Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

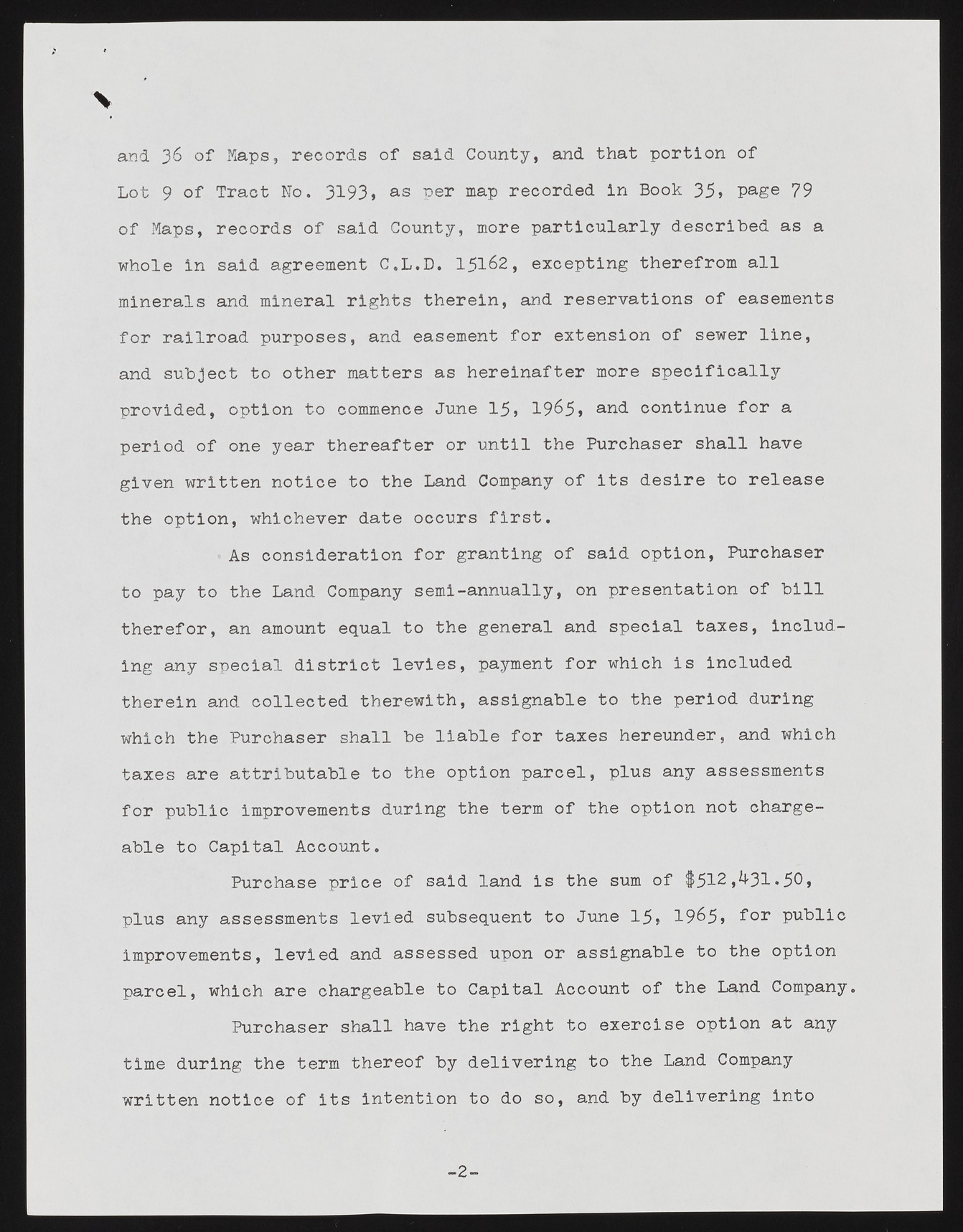

and 36 of Maps, records of said County, and that portion of Lot 9 of Tract No. 3193, as per map recorded in Book 35, page 79 of Maps, records of said County, more particularly described as a whole in said agreement C.L.D. 15162, excepting therefrom all minerals and mineral rights therein, and reservations of easements for railroad purposes, and easement for extension of sewer line, and subject to other matters as hereinafter more specifically provided, option to commence June 15» 1965> an<^- continue for a period of one year thereafter or until the Purchaser shall have given written notice to the Land Company of its desire to release the option, whichever date occurs first. As consideration for granting of said option, Purchaser to pay to the Land Company semi-annually, on presentation of bill therefor, an amount equal to the general and special taxes, including any special district levies, payment for which is included therein and collected therewith, assignable to the period during which the Purchaser shall be liable for taxes hereunder, and which taxes are attributable to the option parcel, plus any assessments for public improvements during the term of the option not chargeable to Capital Account. Purchase price of said land is the sum of $512,^31*50> plus any assessments levied subsequent to June 15, 1965> for Public improvements, levied and assessed upon or assignable to the option parcel, which are chargeable to Capital Account of the Land Company. Purchaser shall have the right to exercise option at any time during the term thereof by delivering to the Land Company written notice of its intention to do so, and by delivering into -2-