Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

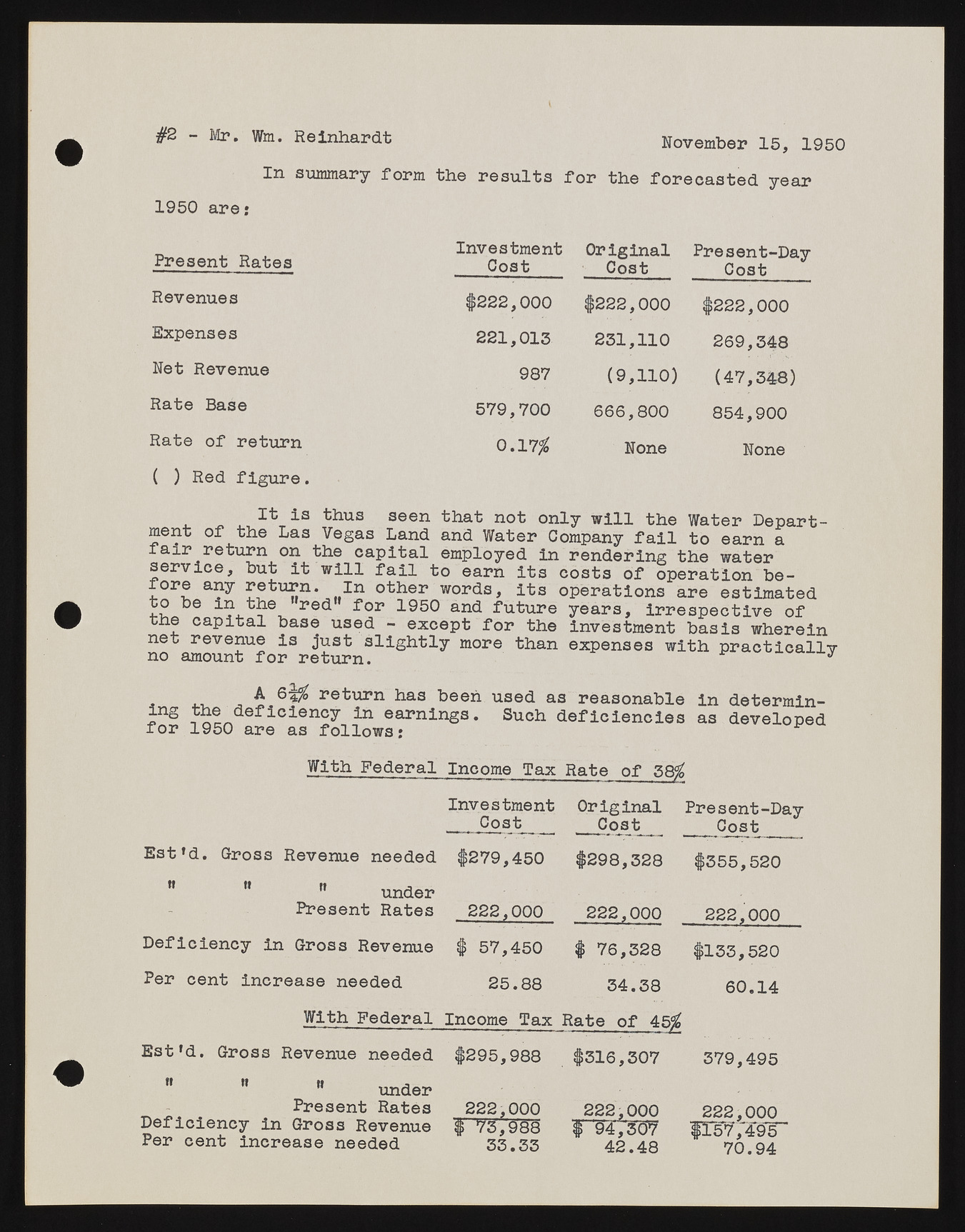

#2 - Mr. Wm. Reinhardt November 15, 1950 In summary form the results for the forecasted year 1950 are: Present Rates Investment Cost Original Cost Present-Day Cost Revenues #2 2 2 ,0 0 0 #2 2 2 ,0 0 0 #2 2 2 ,0 0 0 Expenses 221,013 231,110 269,348 Net Revenue 987 (9,110) (47,348) Rate Base 579,700 666,800 854,900 Rate of return 0.17$ None None ( ) Red figure. It is thus seen that not only will the Water Department of the Las Vegas Land and Water Company fail to earn a air return on the capital employed in rendering the water service, but it will fail to earn its costs of operation before any return. In other words, Its operations are estimated to be in the red for 1950 and future years, irrespective of the capital base used - except for the Investment basis wherein net revenue is just slightly more than expenses no amount for return. with practicallyJ ^ ,, , £ return has been used as reasonable in determin-fionrg 1t9he5 0 daerfei ciase nfcoyl lionw se:arnings. Such deficiencies as developed With Federal Income Tax Rate of 58# Est’d. Gross Revenue needed n under Present Rates Deficiency in Gross Revenue Per cent increase needed With Federal Est'd. Gross Revenue needed " M I under Present Rates Deficiency in Gross Revenue Per cent increase needed Investment __ Cost Original Cost Present-Day Cost #279,450 #298,328 #355,520 2 2 2 ,0 0 0 2 2 2 ,0 0 0 2 2 2 ,0 0 0 # 57,450 # 76,328 #133,520 25.88 34.38 60.14 Income Tax Rate of 45$ #295,988 #316,307 379,495 2 2 2 ,0 0 0 f 73,988 33.33 2 2 2 ,0 0 0 # 94,307 42.48 2 2 2 ,0 0 0 fl57,495 70.94