Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

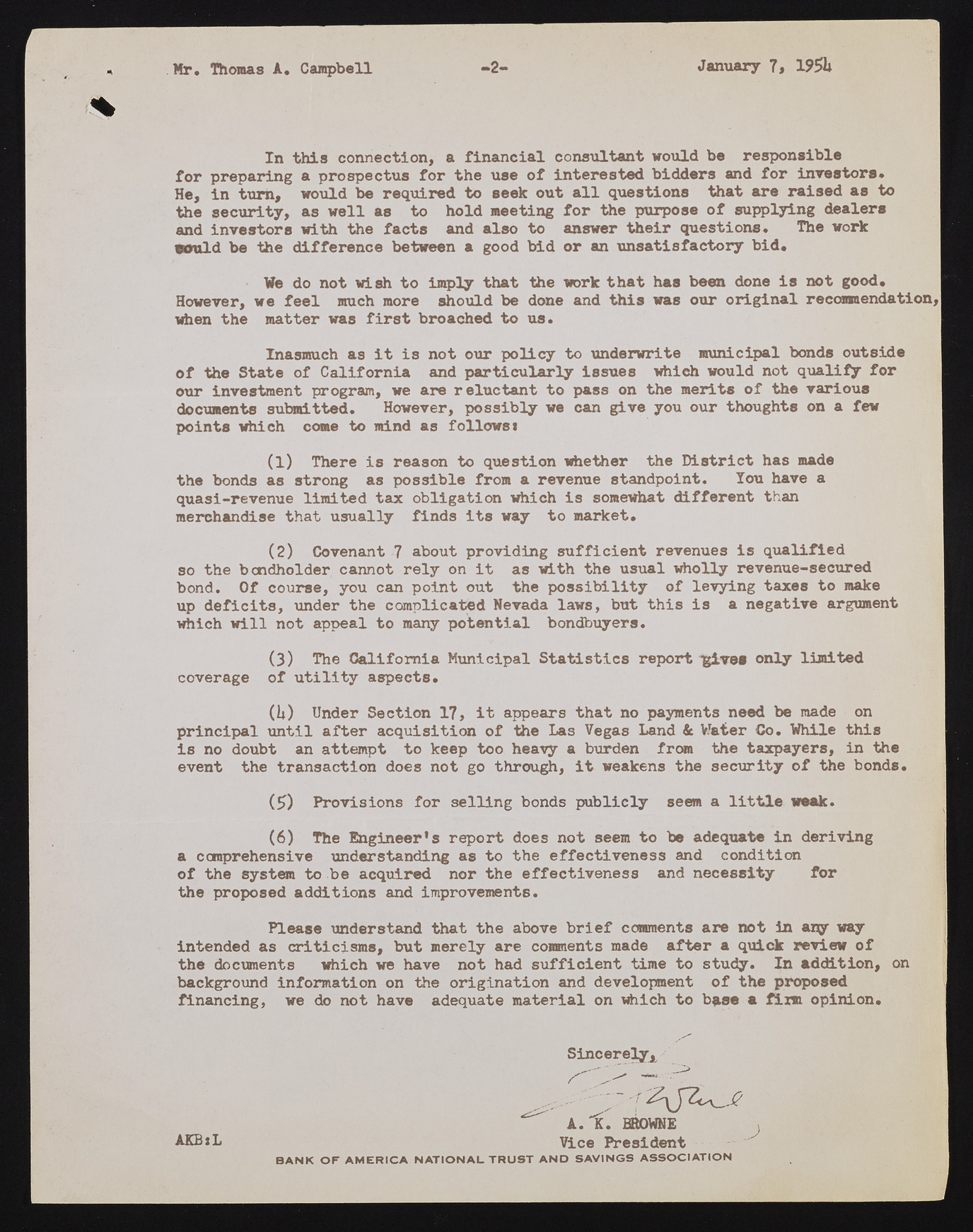

Mr. Thomas A. Campbell 2 January 7* 1951* In this connection, a financial consultant would be responsible for preparing a prospectus for the use of interested bidders and for investors. He, in turn, would be required to seek out all questions that are raised as to the security, as well as to hold meeting for the purpose of supplying dealers and investors with the facts and also to answer their questions. The work mould be the difference between a good bid or an unsatisfactory bid. We do not wish to imply that the work that has been done is not good. However, we feel much more should be done and this was our original recomnendation, when the matter was first broached to us. Inasmuch as it is not our policy to underwrite municipal bonds outside of the State of California and particularly issues which would not qualify for our investment program, we are reluctant to pass on the merits of the various documents submitted. However, possibly we can give you our thoughts on a few points which come to mind as followst (1) There is reason to question whether the District has made the bonds as strong as possible from a revenue standpoint. Tou have a quasi-revenue limited tax obligation which is somewhat different than merchandise that usually finds its way to market. (2) Covenant 7 about providing sufficient revenues is qualified so the bondholder cannot rely on it as with the usual wholly revenue-secured bond. Of course, you can point out the possibility of levying taxes to make up deficits, "under the complicated Nevada laws, but this is a negative argument which will not appeal to many potential bondbuyers. (3) The California Municipal Statistics report "gives only limited coverage of utility aspects. (U) Under Section 17, it appears that no payments need be made on principal until after acquisition of the Las Vegas Land 4c Water Co. While this is no doubt an attempt to keep too heavy a burden from the taxpayers, in the event the transaction does not go through, it weakens the security of the bonds. (5) Provisions for selling bonds publicly seem a little weak. (6) The Engineer’s report does not seem to be adequate in deriving a comprehensive understanding as to the effectiveness and condition of the system to be acquired nor the effectiveness and necessity for the proposed additions and improvements. Please understand that the above brief comments are not in any way intended as criticisms, but merely are comments made after a quick review of the documents which we have not had sufficient time to study. In addition, on background information on the origination and development of the proposed financing, we do not have adequate material on which to base a firm opinion. Sincerely^ ... ...~~ m A. *K. BROWNE Vice President BANK OF AMERICA NATIONAL TRUST AND SAVINGS ASSOCIATION AKBsL