Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

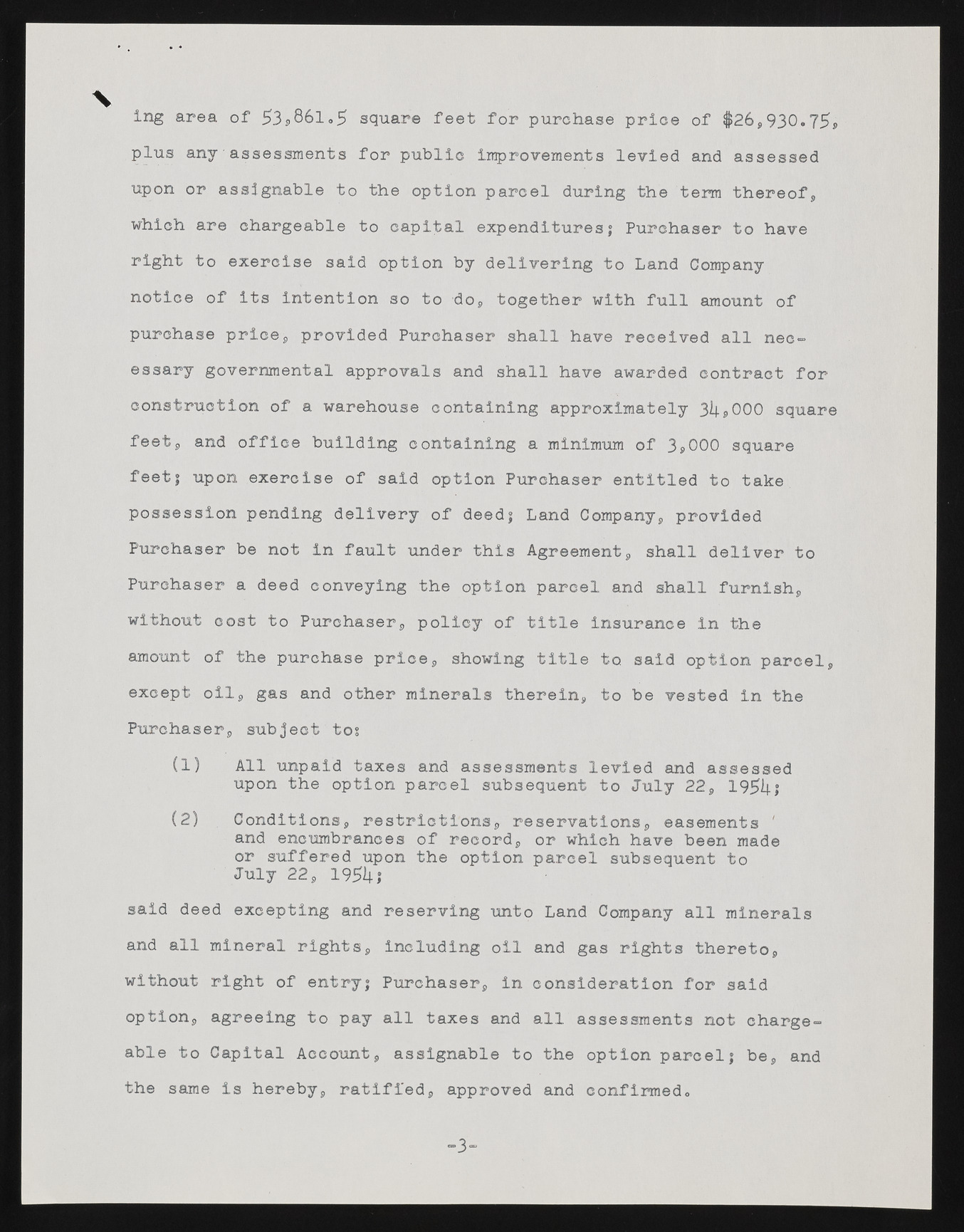

\ ing area of 53«> 861.5 square feet for purchase price of $26,930.75, plus any assessments for public improvements levied and assessed upon or assignable to the option parcel during the term thereof, which are chargeable to capital expenditures; Purchaser to have right to exercise said option by delivering to Land Company notice of its intention so to do, together with full amount of purchase price, provided Purchaser shall have received all necessary governmental approvals and shall have awarded contract for construction of a warehouse containing approximately 3l|,000 square feetp and office building containing a minimum of 3,000 square feet; upon exercise of said option Purchaser entitled to take possession pending delivery of deed; Land Company, provided Purchaser be not in fault under this Agreement, shall deliver to Purchaser a deed conveying the option parcel and shall furnish, without cost to Purchaser, policy of title insurance in the amount of the purchase price, showing title to said option parcel, except oil, gas and other minerals therein, to be vested in the Purchaser, subject to? (1) All unpaid taxes and assessments levied and assessed upon the option parcel subsequent to July 22, 195U; (2) Conditions, restrictions, reservations, easements ' and encumbrances of record, or which have been made or suffered upon the option parcel subsequent to July 22, 1951+; said deed excepting and reserving unto Land Company all minerals and all mineral rights, including oil and gas rights thereto, without right of entry; Purchaser, in consideration for said option, agreeing to pay all taxes and all assessments not chargeable to Capital Account, assignable to the option parcel; be, and the same is hereby, ratified, approved and confirmed. >3-