Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

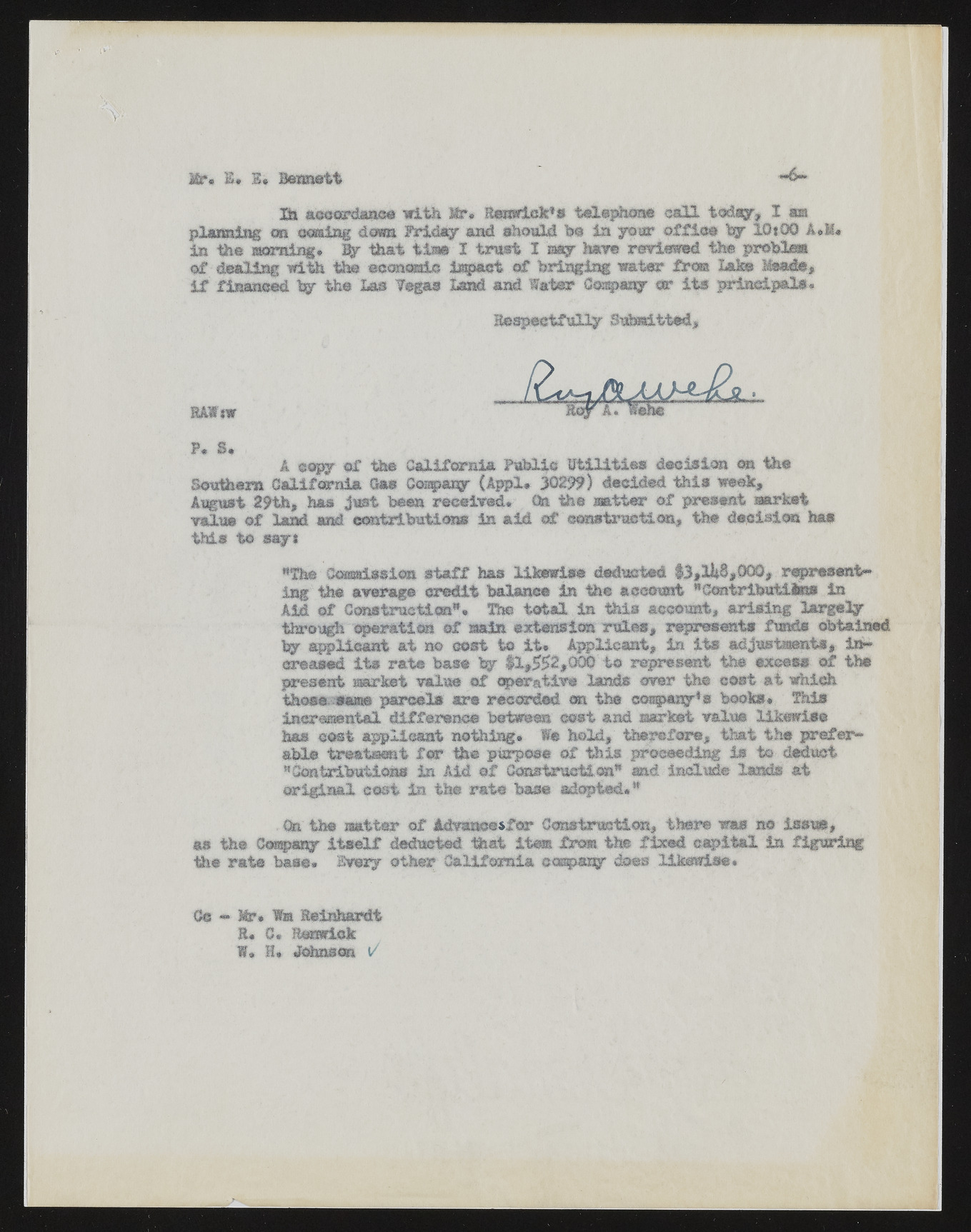

Mr* ®* Si Bennett 3fe accordance ?with Mr* Renwick’s telephone gall today, I as planning on oomtog down. Friday and should be in your office by 10*00 A*M* in the asoralng. W that tliae I trust 1 may Mm reviewed the problem of dealing with the economic impact of bringing water fro® Lake Msade, if financed by the Las Tagus Land and Water Company or its principals. Respectfully Submitted, SAW nr F. S. A sort of the California Public Utilities decision ©st the Southern California Gas Co^any (Appl. 30299) decided this week, August 29th, has just been received. Oa the matter of present market value of band and contributions in aid of emstr‘action, the decision has this to say i "The Commission staff has likewise deducted 13,1^8,000, representing the average credit balance in the account *Cwi tributihns in AM of Gonatraction". The total in this account, arising largely through operation of main extension rules, represents funds obtained by applicant at no cost to it* Applicant, in its adjustment*, increased its rate base by 11,552,000 to represent the excess of the preseat market value of operative lands over the coat at which those.-same parcels are recorded m the company1® books. This incremental difference between cost and market value likewise has cost applicant nothing. We hold, therefore, that ths preferable treatment for the purpose of this preceding is to deduct "Contributions in Aid ©f Construction* md indttde lands at original cost in the rate base adopted. ** Oft the matter of Advanoesfcr Construction, there was no issue, as the Company itself deducted that item from the fixed capital to figuring the rate base. '&mxj other California company does likewise. Go - Wa Reinhardt R* C« Reaetok W» H. Johnson </