Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

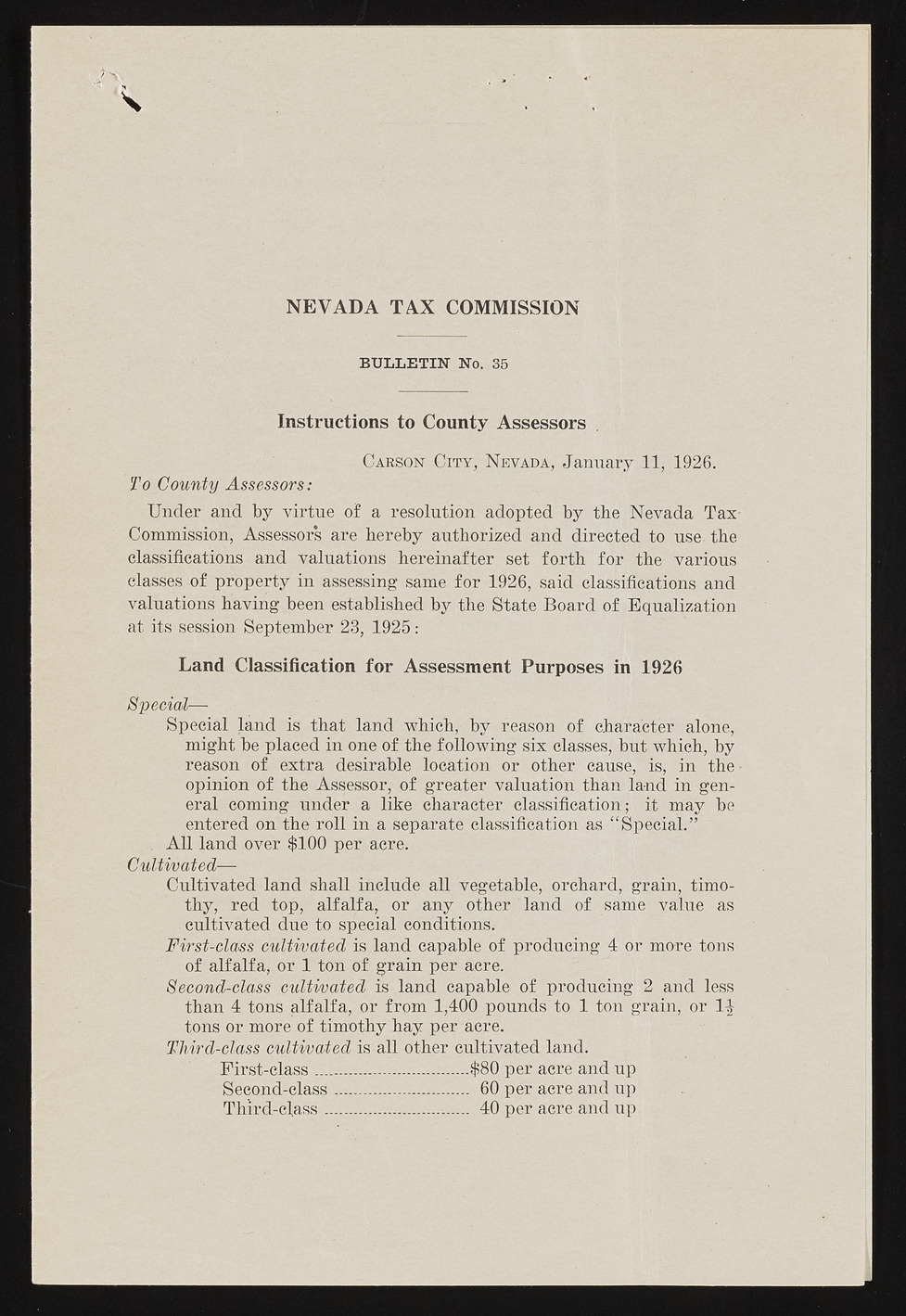

NEVADA TAX COMMISSION BULLETIN No. 35 Instructions to County Assessors Carson City, Nevada, January 11, 1926. To County Assessors: Under and by virtue of a resolution adopted by the Nevada Tax- Commission, Assessors are hereby authorized and directed to use. the classifications and valuations hereinafter set forth for the various classes of property in assessing same for 1926, said classifications and valuations having been established by the State Board of Equalization at its session September 23, 1925: Land Classification for Assessment Purposes in 1926 Special—? Special land is that land which, by reason of character alone, might be placed in one of the following six classes, but which, by reason of extra desirable location or other cause,' is, in the-opinion of the Assessor, of greater valuation than land in general coming under a like character classification; it may be entered on the roll in a separate classification as “Special.” . All land over $100 per acre. Cultivated—• Cultivated land shall include all vegetable, orchard, grain, timothy, red top, alfalfa, or any other land of same value as cultivated due to special conditions. First-class cultivated is land capable of producing 4 or mure tons of alfalfa, or 1 ton of grain per acre. Second-class cultivated is land capable of producing 2 and less than 4 tons alfalfa, or from 1,400 pounds to 1 ton grain, or 1 | tons or more of timothy hay per acre. Third-class cultivated is all other cultivated land. First-class....................... .-......$80 per acre and up Second-class ,............ ............ 60 per acre and up Third-class ................. ........... 40 per acre and up