Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

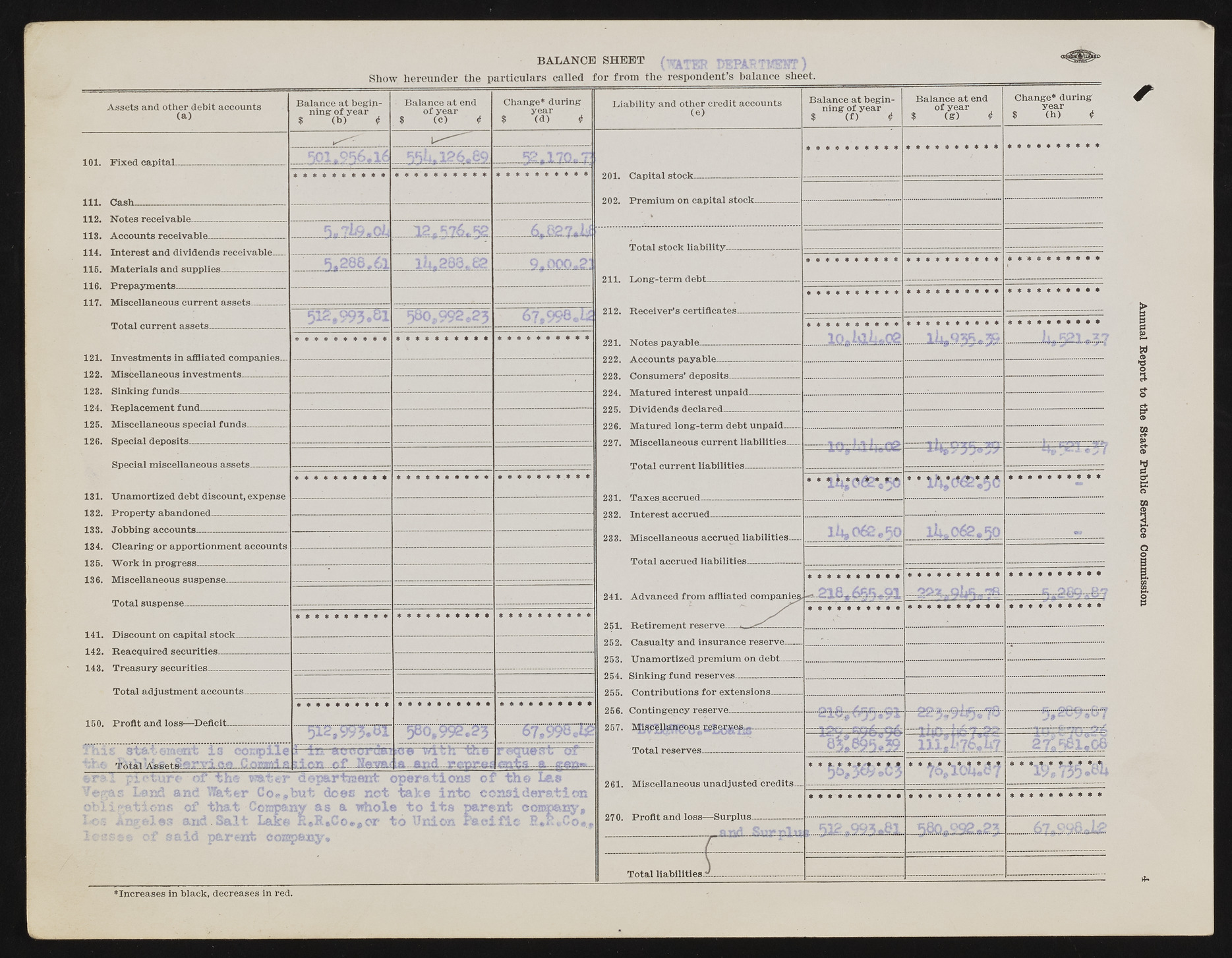

BALANCE SHEET (XATBP PEPAHTME8T) <" ^ ^ D Show hereunder the particulars called for from the respondent’s balance sheet. ______________ __________ _ ^ ^ = = = = = ^ = _ _ _ Assets and other debit accounts (a) Banlainngce o af ty beeagrin$ (b) 4 Balaonf cyee aatr end $ (c) 4 Changyee*a rduring $ (d) <t Liability and other credit accounts (e) Banlainncge o af ty beeagri n$ (f) 4 Balaonf cyee aatr end $ (g) t Changyee*a rduring $ (h) 4 * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * r:r '. y. fOl is^ r r-L- ------- go R2. 1 7 0 . T 111. Cash * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * 202. Premium on capital stock............... 112. Notes receivable.--------- ------------ % ? l a . c h 1 2 , 9 7 6 . 9 2 . .6> .827* i i 114. Interest and dividends receivable__ Total stock liability .. _________ S . 288.61 l h . 2 8 3 . 6 2 9 t 0000.2' 211. Long-term debt . . . . . . * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * 117. Miscellaneous current assets........... * * * * * * * * * * * * * * * * * * * * * * * * * * * * * 0 5 1 2 * 9 9 3 o S l 580, 9 9 2 ,23 * * * * * * * * * * i o J a L .02 * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * q 1 * Q5C w * 126. Special deposits ...................... — . Special miscellaneous assets............ j j v J J 181. Unamortized debt discount, expense * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * **/*',* * JL* 4^ V' v * * * * * * * * * * 233. Miscellaneous accrued liabilities— 314, 062,50 l l u 062.90 134. Clearing or apportionment accounts. Total accrued liabilities ........... - 136. Miscellaneous suspense.. ___ 241. Advanced from affliated companies * * * * * * * * * * 0*1 P /t e r q * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * 252. Casualty and insurance reserve---- 253. Unamortized premium on debt----- 143. Treasury securities__ ________ Total adjustment accounts............... 254. Sinking fund reserves...................... * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *•- r% 257. Miscellaneous reserves—-------------- {v / 9^ | __ D12, 993.01 5 8 0 ,9 9 2 * 2 3 67, 9 9 8 , 1^ Total reserves . ........... 4»'*•*£? - A ^ 3 i n a c c o r d a i Cm ( fj bias (C <5 Us' s lftn rsf* Nfl-xwu see w i t h t h e l a n n d r e n r e f r e q u e s t —o f £ n t s . e o n ® — * * *. * *..(* **- * A * * * * *t_ *e * * < ,i|f * * * * * * * * * * fe r a l p ictu re o f t h e w a t e r d e p a r t m e n t o p e r a t i o n s o f t h e L a s v e g a s L a n d a n d W a te r C o . , b u t d e e s n e t t a k e i n t o c o n s i d e r a t i o n o b l i g a t i o n s o f t h a t C om pany a s a w h o l e t o i t s p a r e n t c o m p a n y , I»os A n g e l e s a n d . S a l t L a k e R » B .» C o * ,o r t o U n io n r a c i f l c H . K i C o * . , l e s s e e o f s a i d p a r e n t c o m p a n y . * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * 9 lir .999*83 Total liabilities.” ............................ ?Increases in black, decreases in red. Annual Report to the State Public Service Commission