Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

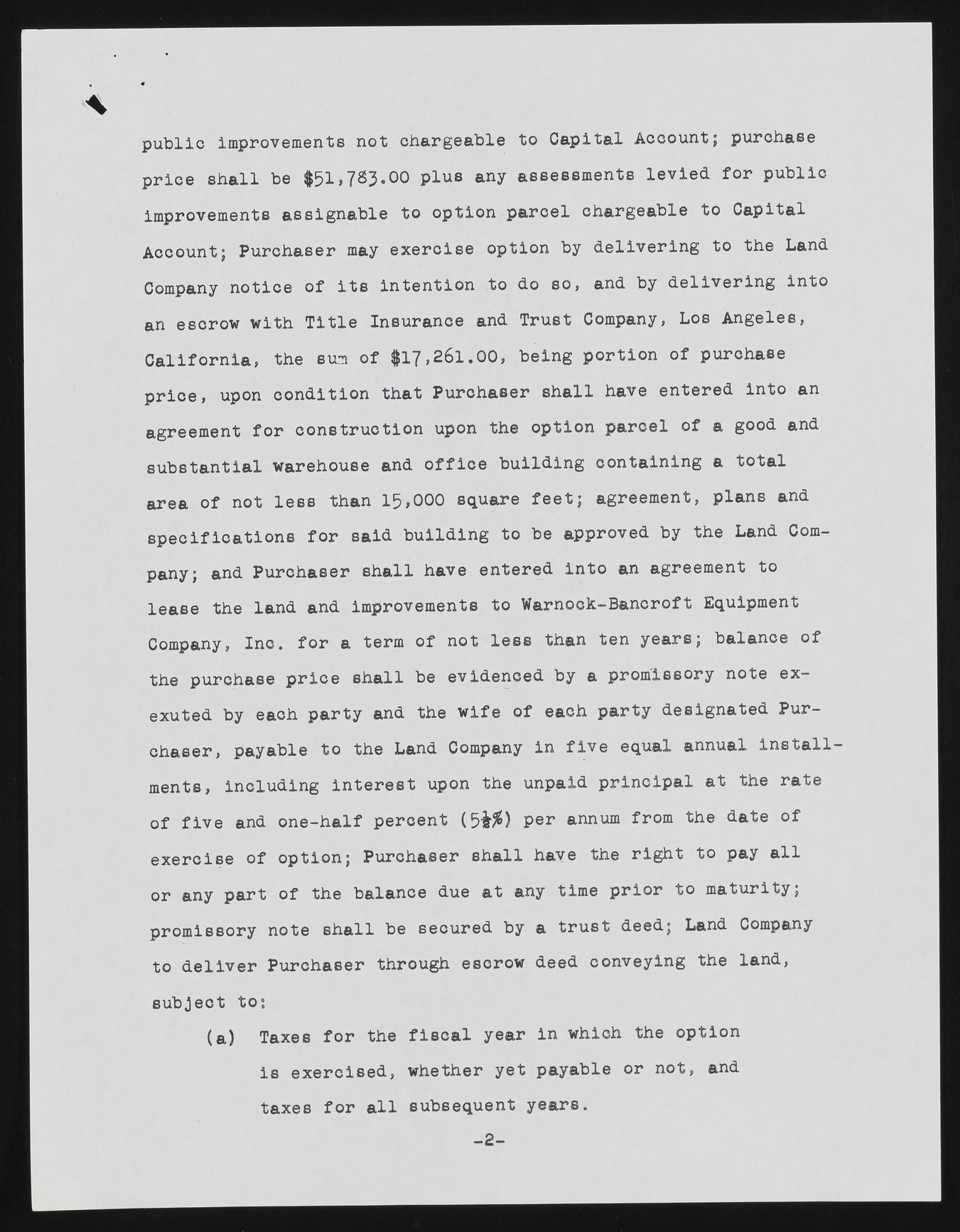

public Improvements not chargeable to Capital Account; purchase price shall be $5 1 ,782.00 plus any assessments levied for public improvements assignable to option parcel chargeable to Capital Account; Purchaser may exercise option by delivering to the Land Company notice of its intention to do so, and by delivering into an escrow with Title Insurance and Trust Company, Los Angeles, California, the sum of $17,261.00, being portion of purchase price, upon condition that Purchaser shall have entered into an agreement for construction upon the option parcel of a good and substantial warehouse and office building containing a total area of not less than 15,000 square feet; agreement, plans and specifications for said building to be approved by the Land Company; and Purchaser shall have entered into an agreement to lease the land and improvements to Warnock-Bancroft Equipment Company, Inc. for a term of not less than ten years; balance of the purchase price shall be evidenced by a promissory note ex— exuted by each party and the wife of each party designated Purchaser, payable to the Land Company in five equal annual installments, including Interest upon the unpaid principal at the rate of five and one-half percent (5# ) per annum from the date of exercise of option; Purchaser shall have the right to pay all or any part of the balance due at any time prior to maturity; promissory note shall be secured by a trust deed; Land Company to deliver Purchaser through escrow deed conveying the land, subject to; (a) Taxes for the fiscal year in which the option is exercised, whether yet payable or not, and taxes for all subsequent years. » * -2-