Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

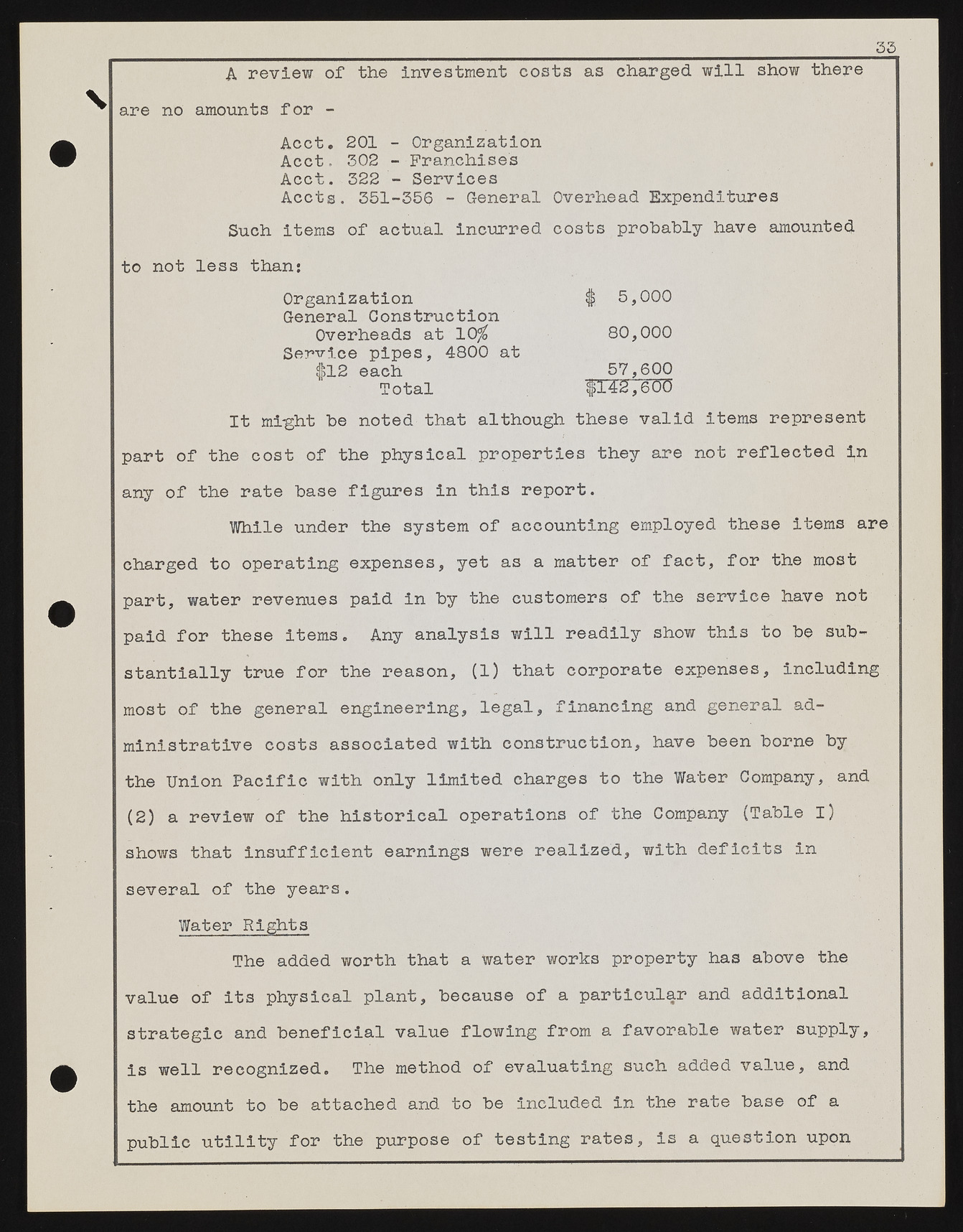

35 \ A review of the investment costs as charged will show there are no amounts for - Acct. 201 - Organization Acct. 302 - Franchises Acct. 322 - Services Accts. 351-350 - General Overhead Expenditures Such items of actual incurred costs probably have amounted to not less than: Organization General Construction Overheads at 10^ Service pipes, 4800 at $12 each Total I 5 , 000 80,000 57,600 fl'4’2’,6’00 It mi-ght be noted that although these valid items represent part of the cost of the physical properties they are not reflected 3,n any of the rate base figures in this report. While under the system of accounting employed these items are charged to operating expenses, yet as a matter of fact, for the most part, water revenues paid in by the customers of the service have not paid for these items. Any analysis will readily show this to be substantially true for the reason, (1) that corporate expenses, including most of the general engineering, legal, financing and general administrative costs associated with construction, have been borne by the Union Pacific with only limited charges to the Water Company, and (2) a review of the historical operations of the Company (Table I) shows that insufficient earnings were realized, with deficits in several of the years. Water Rights The added worth that a water works property has above the value of its physical plant, because of a particular and additional strategic and beneficial value flowing from a favorable water supply, is well recognized. The method of evaluating such added value, and the amount to be attached and to be included in the rate base of a public utility for the purpose of testing rates, is a question upon