Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

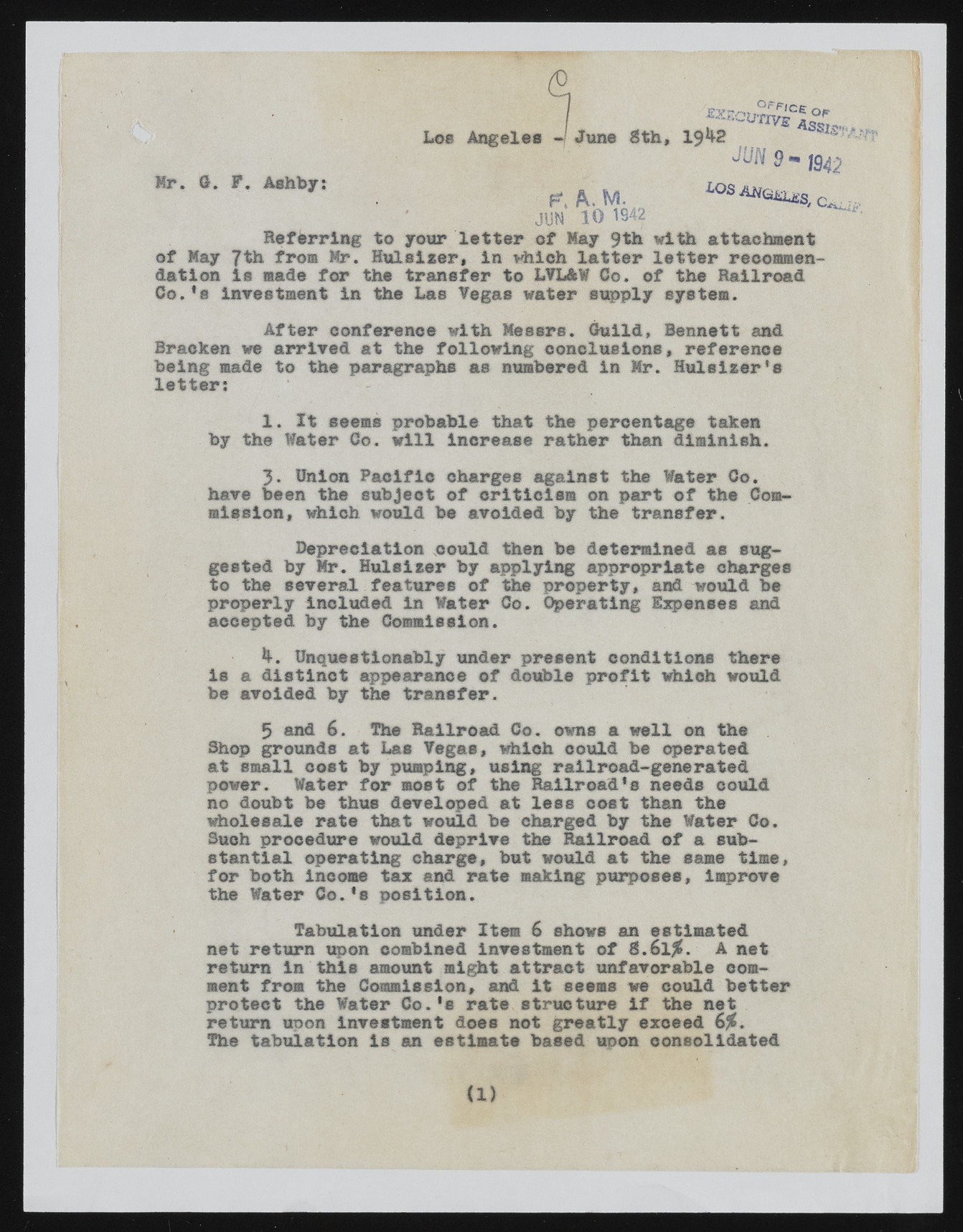

Los Angeles -/ June 3 th, Mr. G. F. Ashby.: f* &, U. JUN 10 1842 Referring to jour letter of May 9th with attachment of May 7th fro® Mr. Hulsiser, in which latter letter recommendation is made for the transfer to LYL&W Co. of the Railroad Co.*a investment in the Las Vegas water supply system. After conference with Messrs. Guild, Bennett and Bracken we arrived at the following conclusions, reference being made to the paragraphs as numbered in Mr. Hulsixer's letter: 1 . It seems probable that the percentage taken by the Water Co. will increase rather than diminish. 3. Onion Pacific charges against the Water Co. have been the subject of criticism on part of the Commission, which would be avoided by the transfer. Depreciation could then be determined as suggested by Mr. Hulsiser by applying appropriate charges to the several features of the property, and would be properly included in Water Co. Operating Expenses and accepted by the Commission. 4. Unquestionably under present conditions there is a distinct appearance of double profit which would be avoided by the transfer. 5 and 6 . The Railroad Co. owns a well on the Shop grounds at Las Vegas, which could be operated at small cost by pumping, using railroad-generated power. Water for most of the Railroad's needs could no doubt be thus developed at less cost than the wholesale rate that would be charged by the Water Co. Such procedure would deprive the Railroad of a substantial operating charge, but would at the same time, for both income tax and rate making purposes, improve the Water Co.'s position. Tabulation under Item 6 shows an estimated net return upon combined investment of £.6 l^. A net return in this amount might attract unfavorable comment from the Commission, and it seems we could better protect the Water Co.'s rate structure if the net return upon investment does not greatly exceed $%. The tabulation is an estimate based upon consolidated <1 )