Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

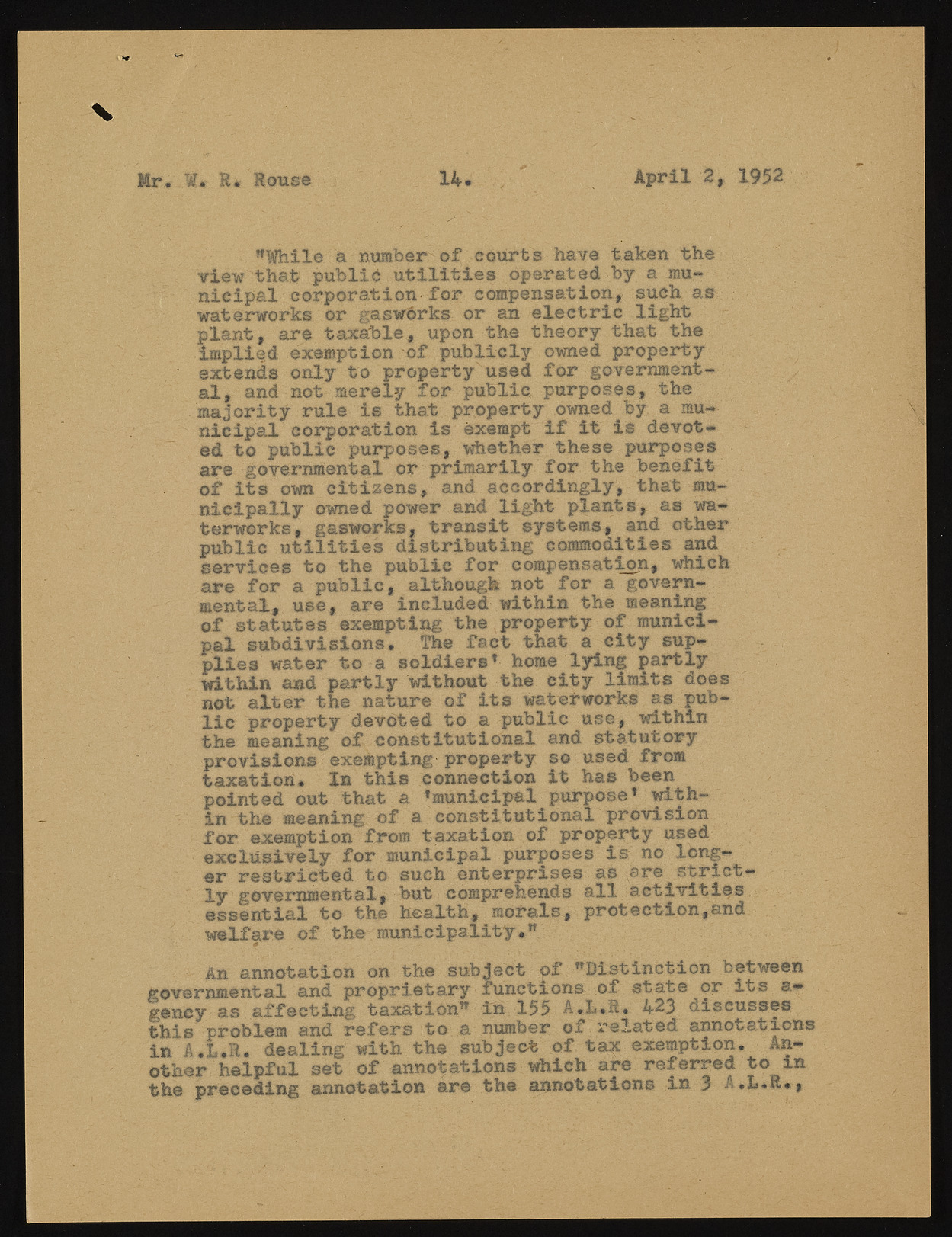

Mr. W. R. Rouse 14 April 2, 1952 *M hile a number of courts have taken the view that public utilities operated by a municipal corporation for compensation, such as waterworks or gasworks or an electric light plant, are taxable, upon the theory that the implied exemption of publicly owned property extends only to property used for governmental, and not merely for public purposes, the majority rule is that property owned by a municipal corporation is exempt if it is devoted to public purposes, whether these purposes are governmental or primarily for the benefit of its own citizens, and accordingly, that mun i ei p a l ly owned power and light plants, as waterworks, gasworks, transit systems, and other public utilities distributing commodities and services to the public for compensation, which are for a public, although not for a governmental, use, are included within the meaning of statutes exempting the property of municipal subdivisions. The fact that a city supplies water to a soldiers* home lying partly within and partly without the city limits does not alter the nature of its waterworks as public property devoted to a public use, within the meaning of constitutional and statutory provisions exempting property so used from taxation. In this connection it has been pointed out that a ‘m u n ic ip a l in the meaning of a constitutiopnuraplo sper o* vwiisitohnfor exemption from taxation of property used exclusively for municipal purposes is no longer restricted to such enterprises as are strictly governmental, but comprehends all activities essential to the health, morals, protection,and welfare of the municipality,0 An annotation on the subject of "Distinction between governmental and proprietary functions of state or its a-geney as affecting taxation" in 155 A.L.fi. 423 discusses this problem and refers to a number of related annotations in A.L.R. dealing with the subject of tax exemption. Another helpful set of annotations which are referred to in the preceding annotation are the annotations in 3 A.l.R*,