Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

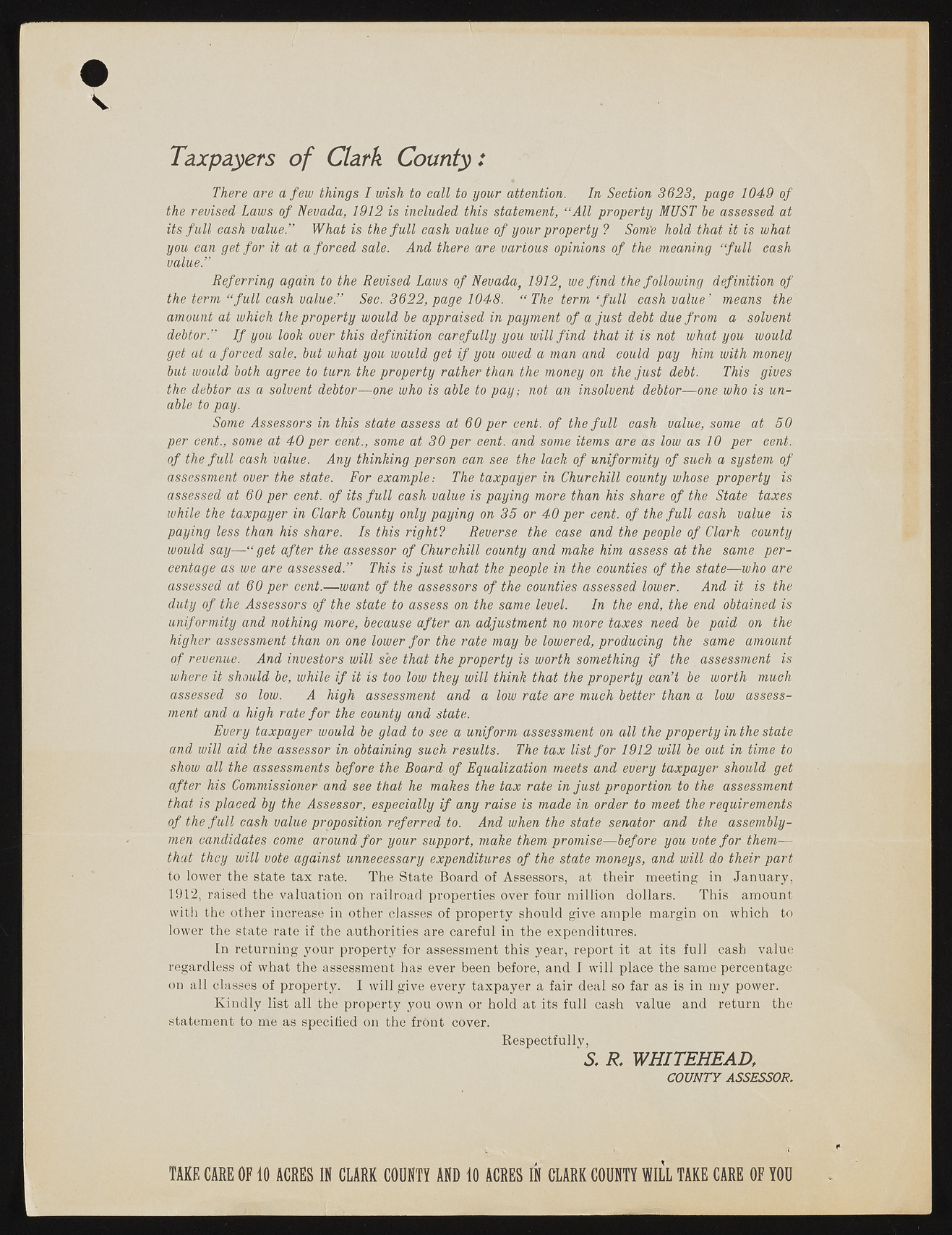

Taxpayers o f Clark County: There are a few things I wish to call to your attention. In Section 3623, page 1049 of the revised Laws of Nevada, 1912 is included this statement, “All property MUST he assessed at its fu ll cash value.” What is the fu ll cash value of your property ? Som'e hold that it is what you can get for it at a forced sale. And there are various opinions of the meaning “fu ll cash value.” Referring again to the Revised Laws of Nevada, 1912, we fin d the following definition of the term “fu ll cash value.” Sec. 3622, page 1048. “ The term ‘fu ll cash value’ means the amount at which the property would be appraised in payment of a ju st debt due from a solvent debtor.” I f you look over this definition carefully you will fin d that it is not what you would get at a forced sale, but what you would get if you owed a man and could pay him with money but would both agree to turn the property rather than the money on the ju st debt. This gives the debtor as a solvent debtor— one who is able to pay; not an insolvent debtor-^one who is unable to pay. Some Assessors in this state assess at 60 per cent, of the fu ll cash value, some at 50 per cent., some at 40 per cent., some at 30 per cent, and some items are as low as 10 per cent, of the fu ll cash value. Any thinking person ean see the lack of uniformity of such a system of assessment over the state. For example: The taxpayer in Churchill county whose property is assessed at 60 per cent, of its fu ll cash value is paying more than his share of the State taxes while the taxpayer in Clark County only paying on 35 or 40 per cent, of the fu ll cash value is paying less than his share. Is this right? Reverse the case and the people of Clark county would say— “get after the assessor of Churchill county and make him assess at the same percentage as we are assessed.” This is ju st what the people in the counties of the state— who are assessed at 60 per eent.— want of the assessors of the counties assessed lower. And it is the duty of the Assessors of the state to assess on the same level. In the end, the end obtained is uniformity and nothing more, because after an adjustment no more taxes need be paid on the higher assessment than on one lower fo r the rate may be lowered, producing the same amount of revenue. And investors will see that the property is worth something if the assessment is where it should be, while i f it is too low they will think that the property can’t be worth much assessed so low. A high assessment and a low rate are much better than a low assessment and a high rate fo r the county and state. Every taxpayer would be glad to see a uniform assessment on all the property in the state and will aid the assessor in obtaining such results. The tax list fo r 1912 will be out in time to show all the assessments before the Board of Equalization meets and every taxpayer should get after his Commissioner and see that he makes the tax rate in ju st proportion to the assessment that is placed by the Assessor, especially if any raise is made in order to meet the requirements of the fu ll cash value proposition referred to. And when the state senator and the assembly-men candidates come around fo r your support, make them promise-f bef ore you vote fo r them— that they will vote against unnecessary expenditures of the state moneys, and will do their part to lower the state tax rate. The State Board of Assessors, at their meeting in January, 1912, raised the valuation on railroad properties over four million dollars. This amount with the other increase in other classes of property should give ample margin on which to lower the state rate if the authorities are careful in the expenditures. In returning your property for assessment this year, report it at its full cash value regardless of what the assessment has ever been before, and I will place the same percentage on all classes of property. I will give every taxpayer a fair deal so far as is in my power. Kindly list all the property you own or hold at its full cash value and return the statement to me as specified on the front cover. Respectfully, S. R. W H I T E H E A D , C O U N T Y A S S E S S O R . TAKE CARE OF 10 ACRES IN CLARK COUNTY AND 10 ACRES i CLARK COUNTY WILL TAKE CARE OF YOU