Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

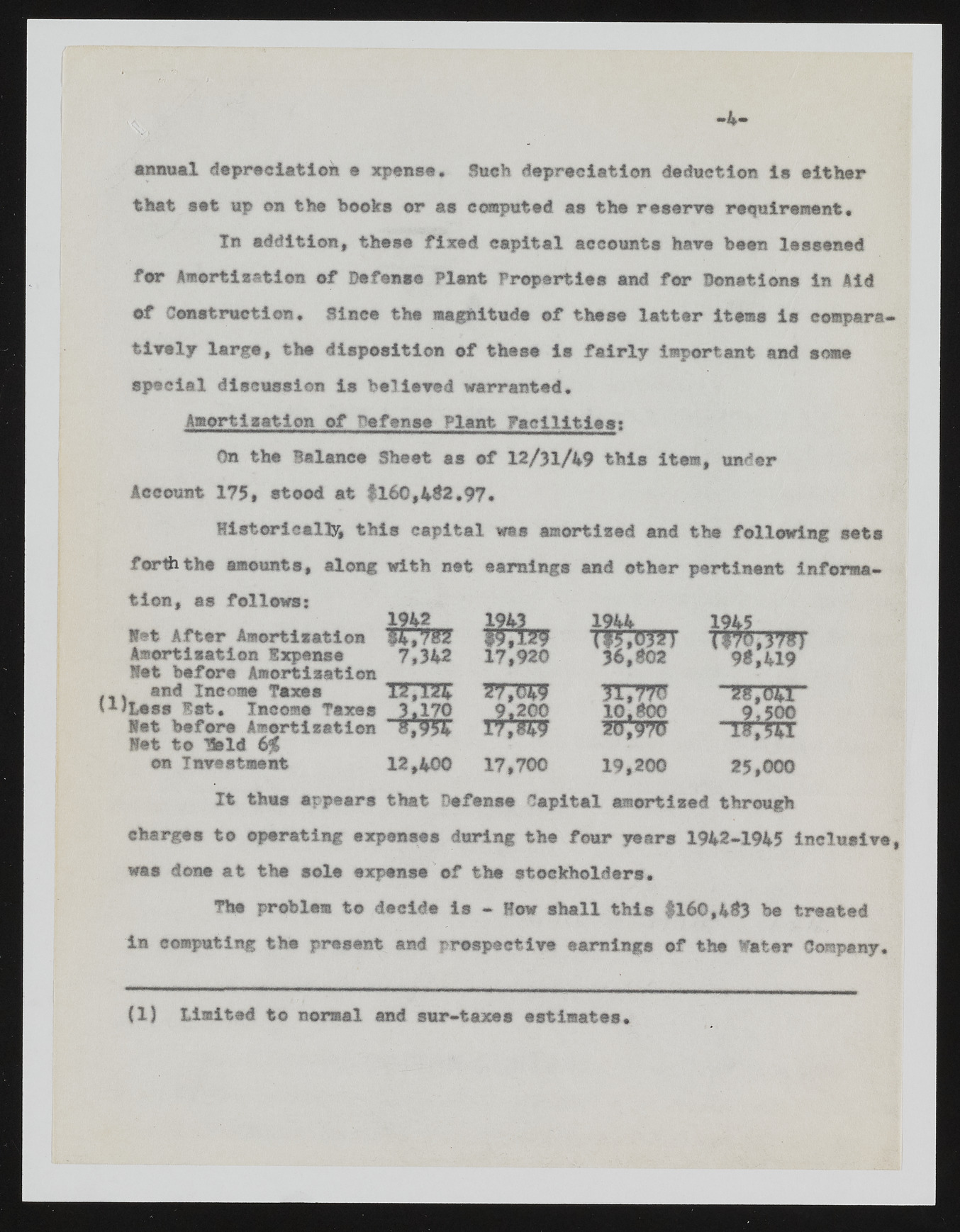

•nnual depreciation e xpense. Such depreciation deduction is either that set up on the books or as computed as the reserve requirement* In addition, these fixed capital accounts have been lessened for Amortisation of Defense Plant Properties and for Donations In Aid of Construction* Since the magnitude of these letter items is compare* tivsly largo, the disposition of these is fairly important and some special discussion is believed warranted. Amortisation of Defense Plant Facilities: On the Balance Sheet as of 12/31/49 this item, under Account 175, etood at $160,402.97. Historically, this capital was amortised and the following sets forth the amounts, along with net earnings and other pertinent information, as fellows: 1942 1943 H«?t After Amortisation $4,782 $9/^9 Amortisation Expense 7,342 17,920 Net before Amortisation and Income Taxes 12,124 27,049 J-JLess 1st. Income Taxes 3.170 9.200 Met before Amortisation 8,17,149 Hat to mid 6£ on Investment 12,400 17,700 TI57Bm 36,S02 3T,773 10.BOO 20',*970 19,200 It thus appears that Defense Capital amortised through charges to operating expenses during the four years 1942-1945 inclusive, was done at tha sole expense of the stockholders* The problem to decide is - How shall this $160,4*3 be treated in computing the present and prospective earning# of the later Company. (1) limited to normal and sur-taxes estimates.