Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

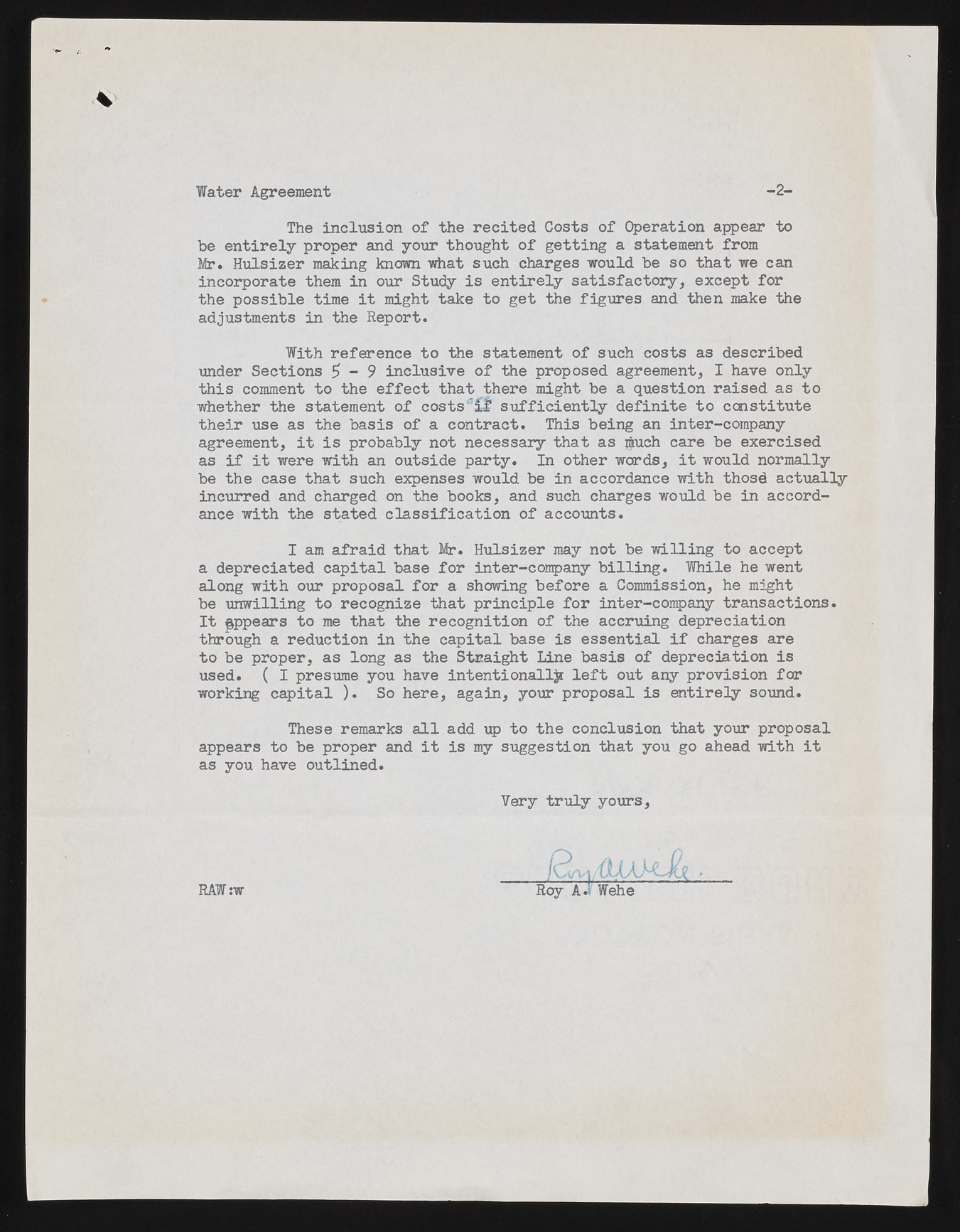

Water Agreement -2- The inclusion of the recited Costs of Operation appear to be entirely proper and your thought of getting a statement from Mr. Hulsizer making known what such charges would be so that we can incorporate them in our Study is entirely satisfactory, except for the possible time it might take to get the figures and then make the adjustments in the Report. under Sections 5 - 9 inclusive of the proposed agreement, I have only this comment to the effect that there might be a question raised as to whether the statement of costs^^f sufficiently definite to constitute their use as the basis of a contract. This being an inter-company agreement, it is probably not necessary that as pach care be exercised as if it were with an outside party. In other words, it would normally be the case that such expenses would be in accordance with thosd actually incurred and charged on the books, and such charges would be in accordance with the stated classification of accounts. a depreciated capital base for inter-company billing. While he went along with our proposal for a showing before a Commission, he might be unwilling to recognize that principle for inter-company transactions. It appears to me that the recognition of the accruing depreciation through a reduction in the capital base is essential if charges are to be proper, as long as the Straight Line basis of depreciation is used. ( I presume you have intentionally left out ary provision for working capital ). So here, again, your proposal is entirely sound. appears to be proper and it is my suggestion that you go ahead with it as you have outlined. With reference to the statement of such costs as described I am afraid that Mr. Hulsizer may not be willing to accept These remarks all add up to the conclusion that your proposal Very truly yours, RAW :w Roy a .» wene