Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

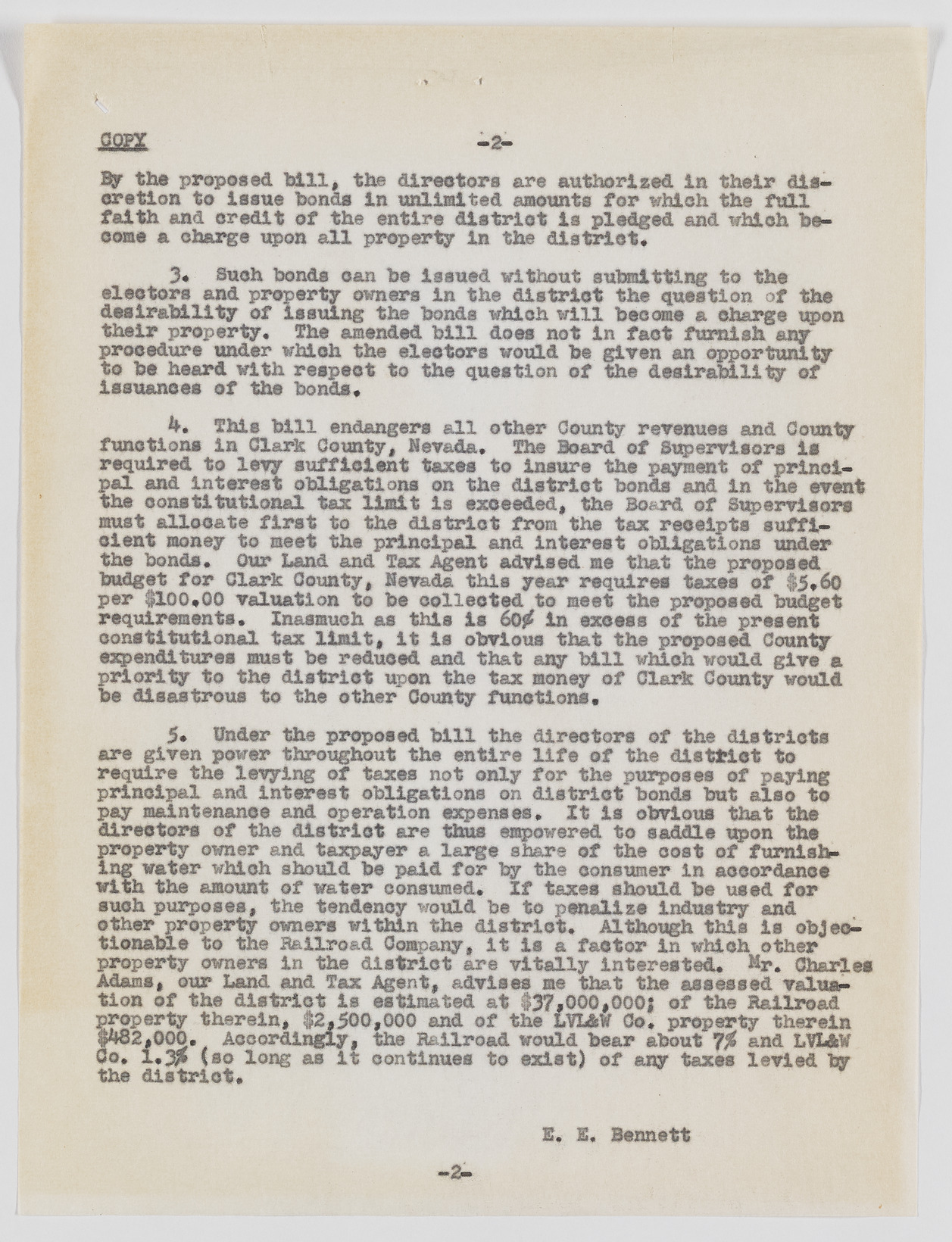

f copy -2- % the proposed bill, the directors are authorise la their die* eretion to Issue bonds in unlimited amounts for which the full faith and credit of the entire district is pledged and which become a charge upon all property 1b the district* 3* Such beads can be issued without submitting to the electors and property owners In the district the question of the desirability of issuing the bonds which will become a charge upon their property* The amended bill does not in fact furnish any procedure under which the electors would be given an opportunity to be heard with respect to the question of the desirability of issuances of the bonds* h. This bill endangers all other County revenues and County functions in Clark County, Nevada, The Board of Supervisors is required to levy sufficient taxes to insure the payment of principal and interest obligations on the district bonds and in the event the constitutional tax limit is exceeded, the Board of Supervisors must allocate first to the district from the tax receipts sufficient money to meet the principal and interest obligations under the bonds* Our Land and Tax Agent advised me that the proposed budget for Clark County, Nevada this year requires taxes of $5,60 per $100*00 valuation to be collected to meet the proposed budget requirements* Inasmuch as this is 60j£ in excess of the present constitutional tax limit, it Is obvious that the proposed County expenditures must be reduced and that any bill which would give a priority to the district upon the tax money of Clark County would be disastrous to the other County functions. 5* Under the proposed bill the directors of the districts are given power throughout the entire life of the district to require the levying of taxes not only for the purposes of paying principal and Interest obligations on district bonds but also to pay maintenance and operation expenses* It is obvious that the directors of the district are thus empowered to saddle upon the property owner and taxpayer a large share of the cost of furnishing water which should be paid for by the consumer in accordance with the amount of water consumed* If taxes should be used for such purposes, the tendency would be to penalize industry and other property owners within the district* Although this is objectionable to the Railroad Company, it is a factor in which other property owners in the district are vitally interested* hr. Charles Adams, our Land and Tax Agent, advises me that the assessed value*- tloa of the district is estimated at #37,000,0001 of the Railroad S party therein, $2,500,000 and of the LVL&W Co, property therein 2,000. Accordingly, the Hallroad would bear about and IMAV a*3p fsc long as it continues to exist) of any taxes levied by the district* E. E. Bennett —2 —