Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

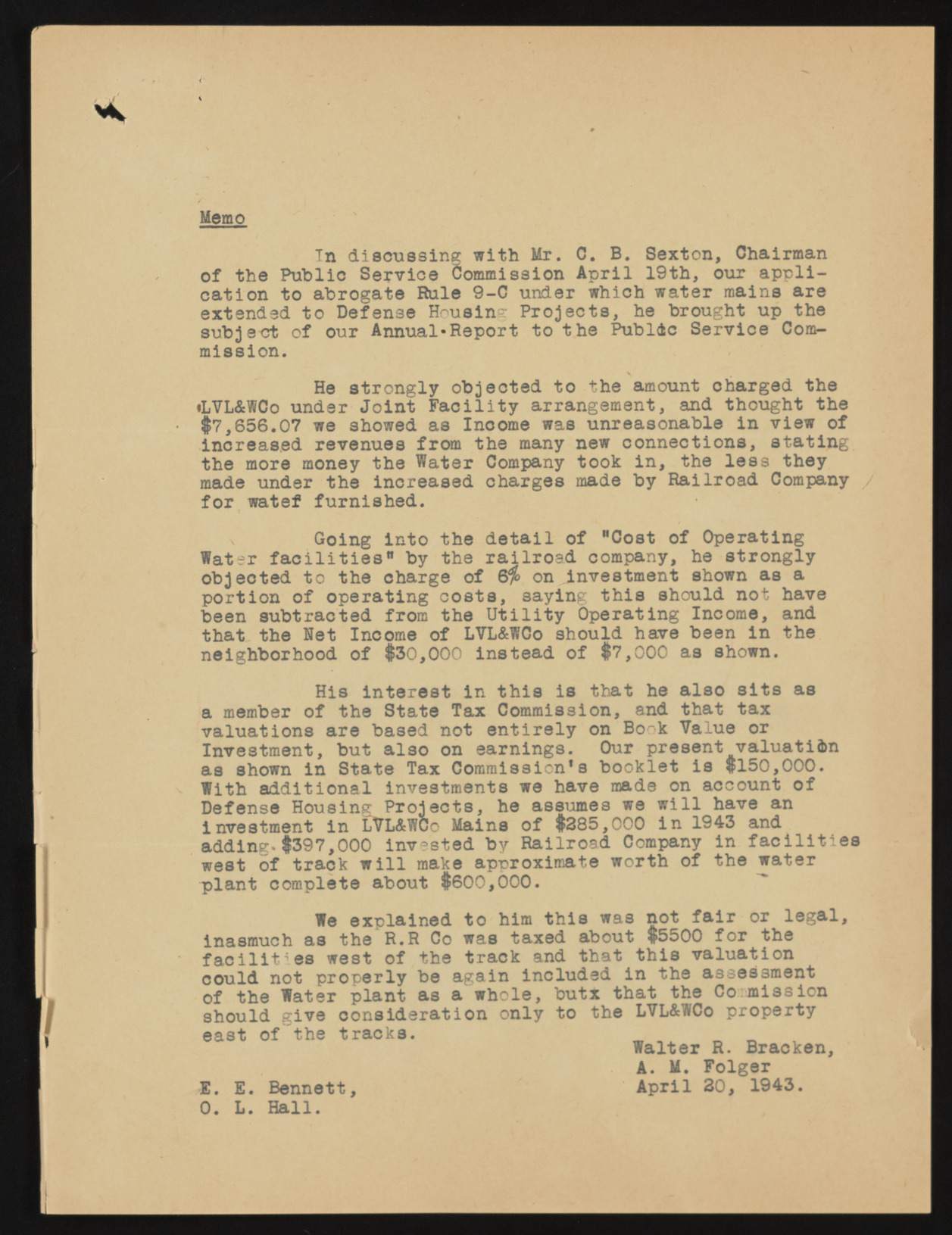

Memo Tn discussing with Mr. C. B. Sexton, Chairman of the Public Service Commission April 19th, our application to abrogate Rule 9-C under which water mains are extended to Defense Housing Projects, he brought up the subject of our Annual*Report to the Public Service Commission. He strongly objeoted to the amount oharged the •LVL&WCo under Joint Facility arrangement, and thought the $7,656.07 we showed as Income was unreasonable in view of increased revenues from the many new connections, stating the more money the Water Company took in, the less they made under the increased charges made by Railroad Company for watef furnished. Going into the detail of "Cost of Operating Water facilities" by the railroad company, he strongly objeoted to the charge of 6$ on investment shown as a portion of operating costs, saying this should not have been subtracted from the Utility Operating Income, and that the Net Income of LVL&WCo should have been in the neighborhood of $30,000 instead of $7,000 as shown. His interest in this is that he also sits as a member of the State Tax Commission, and that tax valuations are based not entirely on Book Value or Investment, but also on earnings. Our present valuation as shown in State Tax Commission's booklet is $150,000. With additional investments we have made on account of Defense Housing Projects, he assumes we will have an investment in LVL&WCo Mains of $385,000 in 1943 and adding.$397,000 invested by Railroad Company in facilities west of track will make approximate worth of the water plant complete about $600,000. We explained to him this was not fair or legal, inasmuch as the R.R Co was taxed about $5500 for the facilities west of the track and that this valuation could not properly be again included in the assessment of the Water plant as a whole, butx that the Co mission should give consideration only to the LVL&WCo property east of the tracks. Walter R. _Bracken, A. M. Folger E. E. Bennett, April 30, 1943. 0. L. Hall.