Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

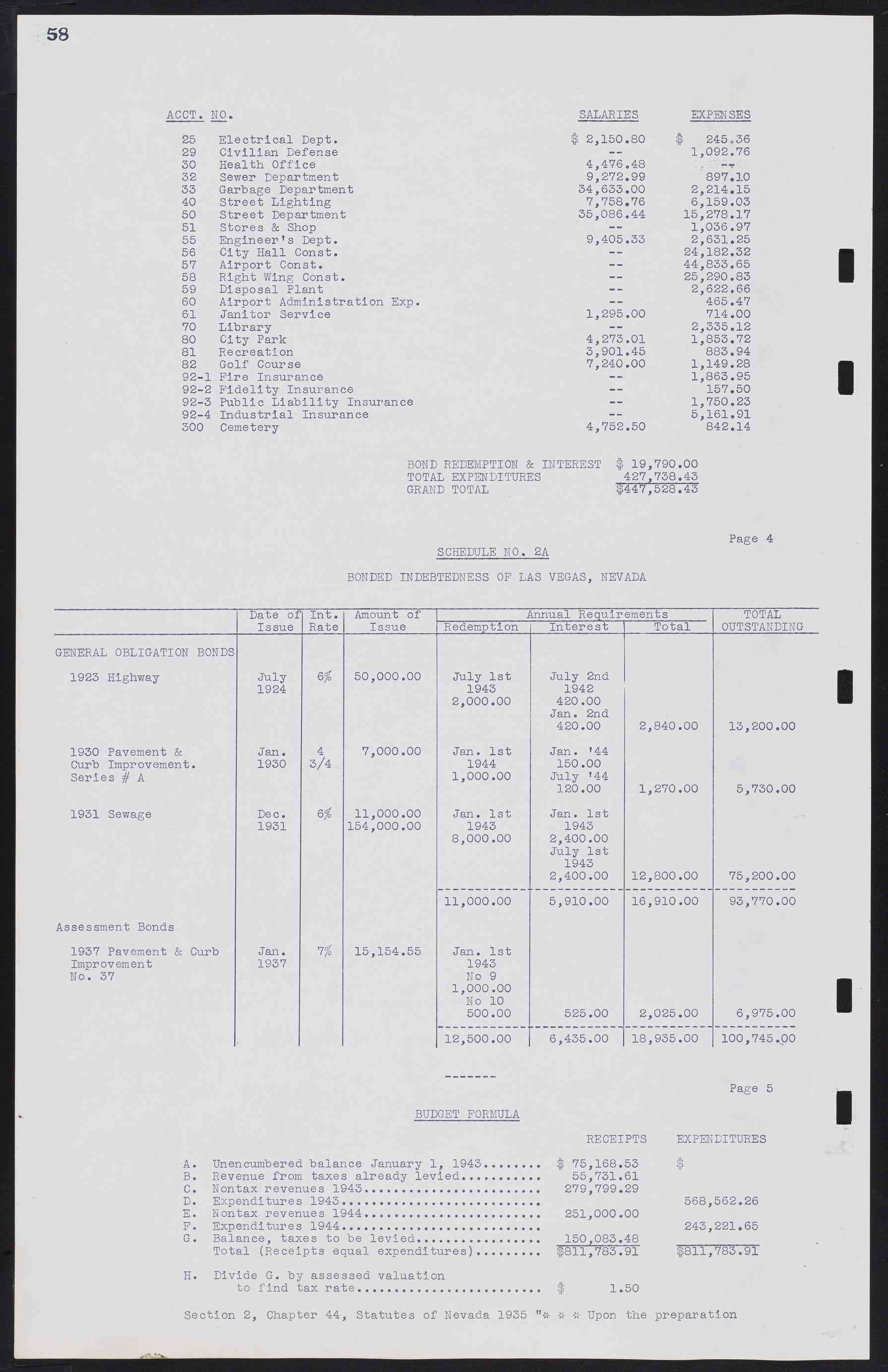

ACCT. NO. SALARIES EXPENSES 25 Electrical Dept. $ 2,150.80 $ 245.36 29 Civilian Defense — 1,092.76 30 Health Office 4,476.48 -- 32 Sewer Department 9,272.99 897.10 33 Garbage Department 34,633.00 2,214.15 40 Street Lighting 7,758.76 6,159.03 50 Street Department 35,086.44 15,278.17 51 Stores & Shop -- 1,036.97 55 Engineer's Dept. 9,405.33 2,631.25 56 City Hall Const. -- 24,182.32 57 Airport Const. -- 44,833.65 58 Right Wing Const. — 25,290.83 59 Disposal Plant -- 2,622.66 60 Airport Administration Exp. -- 465.47 61 Janitor Service 1,295.00 714.00 70 Library -- 2,335.12 80 City Park 4,273.01 1,853.72 81 Recreation 3,901.45 883.94 82 Golf Course 7,240.00 1,149.28 92-1 Fire Insurance -- 1,863.95 92-2 Fidelity Insurance — 157.50 92-3 Public Liability Insurance — 1,750.23 92-4 Industrial Insurance — 5,161.91 300 Cemetery 4,752.50 842.14 BOND REDEMPTION & INTEREST $ 19,790.00 TOTAL EXPENDITURES 427,738.43 GRAND TOTAL $447,528.43 Page 4 SCHEDULE NO. 2A BONDED INDEBTEDNESS OF LAS VEGAS, NEVADA Date of Int. Amount of Annual Requirements TOTAL ___________________________Issue Rate____Issue_____Redemption Interest______Total____OUTSTANDING GENERAL OBLIGATION BONDS 1923 Highway July 6% 50,000.00 July 1st July 2nd 1924 1943 1942 2,000. 00 420.00 Jan. 2nd 420.00 2,840.00 13,200.00 1930 Pavement & Jan. 4 7,000.00 Jan. 1st Jan. '44 Curb Improvement. 1930 3/4 1944 150.00 Series #A 1,000.00 July '44 120.00 1,270.00 5,730.00 1931 Sewage Dec. 6% 11,000.00 Jan. 1st Jan. 1st 1931 154,000.00 1943 1943 8,000. 00 2,400.00 July 1st 1943 2,400.00 12,800.00 75,200.00 11,000.00 5,910.00 16,910.00 93,770.00 Assessment Bonds 1937 Pavement & Curb Jan. 7% 15,154.55 Jan. 1st Improvement 1937 1943 No. 37 No 9 1,000. 00 No 10 500.00 525.00 2,025.00 6,975.00 12,500.00 | 6,435.00 | 18,935.00 100,745.00 Page 5 BUDGET FORMULA RECEIPTS EXPENDITURES A. Unencumbered balance January 1, 1943....... $ 75,168.53 $ B. Revenue from taxes already levied.......... 55,731.61 C. Nontax revenues 1943.................. 279,799.29 D. Expenditures 1943.............................. 568,562.26 E. Nontax revenues 1944....................... 251,000.00 F. Expenditures 1944............................ 243,221.65 G. Balance, taxes to be levied........... 150,083.48 Total (Receipts equal expenditures)........ $811,783.91 $811,783.91 H. Divide G. by assessed valuation to find tax rate....................... $ 1.50 Section 2, Chapter 44, Statutes of Nevada 1935 "* * Upon the preparation