates Investment Cost Original Present "Taj Cost Day Cost Revenues Expenses Net Revenue Rate Base Rate of Return $242,200 260,097 (17,897) 666,300 $242,200 $242,200 $242,200 254,534 267,887 318,247 (12,334) (25,687) (76,047) 666,500 750,300 978,200 (~~~) Red figures Summary of Deficiencies in Return Investment Cost Original Present (aj 051 Cost Day Cost Estimated Gross Revenue Needed Estimated Gross Revenue under Present Rates Deficiency in Gross Revenue Per Cent Increase Needed $328,293 242,200 86,093 35.55 $322,730 242,200 80,530 33.25 $345,989 242,200 103,789 42.85 $423,222 242,200 181,022 74.74 (a) With 1230.74 acres of land considered in computing Joint Facility Rents (b) With 679.24 acres of land considered in computing Joint Facility Rents It is thus seen that the estimated gross revenue deficiency ranges from $80,530 on the Investment Basis to $181,022 on the Present Day Cost estimates, with $103,789 on the Original Cost. The latter figure compares with $94,307 developed in the November 1st study. This further increase in the revenue requirement as between the two studies is occasioned in large measure by a resumption In the inflationary trend of rising costs of operation which the whole nation Is experiencing. In the November 1st report, Table R sets forth the proposed rates to yield an increase in customer billing of approximately $94,486 a year. Such rates have also been filed with the Commission. Inasmuch as costs of supplying water service have further increased, as shown in this supplemental study, and will probably continue to increase beyond what is herein estimated, the question naturally arises as to whether further increases in rates be sought at this time. While a decision on this matter is one for management to decide, after weighing all factors, it is my recommendation that consideration be given to immediately securing the increase initially sought and at a later date obtain such added amount as conditions then warrant.