Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

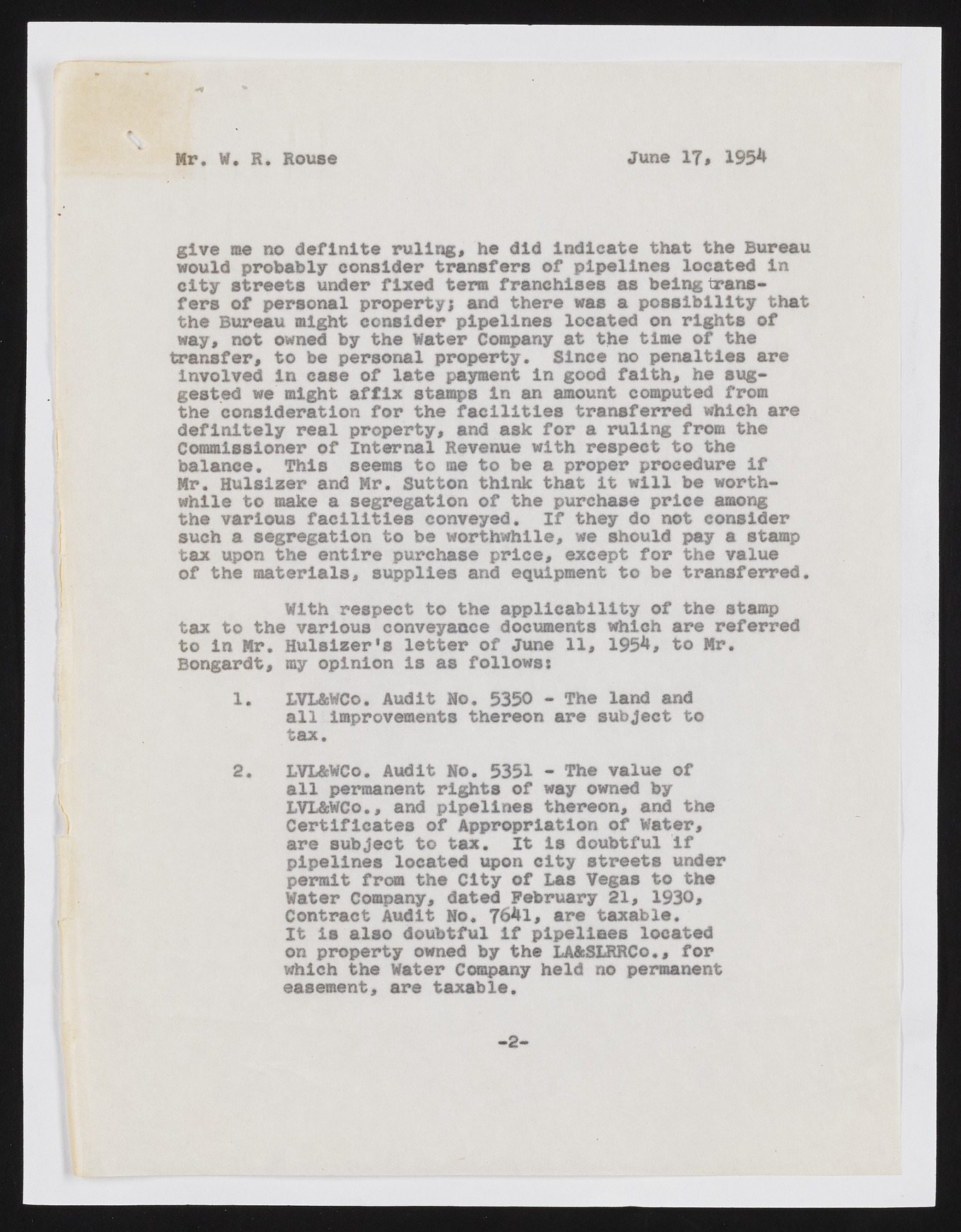

Mr. W. R. Rouse June IT* 195* give me no definite ruling* he did Indicate that the Bureau would probably consider transfers of pipelines located in city streets under fixed term franchises as being transfers of personal property! and there was a possibility that the Bureau might consider pipelines located on rights of way, not owned by the Water Company at the time of the transfer, to be personal property. Since no penalties are involved in case of late payment in good faith, he suggested we might affix stamps in an amount computed from the consideration for the facilities transferred which are definitely real property, and ask for a ruling from the Commissioner of Internal Revenue with respect to the balance. This seems to me to be a proper procedure if Mr. Hulslzer and Mr. Sutton think that it will be worthwhile to make a segregation of the purchase price among the various facilities conveyed. If they do not consider such a segregation to be worthwhile, we should pay a stamp tax upon the entire purchase price, except for the value of the materials, supplies and equipment to be transferred. With respect to the applicability of the stamp tax to the various conveyance documents which are referred to in Mr. Hulsizer's letter of June 11, 195*, to Mr. Bongardt, my opinion is as follows* 1. LVL&WCo. Audit No. 5350 - The land and all improvements thereon are subject to tax. 2. LVL&wco. Audit No. 5351 - The value of all permanent rights of way owned by LVL&wco., and pipelines thereon, and the Certificates of Appropriation of Water, are subject to tax. It is doubtful if pipelines located upon city streets under permit from the City of Las Vegas to the Water Company, dated February 21, 1930, Contract Audit No. 76*1, are taxable. It is also doubtful if pipelines located on property owned by the LA&SLRRCo., for which the water Company held no permanent easement, are taxable. -2-