Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

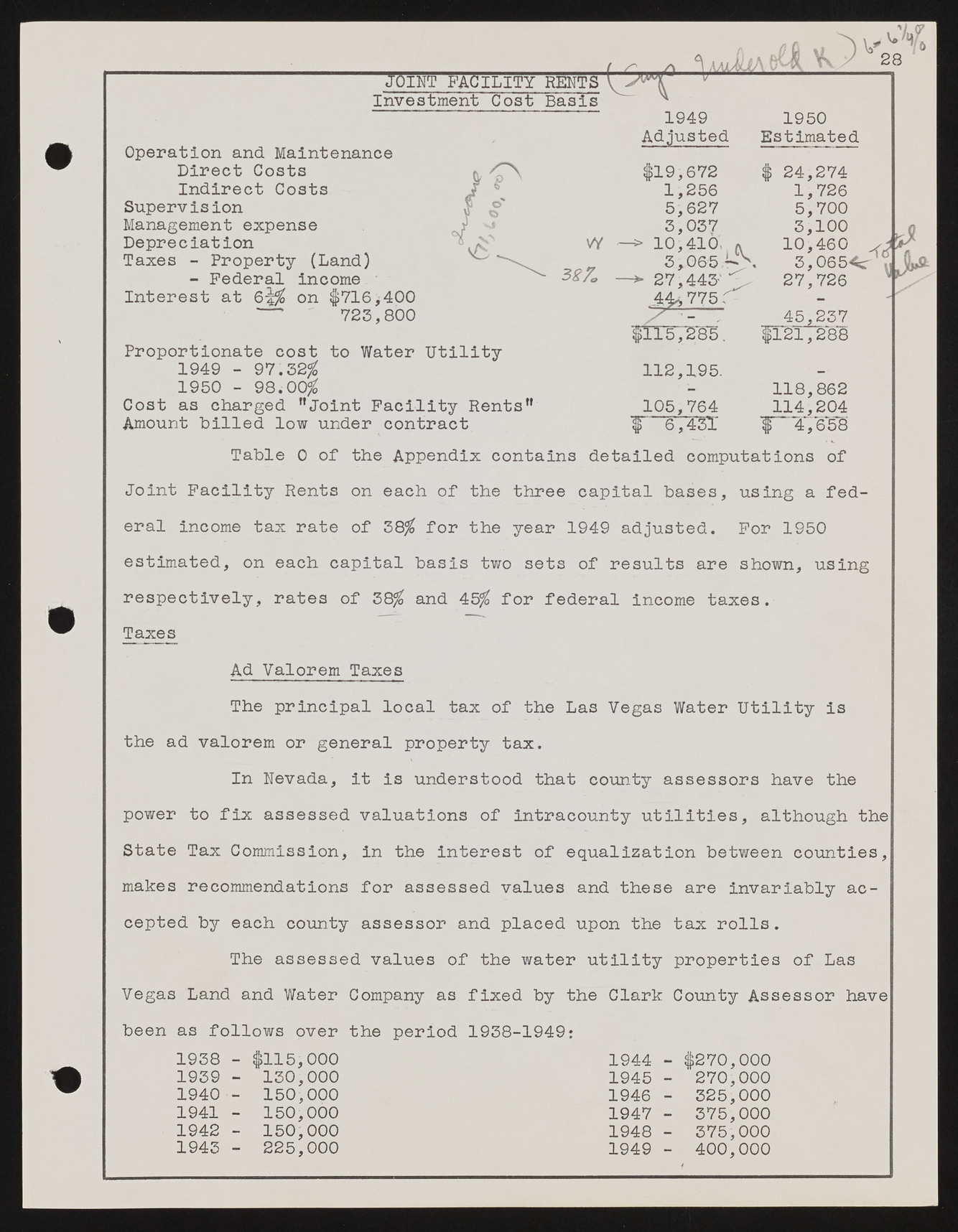

JOINT FACILITY RENTS V Investment Cost Basis a Z7* ?VkajJ L i ^ 28 ^ Operation and Maintenance Direct Costs Indirect Costs Supervision Management expense Depreciation Taxes - Property (Land) - Federal income Interest at 6|$ on $716,400 ’ ' 723,800 v6 Proportionate cost to Water Utility 1949 - 9 7.52% 1950 - 9 8 .0 0 % Cost as charged "Joint Facility Rents" Amount hilled low under contract 1949 Adjusted $19,672 1,256 5,627 3,037 -> 10,410, a 3,065 -*>. -> 27,443- 775.- $115,285. 112,195. 1950 Estimated $ 24,274 1,726 5,700 3,100 10,460 3,065<c 27,726 45,237 t M $T2l,288 105,764 f 6,431 118,862 114,204 f ~ 4,658 Table 0 of the Appendix contains detailed computations of Joint Facility Rents on each of the three capital bases, using a federal income tax rate of 38$ for the year 1949 adjusted. For 1950 estimated, on each capital basis two sets of results are shown, using respectively, rates of 38$ and 45$ for federal income taxes. Taxes Ad Valorem Taxes The principal local tax of the Las Vegas Water Utility is the ad valorem or general property tax. In Nevada, it is understood that county assessors have the power to fix assessed valuations of intracounty utilities, although the State Tax Commission, in the interest of equalization between counties, makes recommendations for assessed values and these are invariably accepted by each county assessor and placed upon the tax rolls. The assessed values of the water utility properties of Las Vegas Land and Water Company as fixed by the Clark County Assessor have been as follows over the period 1938-1949: 1938 - $115,000 1939 - 130,000 1940 - 150,000 1941 - 150,000 1942 - 150,000 1943 - 225,000 1944 - $270,000 1945 - 270,000 1946 - 325,000 1947 - 375,000 1948 - 375,000 1949 - 400,000