Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

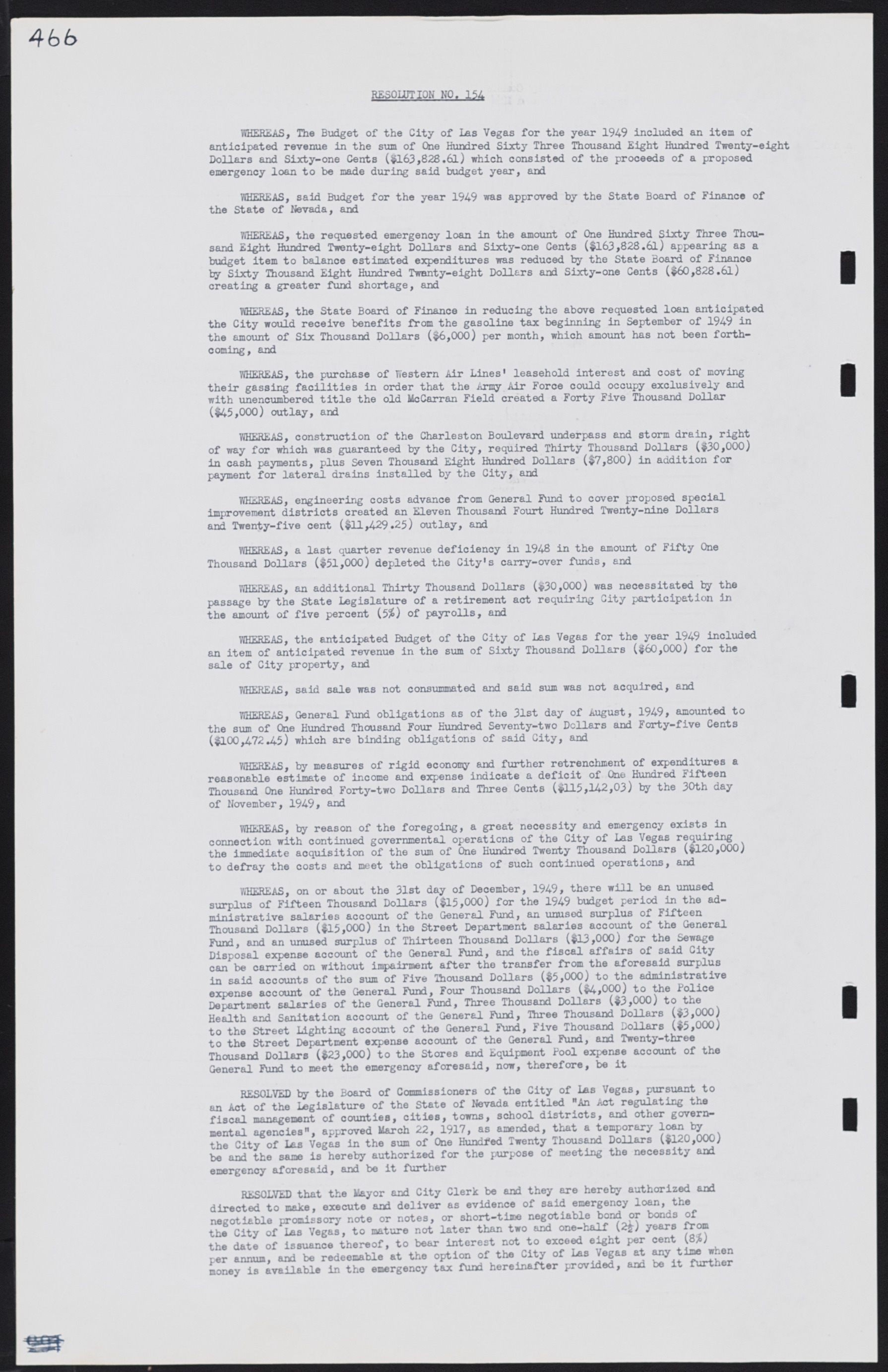

466 RESOLUTION NO. 154 WHEREAS, The Budget of the City of Lae Vegas for the year 1949 included an item of anticipated revenue in the sum of One Hundred Sixty Three Thousand Eight Hundred Twenty-eight Dollars and Sixty-one Cents ($163,828.61) which consisted of the proceeds of a proposed emergency loan to be made during said budget year, and WHEREAS, said Budget for the year 1949 was approved by the State Board of Finance of the State of Nevada, and WHEREAS, the requested emergency loan in the amount of One Hundred Sixty Three Thousand Eight Hundred Twenty-eight Dollars and Sixty-one Cents ($l63,828.6l) appearing as a budget item to balance estimated expenditures was reduced by the State Board of Finance by Sixty Thousand Eight Hundred Twenty-eight Dollars and Sixty-one Cents ($60,828.61) creating a greater fund shortage, and WHEREAS, the State Board of Finance In reducing the above requested loan anticipated the City would receive benefits from the gasoline tax beginning in September of 1949 in the amount of Six Thousand Dollars ($6,000) per month, which amount has not been forthcoming, and WHEREAS, the purchase of Western Air Lines' leasehold interest and cost of moving their gassing facilities in order that the Army Air Force could occupy exclusively and with unencumbered title the old McCarran Field created a Forty Five Thousand Dollar ($45,000) outlay, and WHEREAS, construction of the Charleston Boulevard underpass and storm drain, right of way for which was guaranteed by the City, required Thirty Thousand Dollars ($30,000) in cash payments, plus Seven Thousand Eight Hundred Dollars ($7,800) in addition for payment for lateral drains installed by the City, and WHEREAS, engineering costs advance from General Fund to cover proposed special improvement districts created an Eleven Thousand Four Hundred Twenty-nine Dollars and Twenty-five cent ($11,429.25) outlay, and WHEREAS, a last quarter revenue deficiency in 1948 in the amount of Fifty One Thousand Dollars ($51,000) depleted the City's carry-over funds, and WHEREAS, an additional Thirty Thousand Dollars ($30,000) was necessitated by the passage by the State Legislature of a retirement act requiring City participation in the amount of five percent (5%) of payrolls, and WHEREAS, the anticipated Budget of the City of Las Vegas for the year 1949 included an item of anticipated revenue in the sum of Sixty Thousand Dollars ($60,000) for the sale of City property, and WHEREAS, said sale was not consummated and said sum was not acquired, and WHEREAS, General Fund obligations as of the 31st day of August, 1949, amounted to the sum of One Hundred Thousand Four Hundred Seventy-two Dollars and Forty-five Cents ($100,472.45) which are binding obligations of said City, and WHEREAS, by measures of rigid economy and further retrenchment of expenditures a reasonable estimate of income and expense indicate a deficit of One Hundred Fifteen Thousand One Hundred Forty-two Dollars and Three Cents ($115,142,03) by the 30th day of November, 1949, and WHEREAS, by reason of the foregoing, a great necessity and emergency exists in connection with continued governmental operations of the City of Las Vegas requiring the immediate acquisition of the sum of One Hundred Twenty Thousand Dollars ($120,000) to defray the costs and meet the obligations of such continued operations, and WHEREAS, on or about the 31st day of December, 1949, there will be an unused surplus of Fifteen Thousand Dollars ($15,000) for the 1949 budget period in the administrative salaries account of the General Fund, an unused surplus of Fifteen thousand Dollars ($15,000) in the Street Department salaries account of the General Fund, and an unused surplus of Thirteen Thousand Dollars ($13,000) for the Sewage Disposal expense account of the General Fund, and the fiscal affairs of said City can be carried on without impairment after the transfer from the aforesaid surplus in said accounts of the sum of Five Thousand Dollars ($5,000) to the administrative expense account of the General Fund, Four Thousand Dollars ($4,000) to the Police Department salaries of the General Fund, Three Thousand Dollars ($3,000) to the Health and Sanitation account of the General Fund, Three Thousand Dollars ($3,000) to the Street Lighting account of the General Fund, Five Thousand Dollars ($5,000) to the Street Department expense account of the General Fund, and Twenty-three Thousand Dollars ($23,000) to the Stores and Equipment Pool expense account of the General Fund to meet the emergency aforesaid, now, therefore, be it RESOLVED by the Board of Commissioners of the City of las Vegas, pursuant to an Act of the Legislature of the State of Nevada entitled "An Act regulating the fiscal management of counties, cities, towns, school districts, and other govern- mental agencies', approved March 22, 1917, as amended, that a temporary the City of Las Vegas in the sum of One Hundred Twenty Thousand Dollars ($120,000) be and the same is hereby authorized for the purpose of meeting the necessity and emergency aforesaid, and be it further RESOLVED that the Mayor and City Clerk be and they are hereby authorized and directed to make, execute and deliver as evidence of said emergency loan, the negotiable promissory note or notes, or short-time negotiable bond or bonds of the City of Las Vegas, to mature not later than two and one-half (2 1/2) years from the date of issuance thereof, to bear interest not to exceed eight per cent (8%) per annum, and be redeemable at the option of the City of Las Vegas at any time when Money is available in the emergency tax fund hereinafter provided, and be it further