Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

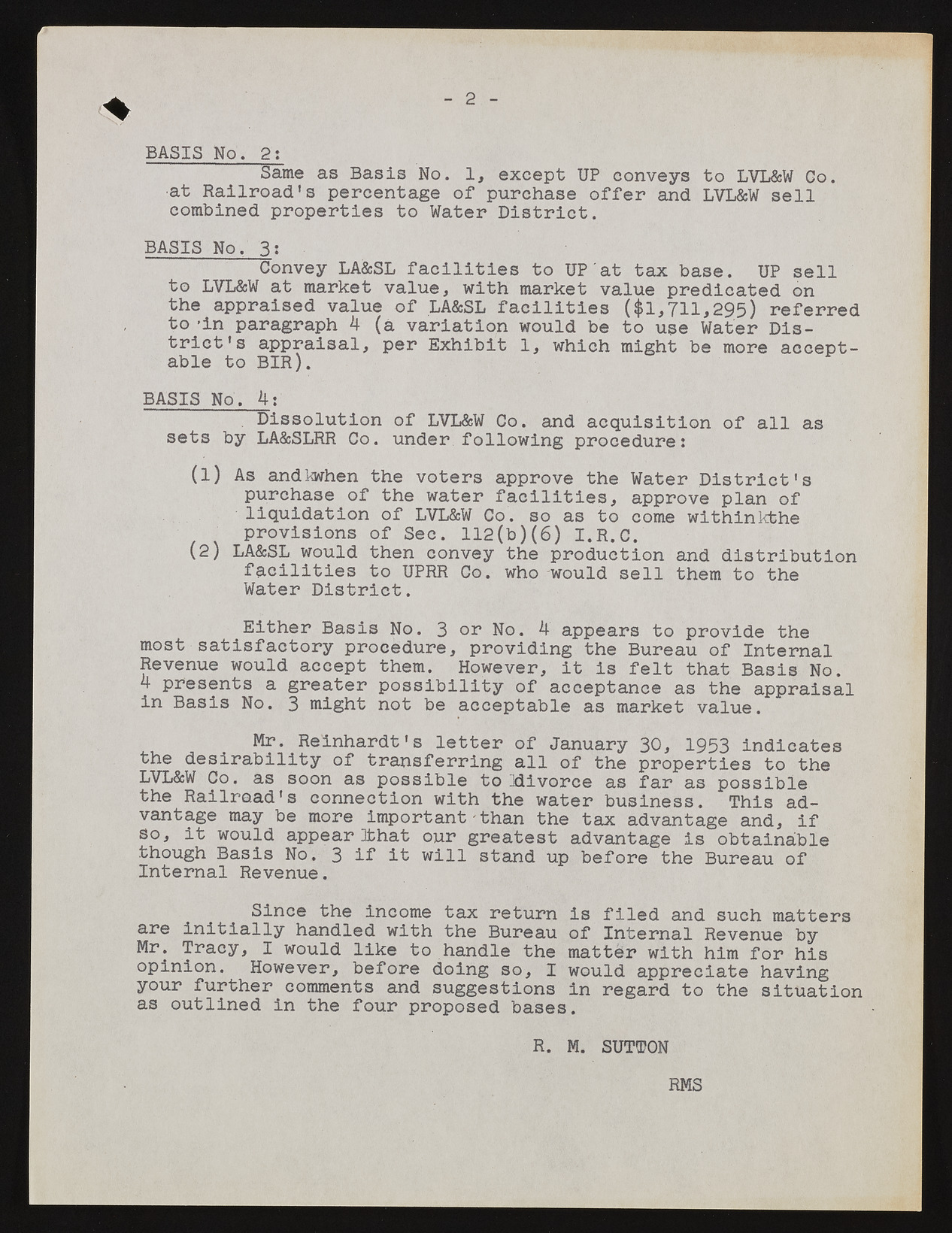

2 BASIS No. 2i Same as Basis No. 1, except UP eonveys to LVL&W Go. at Railroad's percentage of purchase offer and LVL&W sell combined properties to Water District. BASIS No. 3: Convey LA&SL facilities to UP at tax base. UP sell to LVL&W at market value, with market value predicated on the appraised value of LA&SL facilities ($1,711,295) referred to -in paragraph 4 (a variation would be to use Water District's appraisal, per Exhibit 1, which might be more acceptable to BIR). BASIS No. 4: . Dissolution of LVL&W Co. and acquisition of all as sets by LA&SLRR Co. under following procedure: (1) As andkwhen the voters approve the Water District's purchase of the water facilities, approve plan of liquidation of LVL&W Co. so as to come withinkthe provisions of Sec. 112(b)(6) I.R.C. (2) LA&SL would then convey the production and distribution facilities to UPRR Co. who would sell them to the Water District. Either Basis No. 3 or No. 4 appears to provide the most satisfactory procedure, providing the Bureau of Internal Revenue would accept them. However, it is felt that Basis No. 4 presents a greater possibility of acceptance as the appraisal in Basis No. 3 might not be acceptable as market value. Mr. Reinhardt's letter of January 30, 1953 indicates the desirability of transferring all of the properties to the LVL&W Co. as soon as possible toJdivorce as far as possible the Railroad's connection with the water business. This advantage may be more important - than the tax advantage and, if so, it would appear Ithat our greatest advantage is obtainable though Basis No. 3 if it will stand up before the Bureau of Internal Revenue. Since the income tax return is filed and such matters are initially handled with the Bureau of Internal Revenue by Mr. Tracy, I would like to handle the matter with him for his opinion. However, before doing so, I would appreciate having your further comments and suggestions in regard to the situation as outlined in the four proposed bases. R. M. SUTTON RMS