Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

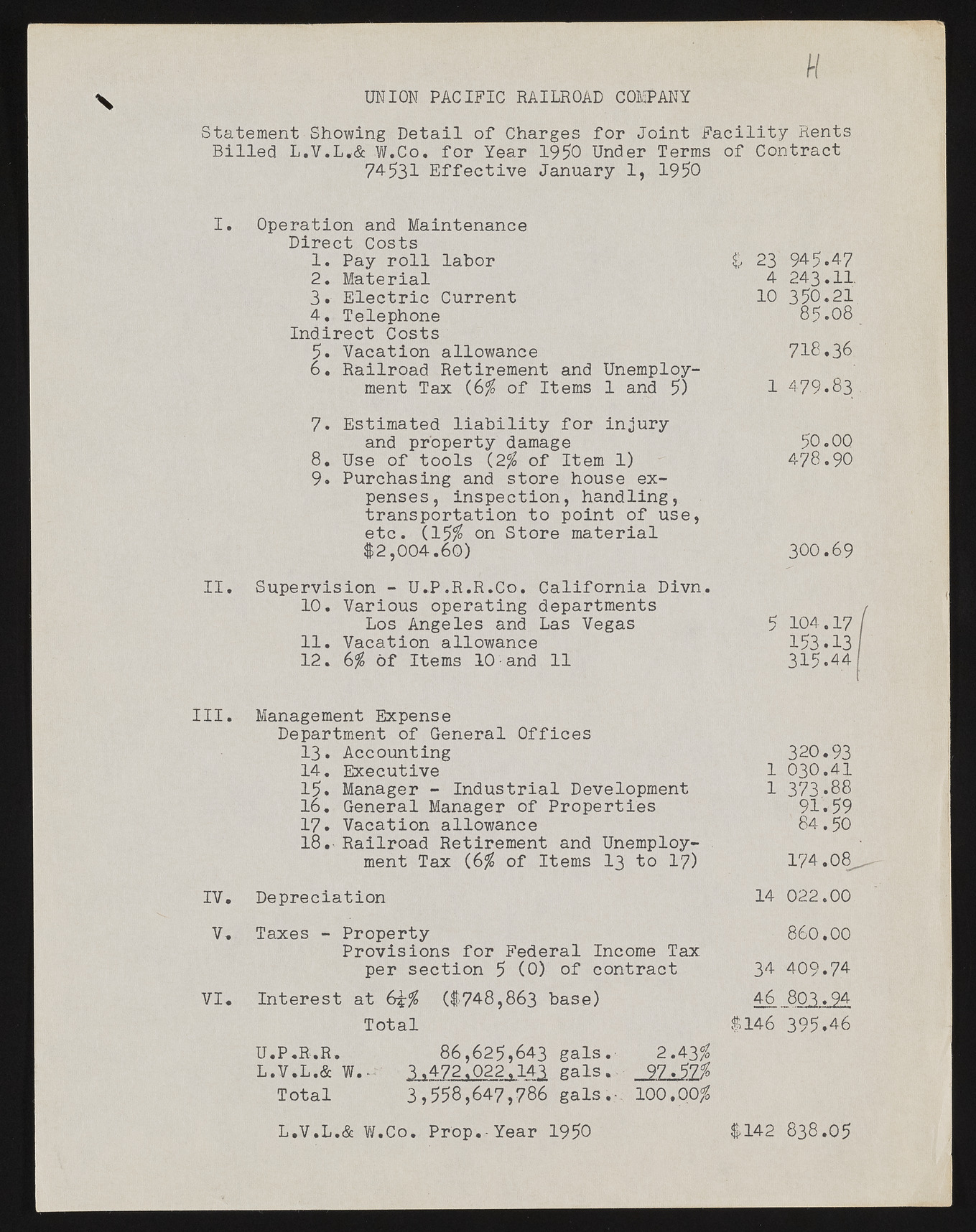

UNION PACIFIC RAILROAD COMPANY H N Statement Showing Detail of Charges for Joint Facility Rents Billed L.V.L.& W.Co. for Year 1950 Under Terms of Contract 74531 Effective January 1, 1950 I. Operation and Maintenance Direct Costs 1. Pay roll labor 2. Material 3• Electric Current 4. Telephone Indirect Costs 5. Vacation allowance 6. Railroad Retirement and Unemployment Tax (6$ of Items 1 and 5) 23 945.47 4 243.11 10 350.21 85.08 718.36 1 479.83 7. Estimated liability for injury and property damage 8. Use of tools (2% of Item 1) 9. Purchasing and store house expenses, inspection, handling, transportation to point of use, etc. (15$ on Store material $2,004.60) 50.00 478.90 300.69 II. Supervision - U.P.R.R.Co. California Divn. 10. Various operating departments Los Angeles and Las Vegas 11. Vacation allowance 12. 6$ of Items 10 and 11 5 104.17 / 153.13 315.44 III. IV. V. VI. Management Expense Department of General Offices 13. Accounting 320.93 14. Executive 1 030.41 15. Manager - Industrial Development 1 373.88 16. General Manager of Properties 91.59 17. Vacation allowance 84.50 18.-Railroad Retirement and Unemploy- ment Tax (6$ of Items 13 to 17) 174.08 Depreciation 14 022.00 Taxes - Property 860.00 Provisions for Federal Income Tax per section 5 (0) of contract 34 409.74 Interest at 65-$ ($748,863 base) 46 803.94 Total $146 395.46 U.P.R.R. 86,625,643 gals. 2.43$ L.V.L.& W.- 3,472.022,143 gals.- 97.57# Total 3,558,647,786 gals.- 100.00$ L.V.L.& W.Co. Prop.-Year 1950 $142 838.05